OppFi SPAC Presentation Deck

36

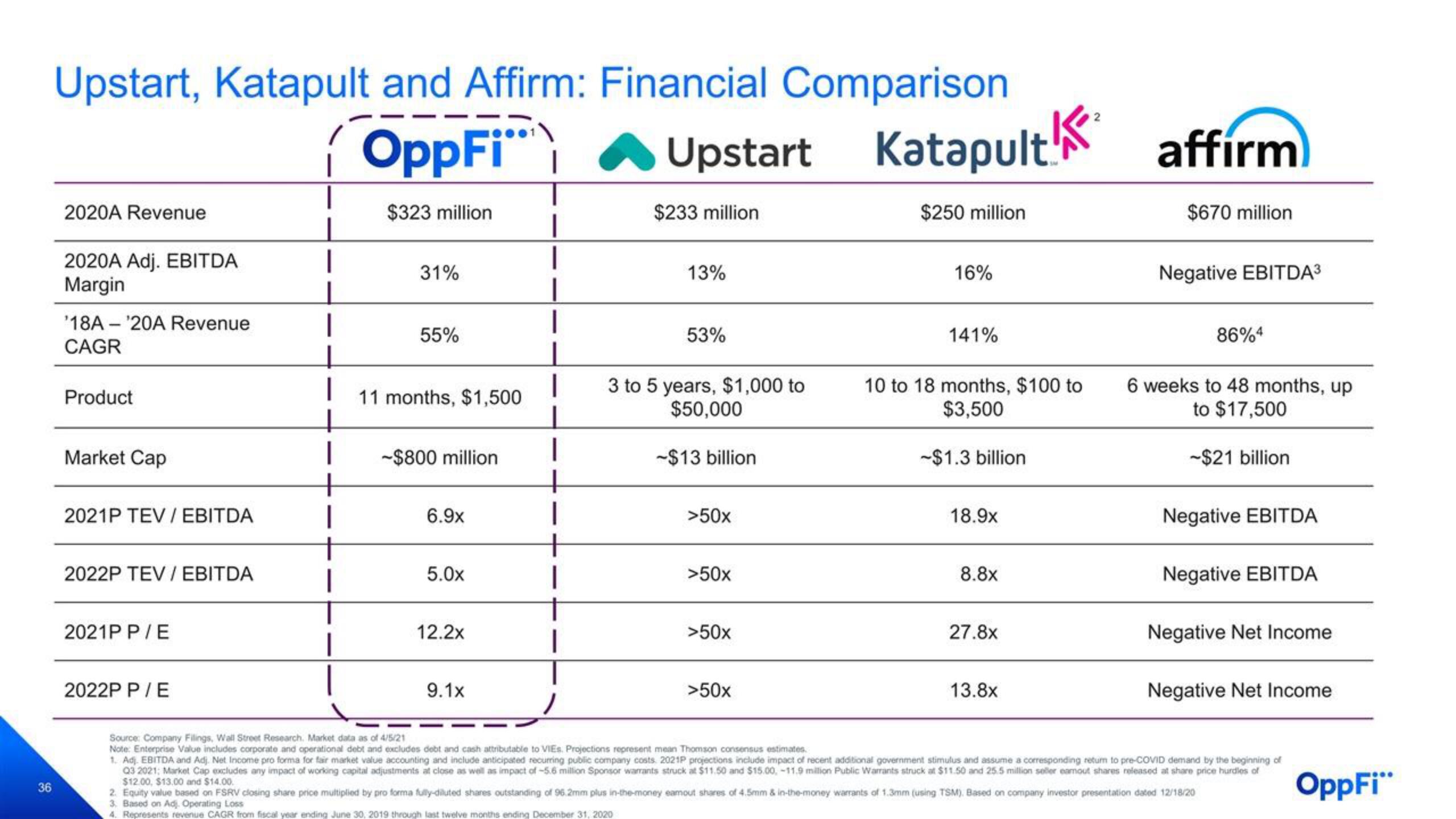

Upstart, Katapult and Affirm: Financial Comparison

OppFi

$323 million

2020A Revenue

2020A Adj. EBITDA

Margin

'18A '20A Revenue

CAGR

Product

Market Cap

2021P TEV/ EBITDA

2022P TEV/ EBITDA

2021P P/E

2022P P/E

I

|

31%

55%

11 months, $1,500

-$800 million

6.9x

5.0x

12.2x

9.1x

1

Upstart Katapult!

$233 million

13%

53%

3 to 5 years, $1,000 to

$50,000

-$13 billion

>50x

>50x

>50x

>50x

$250 million

16%

141%

10 to 18 months, $100 to

$3,500

-$1.3 billion

18.9x

8.8x

27.8x

13.8x

2

affirm

$670 million

Negative EBITDA³

86%4

6 weeks to 48 months, up

to $17,500

-$21 billion

Negative EBITDA

Negative EBITDA

Negative Net Income

Negative Net Income

Source: Company Filings, Wall Street Research. Market data as of 4/5/21

Note: Enterprise Value includes corporate and operational debt and excludes debt and cash attributable to VIEs. Projections represent mean Thomson consensus estimates.

1. Adj. EBITDA and Adj. Net Income pro forma for fair market value accounting and include anticipated recurring public company costs. 2021P projections include impact of recent additional government stimulus and assume a corresponding return to pre-COVID demand by the beginning of

Q3 2021; Market Cap excludes any impact of working capital adjustments at close as well as impact of -5.6 million Sponsor warrants struck at $11.50 and $15.00, -11.9 million Public Warrants struck at $11.50 and 25.5 million seller eamout shares released at share price hurdles of

$12.00, $13.00 and $14.00.

2. Equity value based on FSRV closing share price multiplied by pro forma fully-diluted shares outstanding of 96.2mm plus in-the-money eamout shares of 4.5mm & in-the-money warrants of 1.3mm (using TSM), Based on company investor presentation dated 12/18/20

3. Based on Adj. Operating Loss

OppFi"

4. Represents revenue CAGR from fiscal year ending June 30, 2019 through last twelve months ending December 31, 2020View entire presentation