Citi Investment Banking Pitch Book

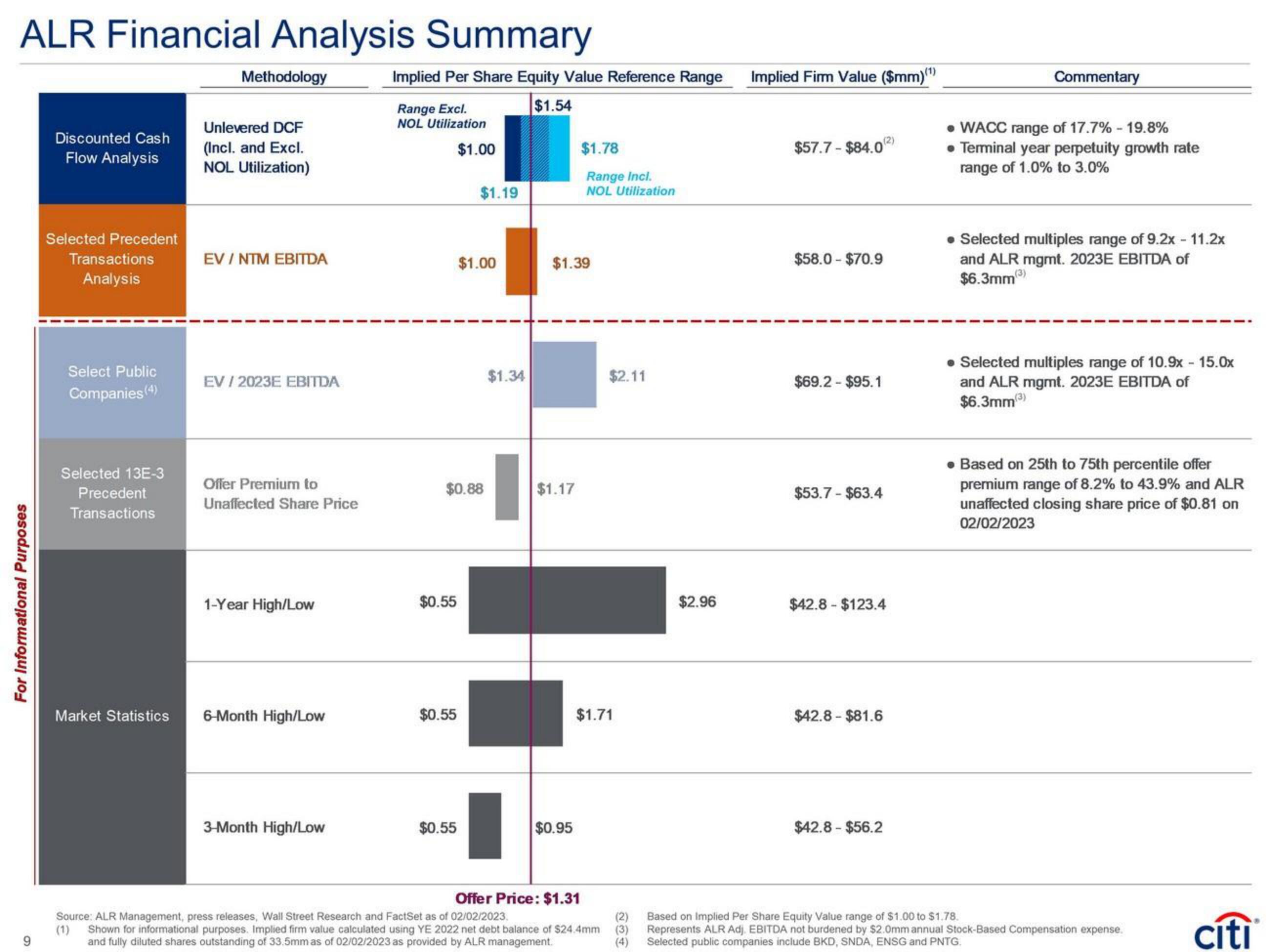

ALR Financial Analysis Summary

For informational Purposes

Discounted Cash

Flow Analysis

Selected Precedent

Transactions

Analysis

Select Public

Companies (4)

Selected 13E-3

Precedent

Transactions

Market Statistics

Methodology

Unlevered DCF

(Incl. and Excl.

NOL Utilization)

EV / NTM EBITDA

EV / 2023E EBITDA

Offer Premium to

Unaffected Share Price

1-Year High/Low

6-Month High/Low

3-Month High/Low

Implied Per Share Equity Value Reference Range

$1.54

Range Excl.

NOL Utilization

$1.00

$0.55

$0.88

$0.55

$1.19

$0.55

$1.00

$1.34

$1.39

$1.17

$1.78

Range Incl.

NOL Utilization

$0.95

$2.11

$1.71

Offer Price: $1.31

Source: ALR Management, press releases, Wall Street Research and FactSet as of 02/02/2023.

Shown for informational purposes. Implied firm value calculated using YE 2022 net debt balance of $24.4mm

and fully diluted shares outstanding of 33.5mm as of 02/02/2023 as provided by ALR management.

(2)

(3)

(4)

$2.96

Implied Firm Value ($mm)(¹)

$57.7 -$84.02)

$58.0-$70.9

$69.2 - $95.1

$53.7-$63.4

$42.8-$123.4

$42.8-$81.6

$42.8-$56.2

Commentary

• WACC range of 17.7% -19.8%

● Terminal year perpetuity growth rate

range of 1.0% to 3.0%

• Selected multiples range of 9.2x - 11.2x

and ALR mgmt. 2023E EBITDA of

$6.3mm (3)

• Selected multiples range of 10.9x - 15.0x

and ALR mgmt. 2023E EBITDA of

$6.3mm(3)

• Based on 25th to 75th percentile offer

premium range of 8.2% to 43.9% and ALR

unaffected closing share price of $0.81 on

02/02/2023

Based on Implied Per Share Equity Value range of $1.00 to $1.78.

Represents ALR Adj. EBITDA not burdened by $2.0mm annual Stock-Based Compensation expense.

Selected public companies include BKD, SNDA, ENSG and PNTG.

cítiView entire presentation