Evercore Investment Banking Pitch Book

Financial Analysis

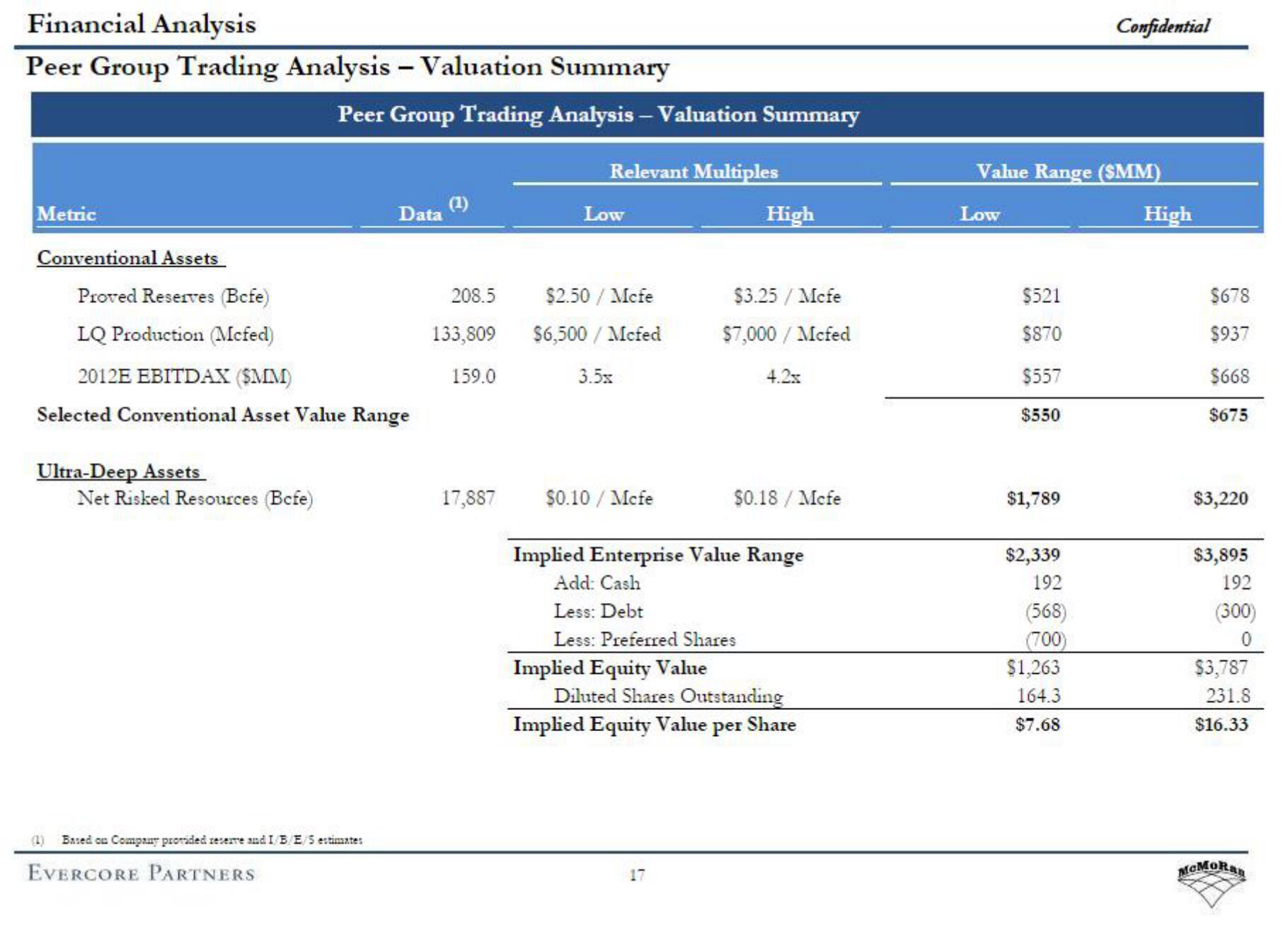

Peer Group Trading Analysis - Valuation Summary

Metric

Conventional Assets

Proved Reserves (Bcfe)

LQ Production (Mcfed)

Ultra-Deep Assets

Peer Group Trading Analysis - Valuation Summary

Relevant Multiples

2012E EBITDAX (SMM)

Selected Conventional Asset Value Range

Net Risked Resources (Bcfe)

Data

(1) Based on Company provided reserve and I/B/E 5 estimates

EVERCORE PARTNERS

Low

$2.50 / Mcfe

208.5

133,809 $6,500/Mcfed

159.0

3.5x

17,887

$0.10 / Mcfe

Implied Equity Value

High

$3.25/Mcfe

$7,000/Mcfed

4.2x

Implied Enterprise Value Range

Add: Cash

Less: Debt

Less: Preferred Shares

17

$0.18/Mcfe

Diluted Shares Outstanding

Implied Equity Value per Share

Value Range ($MM)

Low

$521

$870

$557

$550

$1,789

$2,339

192

(568)

(700)

Confidential

$1,263

164.3

$7.68

High

$678

$937

$668

$675

$3,220

$3,895

192

(300)

$3,787

231.8

$16.33

MCMORanView entire presentation