Confluent IPO Presentation Deck

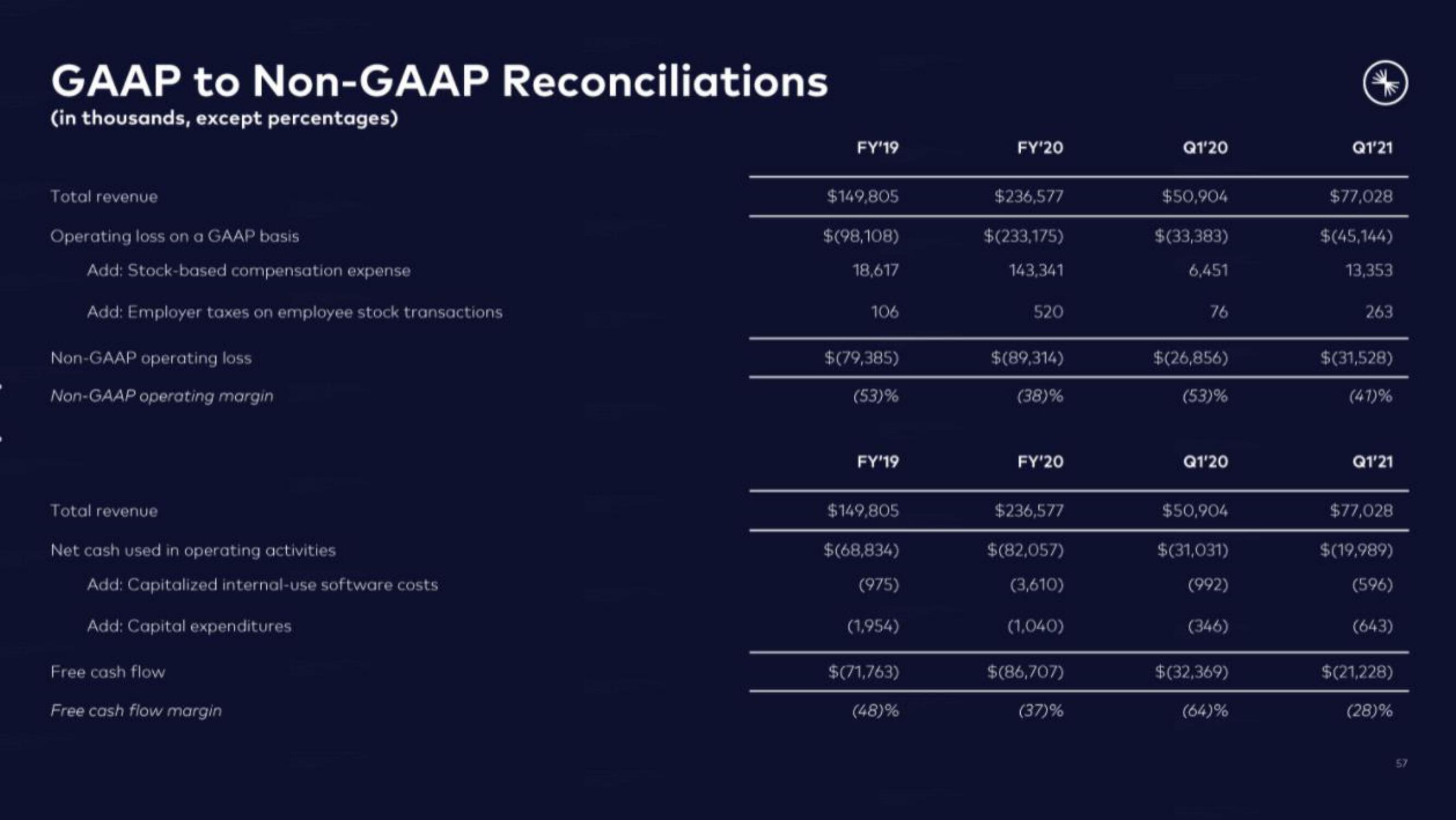

GAAP to Non-GAAP Reconciliations

(in thousands, except percentages)

Total revenue

Operating loss on a GAAP basis

Add: Stock-based compensation expense

Add: Employer taxes on employee stock transactions

Non-GAAP operating loss

Non-GAAP operating margin

Total revenue

Net cash used in operating activities

Add: Capitalized internal-use software costs

Add: Capital expenditures

Free cash flow

Free cash flow margin

FY'19

$149,805

$(98,108)

18,617

106

$(79,385)

(53)%

FY'19

$149,805

$(68,834)

(975)

(1,954)

$(71,763)

(48)%

FY'20

$236,577

$(233,175)

143,341

520

$(89,314)

(38)%

FY'20

$236,577

$(82,057)

(3,610)

(1,040)

$(86,707)

(37)%

Q1'20

$50,904

$(33,383)

6,451

76

$(26,856)

(53)%

Q1'20

$50,904

$(31,031)

(992)

(346)

$(32,369)

(64)%

Q1'21

$77,028

$(45,144)

13,353

263

$(31,528)

(47)%

Q1'21

$77,028

$(19,989)

(596)

(643)

$(21,228)

(28)%

57View entire presentation