J.P.Morgan Results Presentation Deck

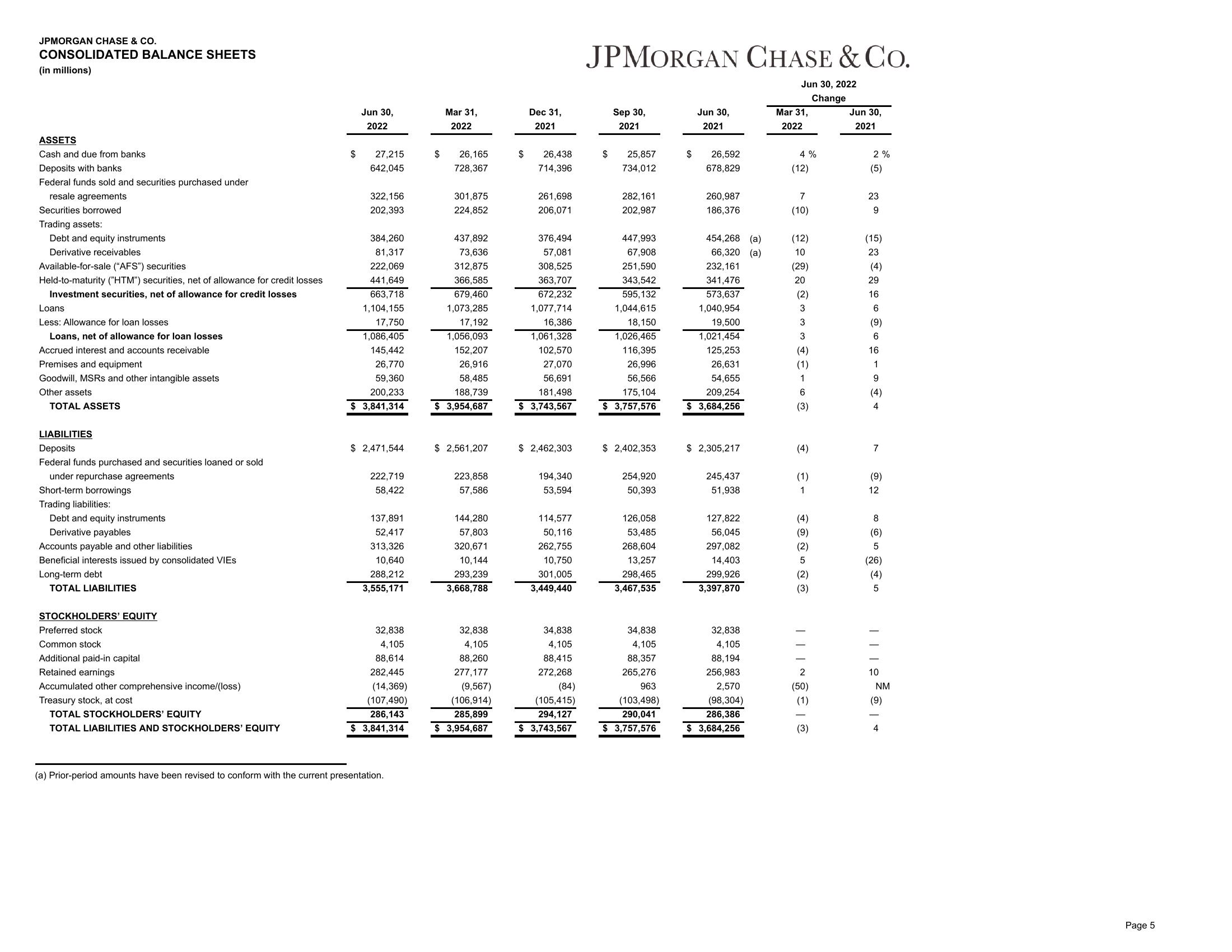

JPMORGAN CHASE & CO.

