Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

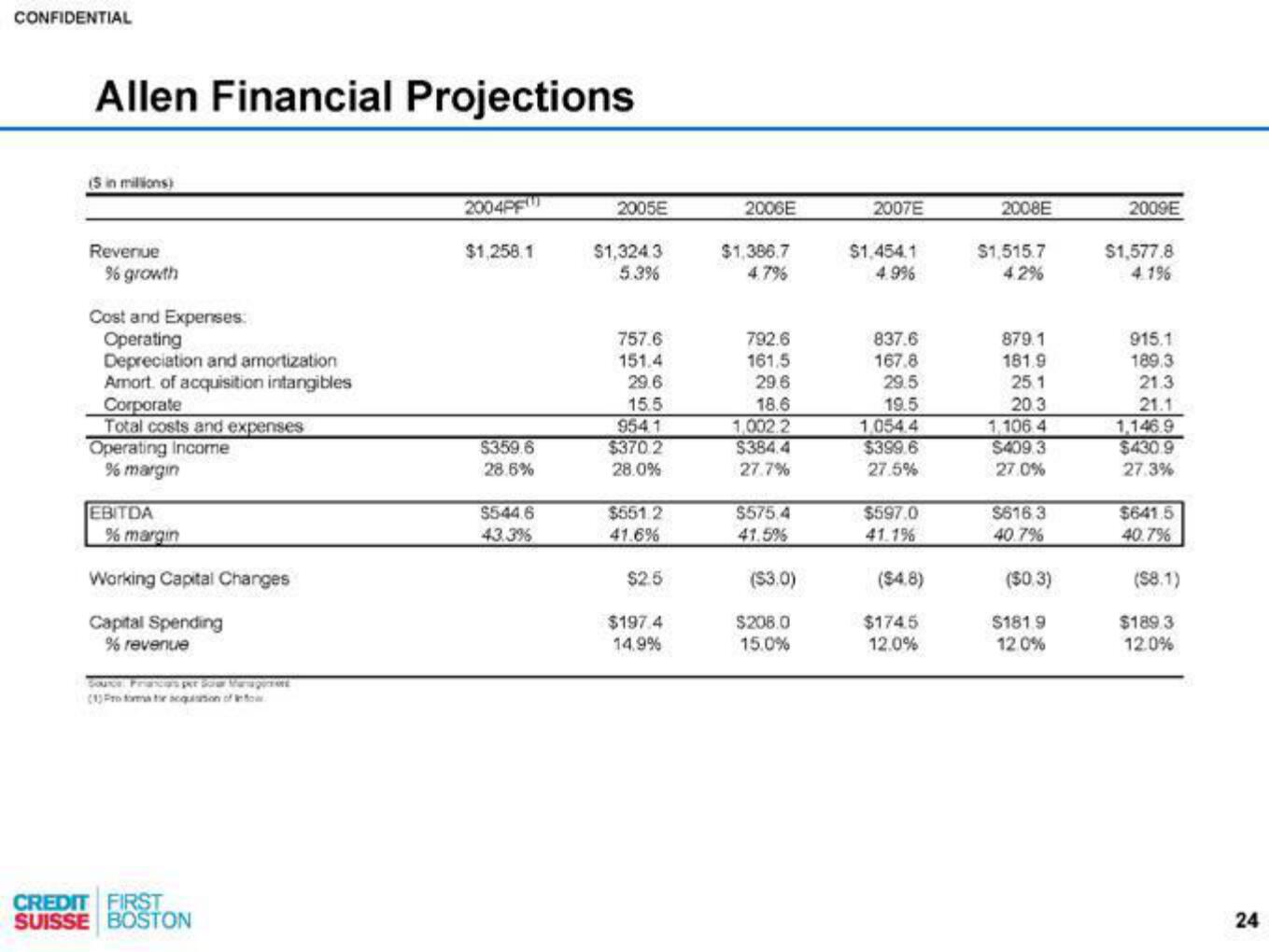

Allen Financial Projections

(5 in millions)

Revenue

%6 growth

Cost and Expenses:

Operating

Depreciation and amortization

Amort, of acquisition intangibles

Corporate

Total costs and expenses

Operating Income

% margin

EBITDA

% margin

Working Capital Changes

Capital Spending

% revenue

SOUTOR

cas per Solar Manageme

CREDIT FIRST

SUISSE BOSTON

2004PF

$1,258.1

$359.6

28.6%

$544.6

43.3%

2005E

$1,324 3

5.3%

757.6

151.4

29.6

15.5

954.1

$370.2

28.0%

$551.2

41.6%

$2.5

$197.4

14.9%

2006E

$1,386.7

4.7%

792.6

161.5

29.6

18.6

1,002.2

$384.4

27.7%

$575.4

41.5%

($3.0)

$208.0

15.0%

2007E

$1.454.1

4.9%

837.6

167.8

29.5

19.5

1,054.4

$399.6

27.5%

$597.0

41.1%

($4.8)

$174.5

12.0%

2008E

$1,515.7

4.2%

879.1

181.9

25.1

20.3

1,106 4

$409.3

27.0%

$616.3

40.7%

($0.3)

$181.9

12.0%

2009E

$1,577.8

4.196

915.1

189.3

21.3

21.1

1,146.9

$430.9

27.3%

$641.5

40.7%

($8.1)

$189.3

12.0%

24View entire presentation