SmileDirectClub Investor Presentation Deck

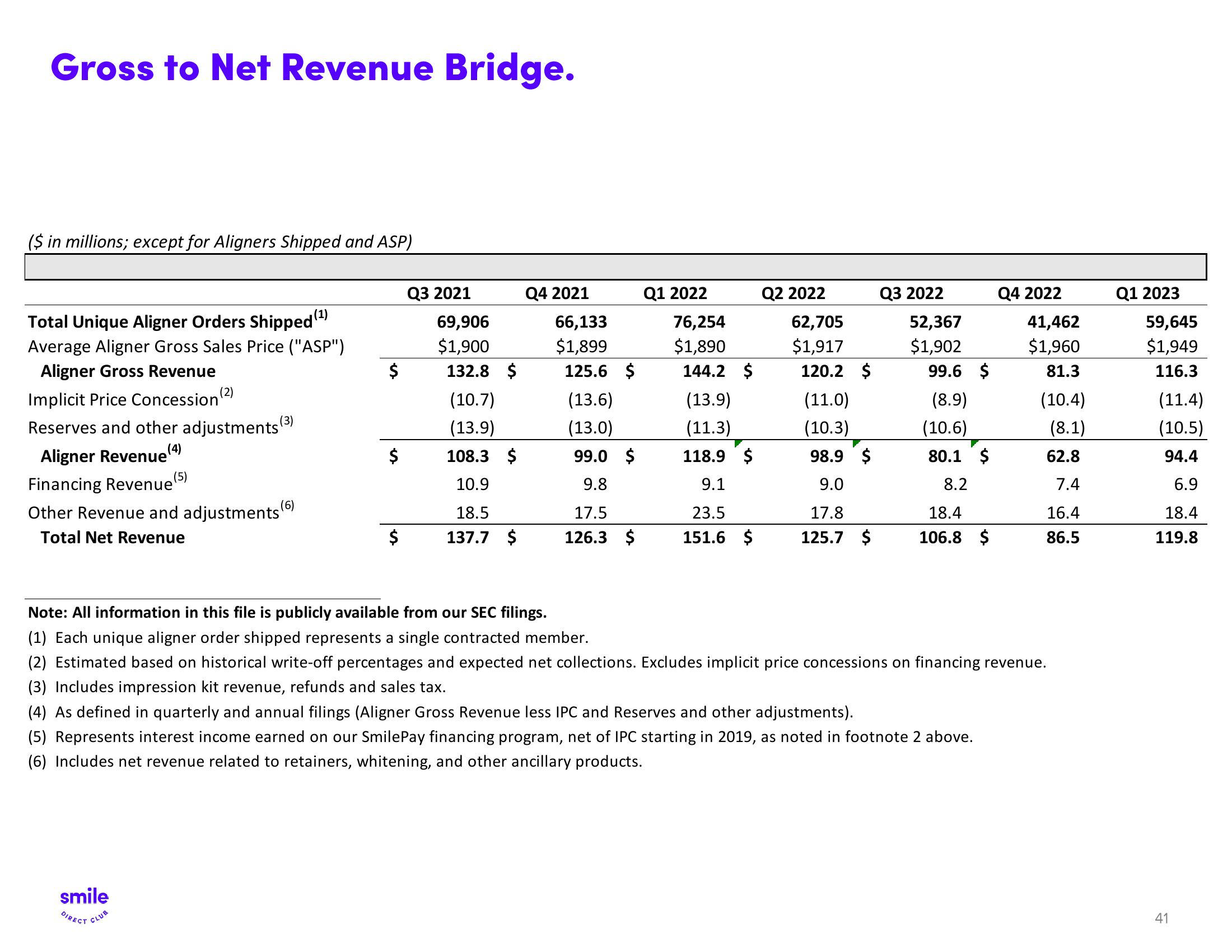

Gross to Net Revenue Bridge.

($ in millions; except for Aligners Shipped and ASP)

Total Unique Aligner Orders Shipped (¹)

Average Aligner Gross Sales Price ("ASP")

Aligner Gross Revenue

Implicit Price Concession (²)

Reserves and other adjustments (³)

Aligner Revenue (4

Financing Revenue (5)

Other Revenue and adjustments (6)

Total Net Revenue

$

smile

DIRECT CLUB

$

$

Q3 2021

69,906

$1,900

132.8 $

(10.7)

(13.9)

108.3 $

10.9

18.5

137.7 $

Q4 2021

66,133

$1,899

125.6 $

(13.6)

(13.0)

99.0 $

9.8

17.5

126.3 $

Q1 2022

76,254

$1,890

144.2 $

(13.9)

(11.3)

118.9 $

9.1

23.5

151.6 $

Q2 2022

62,705

$1,917

120.2 $

(11.0)

(10.3)

98.9 $

9.0

17.8

125.7 $

Q3 2022

52,367

$1,902

99.6 $

(8.9)

(10.6)

80.1 $

8.2

18.4

106.8 $

Q4 2022

41,462

$1,960

81.3

(10.4)

(8.1)

62.8

7.4

16.4

86.5

Note: All information in this file is publicly available from our SEC filings.

(1) Each unique aligner order shipped represents a single contracted member.

(2) Estimated based on historical write-off percentages and expected net collections. Excludes implicit price concessions on financing revenue.

(3) Includes impression kit revenue, refunds and sales tax.

(4) As defined in quarterly and annual filings (Aligner Gross Revenue less IPC and Reserves and other adjustments).

(5) Represents interest income earned on our SmilePay financing program, net of IPC starting in 2019, as noted in footnote 2 above.

(6) Includes net revenue related to retainers, whitening, and other ancillary products.

Q1 2023

59,645

$1,949

116.3

(11.4)

(10.5)

94.4

6.9

18.4

119.8

41View entire presentation