CONSOLIDATED BALANCE SHEETS

(in millions)

ASSETS

Cash and due from banks

Deposits with banks

Federal funds sold and securities purchased under

resale agreements

Securities borrowed

Trading assets:

Debt and equity instruments

Derivative receivables

Available-for-sale ("AFS") securities

Held-to-maturity ("HTM") securities, net of allowance for credit losses

Investment securities, net of allowance for credit losses

Loans

Less: Allowance for loan losses

Loans, net of allowance for loan losses

Accrued interest and accounts receivable

Premises and equipment

Goodwill, MSRs and other intangible assets

Other assets

TOTAL ASSETS

LIABILITIES

Deposits

Federal funds purchased and securities loaned or sold

under repurchase agreements

Short-term borrowings

Trading liabilities:

Debt and equity instruments

Derivative payables

Accounts payable and other liabilities

Beneficial interests issued by consolidated VIES

Long-term debt

TOTAL LIABILITIES

STOCKHOLDERS' EQUITY

Preferred stock

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive income/(loss)

Treasury stock, at cost

TOTAL STOCKHOLDERS' EQUITY

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$

Jun 30,

2022

27,215

642,045

322,156

202,393

384,260

81,317

222,069

441,649

663,718

1,104,155

17,750

1,086,405

145,442

26,770

59,360

200,233

$ 3,841,314

$ 2,471,544

222,719

58,422

137,891

52,417

313,326

10,640

288,212

3,555,171

32,838

4,105

88,614

282,445

(14,369)

(107,490)

286,143

$ 3,841,314

(a) Prior-period amounts have been revised to conform with the current presentation.

$

Mar 31,

2022

26,165

728,367

301,875

224,852

437,892

73,636

312,875

366,585

679,460

1,073,285

17,192

1,056,093

152,207

26,916

58,485

188,739

$ 3,954,687

$ 2,561,207

223,858

57,586

144,280

57,803

320,671

10,144

293,239

3,668,788

32,838

4,105

88,260

277,177

(9,567)

(106,914)

285,899

$ 3,954,687

$

Dec 31,

2021

26,438

714,396

261,698

206,071

376,494

57,081

308,525

363,707

672,232

1,077,714

16,386

1,061,328

102,570

27,070

56,691

181,498

$ 3,743,567

$ 2,462,303

194,340

53,594

114,577

50,116

262,755

10,750

301,005

3,449,440

34,838

4,105

88,415

272,268

(84)

(105,415)

294,127

$ 3,743,567

JPMORGAN CHASE & CO.

Jun 30, 2022

Change

$

Sep 30,

2021

25,857

734,012

282,161

202,987

447,993

67,908

251,590

343,542

595, 132

1,044,615

18,150

1,026,465

116,395

26,996

56,566

175, 104

$3,757,576

$ 2,402,353

254,920

50,393

126,058

53,485

268,604

13,257

298,465

3,467,535

34,838

4,105

88,357

265,276

963

(103,498)

290,041

$ 3,757,576

$

Jun 30,

2021

26,592

678,829

260,987

186,376

454,268 (a)

66,320 (a)

232,161

341,476

573,637

1,040,954

19,500

1,021,454

125,253

26,631

54,655

209,254

$ 3,684,256

$ 2,305,217

245,437

51,938

127,822

56,045

297,082

14,403

299,926

3,397,870

32,838

4,105

88,194

256,983

2,570

(98,304)

286,386

$ 3,684,256

Mar 31,

2022

4%

(12)

^ @ m m = - o m

(10)

(12)

(4)

(1)

1

(4)

(9)

(2)

5

(2)

(3)

| | | € |

(50)

Jun 30,

2021

2%

(5)

23

9

(15)

23

(4)

29

16

6

(9)

6

16

1

9

(4)

4

7

(9)

12

8

(6)

5

(26)

(4)

5

A | @ ₹ • | | |

NM

Page 5View entire presentation