WeWork Investor Presentation Deck

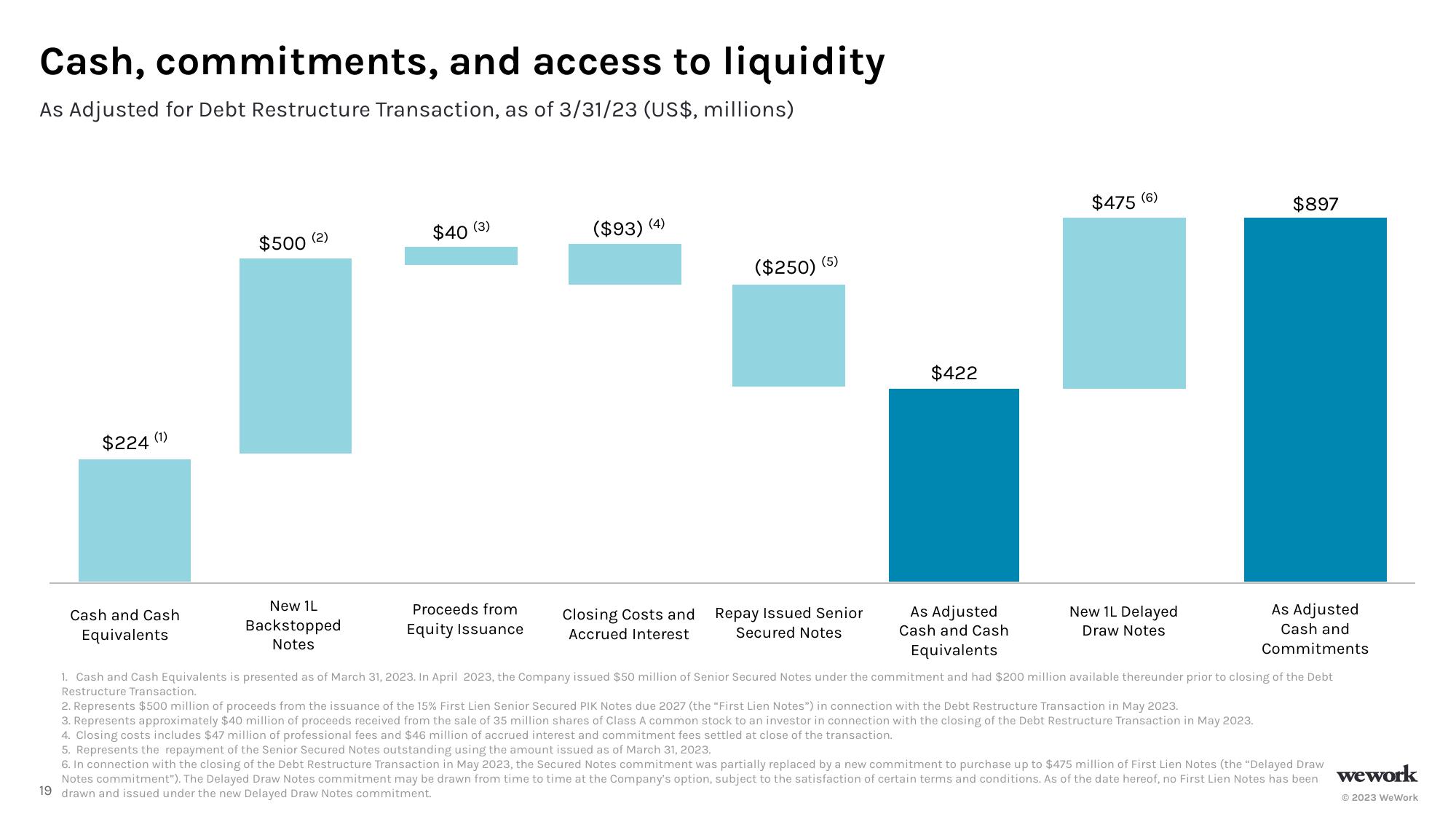

Cash, commitments, and access to liquidity

As Adjusted for Debt Restructure Transaction, as of 3/31/23 (US$, millions)

$224 (¹)

Cash and Cash

Equivalents

$500 (2)

New 1L

Backstopped

Notes

$40 (3

(3)

Proceeds from

Equity Issuance

($93) (4)

Closing Costs and

Accrued Interest

($250) (5)

Repay Issued Senior

Secured Notes

$422

As Adjusted

Cash and Cash

Equivalents

$475 (6)

New 1L Delayed

Draw Notes

$897

2. Represents $500 million of proceeds from the issuance of the 15% First Lien Senior Secured PIK Notes due 2027 (the "First Lien Notes") in connection with the Debt Restructure Transaction in May 2023.

3. Represents approximately $40 million of proceeds received from the sale of 35 million shares of Class A common stock to an investor in connection with the closing of the Debt Restructure Transaction in May 2023.

4. Closing costs includes $47 million of professional fees and $46 million of accrued interest and commitment fees settled at close of the transaction.

As Adjusted

Cash and

Commitments

1. Cash and Cash Equivalents is presented as of March 31, 2023. In April 2023, the Company issued $50 million of Senior Secured Notes under the commitment and had $200 million available thereunder prior to closing of the Debt

Restructure Transaction.

5. Represents the repayment of the Senior Secured Notes outstanding using the amount issued as of March 31, 2023.

6. In connection with the closing of the Debt Restructure Transaction in 2023, the Secured Notes commitment was partially replaced by a new commitment to purchase up to $475 million of First Lien Notes (the "Delayed Draw

Notes commitment"). The Delayed Draw Notes commitment may be drawn from time to time at the Company's option, subject to the satisfaction of certain terms and conditions. As of the date hereof, no First Lien Notes has been wework

19 drawn and issued under the new Delayed Draw Notes commitment.

© 2023 WeWorkView entire presentation