Bakkt Results Presentation Deck

NOTES

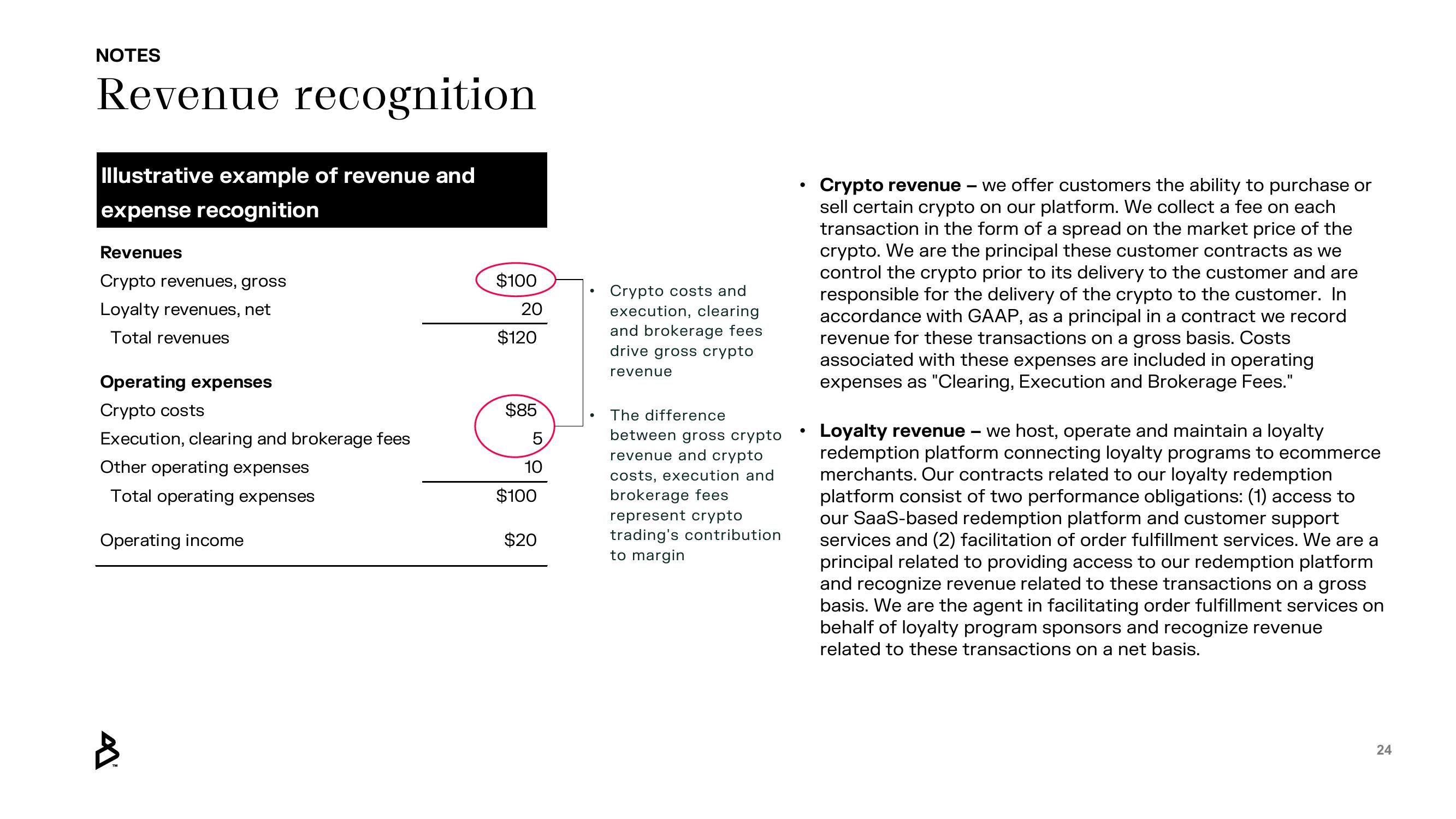

Revenue recognition

Illustrative example of revenue and

expense recognition

Revenues

Crypto revenues, gross

Loyalty revenues, net

Total revenues

Operating expenses

Crypto costs

Execution, clearing and brokerage fees

Other operating expenses

Total operating expenses

Operating income

A

$100

20

$120

$85

5

10

$100

$20

●

Crypto costs and

execution, clearing

and brokerage fees

drive gross crypto

revenue

The difference

between gross crypto

revenue and crypto

costs, execution and

brokerage fees

represent crypto

trading's contribution

to margin

●

Crypto revenue we offer customers the ability to purchase or

sell certain crypto on our platform. We collect a fee on each

transaction in the form of a spread on the market price of the

crypto. We are the principal these customer contracts as we

control the crypto prior to its delivery to the customer and are

responsible for the delivery of the crypto to the customer. In

accordance with GAAP, as a principal in a contract we record

revenue for these transactions on a gross basis. Costs

associated with these expenses are included in operating

expenses as "Clearing, Execution and Brokerage Fees."

Loyalty revenue we host, operate and maintain a loyalty

redemption platform connecting loyalty programs to ecommerce

merchants. Our contracts related to our loyalty redemption

platform consist of two performance obligations: (1) access to

our SaaS-based redemption platform and customer support

services and (2) facilitation of order fulfillment services. We are a

principal related to providing access to our redemption platform

and recognize revenue related to these transactions on a gross

basis. We are the agent in facilitating order fulfillment services on

behalf of loyalty program sponsors and recognize revenue

related to these transactions on a net basis.

-

24View entire presentation