BlackRock Results Presentation Deck

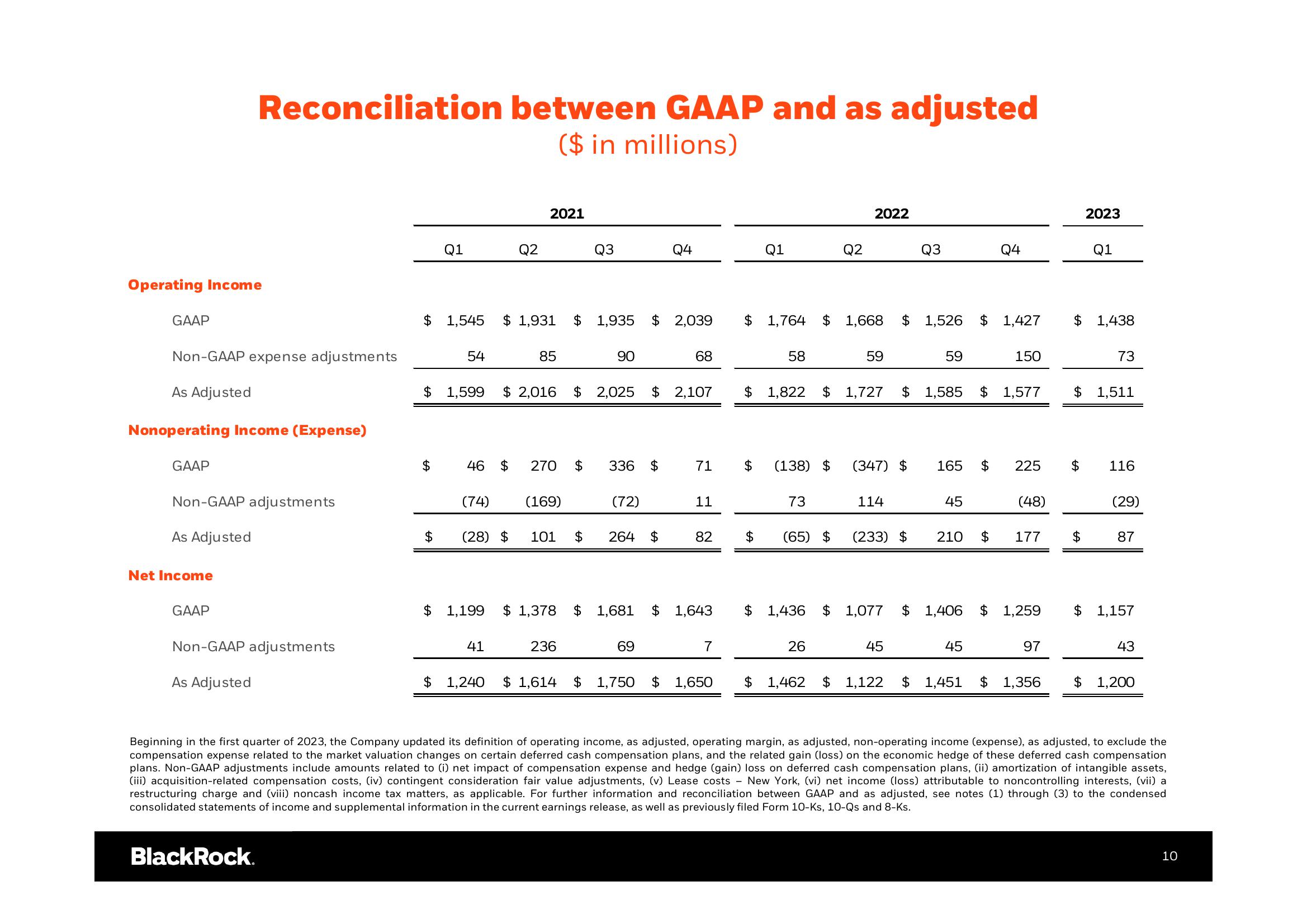

Operating Income

GAAP

Non-GAAP expense adjustments

As Adjusted

Nonoperating Income (Expense)

GAAP

Non-GAAP adjustments

As Adjusted

Net Income

Reconciliation between GAAP and as adjusted

($ in millions)

GAAP

Non-GAAP adjustments

As Adjusted

BlackRock.

Q1

$ 1,545

$

54

Q2

(74)

2021

$ 1,599 $ 2,016

85

41

$ 1,931 $ 1,935 $ 2,039

46 $ 270 $ 336 $

(169)

Q3

$ (28) $ 101 $

90

236

$ 2,025 $ 2,107

(72)

264 $

Q4

69

68

$ 1,240 $1,614 $ 1,750

$ 1,199 $1,378 $ 1,681 $ 1,643

71

11

82

7

Q1

$ 1,764 $

58

$ (138) $

73

$ (65) $

$ 1,822 $ 1,727

$ 1,436 $

Q2

26

2022

1,668

59

(347) $

114

(233) $

Q3

45

1,526

$ 1,585

59

165 $

45

210

1,077 $ 1,406

45

Q4

1,427

150

1,577

(48)

$ 1,259

$ 177 $

97

2023

225 $ 116

$1,650 $ 1,462 $ 1,122 $ 1,451 $ 1,356

Q1

$ 1,438

73

$ 1,511

(29)

87

$ 1,157

43

$ 1,200

Beginning in the first quarter of 2023, the Company updated its definition of operating income, as adjusted, operating margin, as adjusted, non-operating income (expense), as adjusted, to exclude the

compensation expense related to the market valuation changes on certain deferred cash compensation plans, and the related gain (loss) on the economic hedge of these deferred cash compensation

plans. Non-GAAP adjustments include amounts related to (i) net impact of compensation expense and hedge (gain) loss on deferred cash compensation plans, (ii) amortization of intangible assets,

(iii) acquisition-related compensation costs, (iv) contingent consideration fair value adjustments, (v) Lease costs - New York, (vi) net income (loss) attributable to noncontrolling interests, (vii) a

restructuring charge and (viii) noncash income tax matters, as applicable. For further information and reconciliation between GAAP and as adjusted, see notes (1) through (3) to the condensed

consolidated statements of income and supplemental information in the current earnings release, as well as previously filed Form 10-Ks, 10-Qs and 8-Ks.

10View entire presentation