Pershing Square Activist Presentation Deck

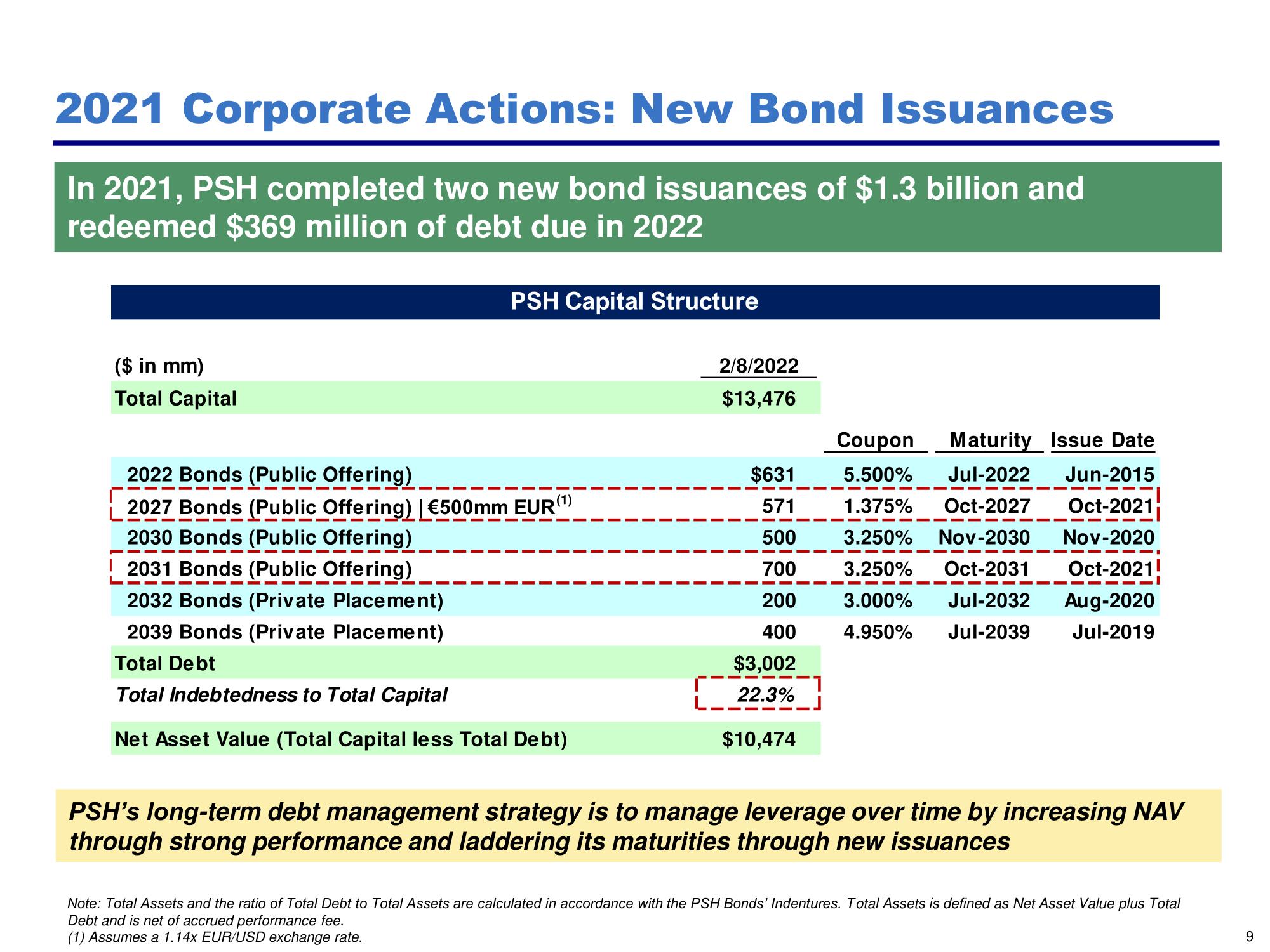

2021 Corporate Actions: New Bond Issuances

In 2021, PSH completed two new bond issuances of $1.3 billion and

redeemed $369 million of debt due in 2022

($ in mm)

Total Capital

PSH Capital Structure

2022 Bonds (Public Offering)

2027 Bonds (Public Offering) | €500mm EUR(¹)

2030 Bonds (Public Offering)

2031 Bonds (Public Offering)

2032 Bonds (Private Placement)

2039 Bonds (Private Placement)

Total Debt

Total Indebtedness to Total Capital

Net Asset Value (Total Capital less Total Debt)

2/8/2022

$13,476

$631

571

500

700

200

400

$3,002

22.3%

$10,474

Coupon

Maturity Issue Date

5.500% Jul-2022 Jun-2015

1.375% Oct-2027 Oct-2021

3.250% Nov-2030 Nov-2020

3.250% Oct-2031 Oct-2021

3.000% Jul-2032 Aug-2020

4.950% Jul-2039 Jul-2019

PSH's long-term debt management strategy is to manage leverage over time by increasing NAV

through strong performance and laddering its maturities through new issuances

Note: Total Assets and the ratio of Total Debt to Total Assets are calculated in accordance with the PSH Bonds' Indentures. Total Assets is defined as Net Asset Value plus Total

Debt and is net of accrued performance fee.

(1) Assumes a 1.14x EUR/USD exchange rate.

9View entire presentation