Apollo Global Management Investor Day Presentation Deck

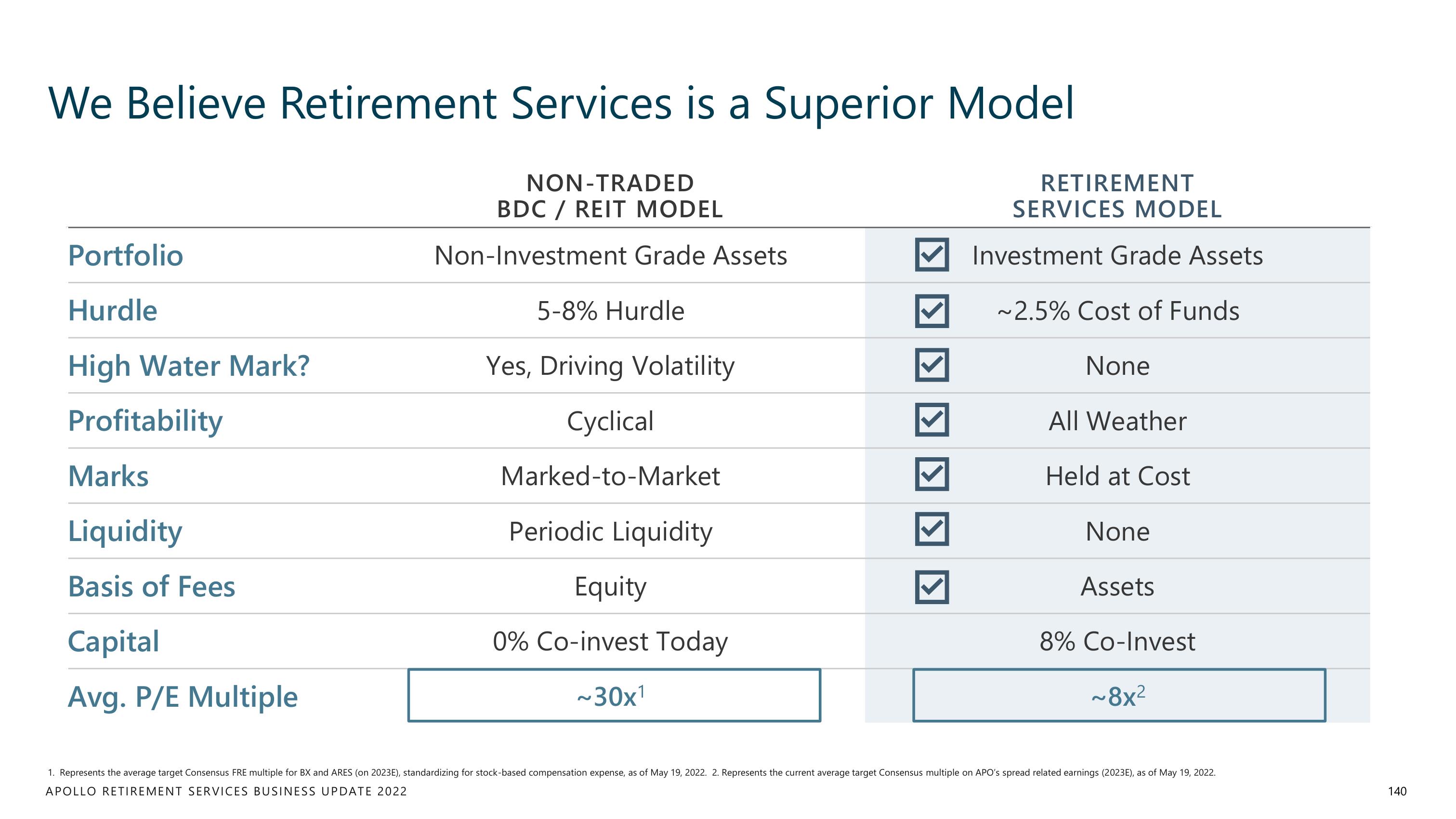

We Believe Retirement Services is a Superior Model

NON-TRADED

BDC / REIT MODEL

Non-Investment Grade Assets

Portfolio

Hurdle

High Water Mark?

Profitability

Marks

Liquidity

Basis of Fees

Capital

Avg. P/E Multiple

5-8% Hurdle

Yes, Driving Volatility

Cyclical

Marked-to-Market

Periodic Liquidity

Equity

0% Co-invest Today

~30x¹

RETIREMENT

SERVICES MODEL

Investment Grade Assets

~2.5% Cost of Funds

None

All Weather

Held at Cost

None

Assets

8% Co-Invest

~8x²

1. Represents the average target Consensus FRE multiple for BX and ARES (on 2023E), standardizing for stock-based compensation expense, as of May 19, 2022. 2. Represents the current average target Consensus multiple on APO's spread related earnings (2023E), as of May 19, 2022.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

140View entire presentation