Grab Results Presentation Deck

Q3 2022 Results

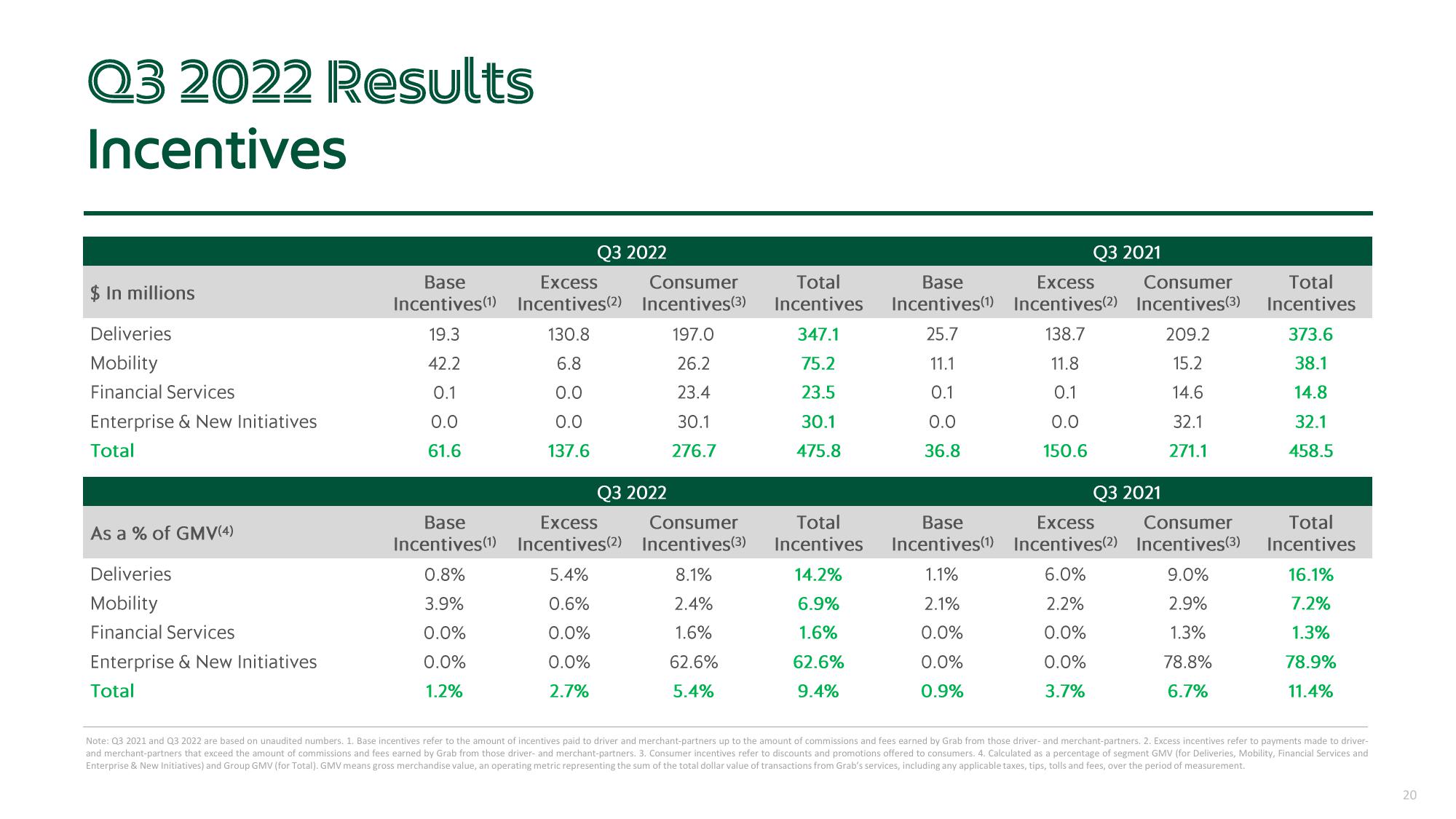

Incentives

$ In millions

Deliveries

Mobility

Financial Services

Enterprise & New Initiatives

Total

As a % of GMV(4)

Deliveries

Mobility

Financial Services

Enterprise & New Initiatives

Total

Base

Excess

Consumer

Incentives (1) Incentives (2) Incentives(3)

19.3

130.8

197.0

42.2

6.8

26.2

0.1

0.0

23.4

0.0

0.0

30.1

61.6

137.6

276.7

Base

Incentives (1)

Q3 2022

0.8%

3.9%

0.0%

0.0%

1.2%

Q3 2022

Consumer

Excess

Incentives (2) Incentives (3)

5.4%

8.1%

0.6%

2.4%

0.0%

1.6%

0.0%

62.6%

2.7%

5.4%

Total

Incentives

347.1

75.2

23.5

30.1

475.8

Total

Incentives

14.2%

6.9%

1.6%

62.6%

9.4%

Q3 2021

Base

Excess Consumer

Incentives (1) Incentives (2) Incentives (3)

25.7

138.7

209.2

11.1

11.8

15.2

0.1

0.1

14.6

0.0

0.0

32.1

36.8

150.6

271.1

Q3 2021

Base

Excess Consumer

Incentives (1) Incentives (2) Incentives (3)

1.1%

6.0%

9.0%

2.1%

2.2%

2.9%

0.0%

0.0%

1.3%

0.0%

0.0%

0.9%

3.7%

78.8%

6.7%

Total

Incentives

373.6

38.1

14.8

32.1

458.5

Total

Incentives

16.1%

7.2%

1.3%

78.9%

11.4%

Note: Q3 2021 and Q3 2022 are based on unaudited numbers. 1. Base incentives refer to the amount of incentives paid to driver and merchant-partners up to the amount of commissions and fees earned by Grab from those driver- and merchant-partners. 2. Excess incentives refer to payments made to driver-

and merchant-partners that exceed the amount of commissions and fees earned by Grab from those driver- and merchant-partners. 3. Consumer incentives refer to discounts and promotions offered to consumers. 4. Calculated as a percentage of segment GMV (for Deliveries, Mobility, Financial Services and

Enterprise & New Initiatives) and Group GMV (for Total). GMV means gross merchandise value, an operating metric representing the sum of the total dollar value of transactions from Grab's services, including any applicable taxes, tips, tolls and fees, over the period of measurement.

20View entire presentation