Morgan Stanley Investment Banking Pitch Book

Portions of this exhibit marked [*] are requested to be treated confidentially

Project Roosevelt

Morgan Stanley

MONROE VALUATION

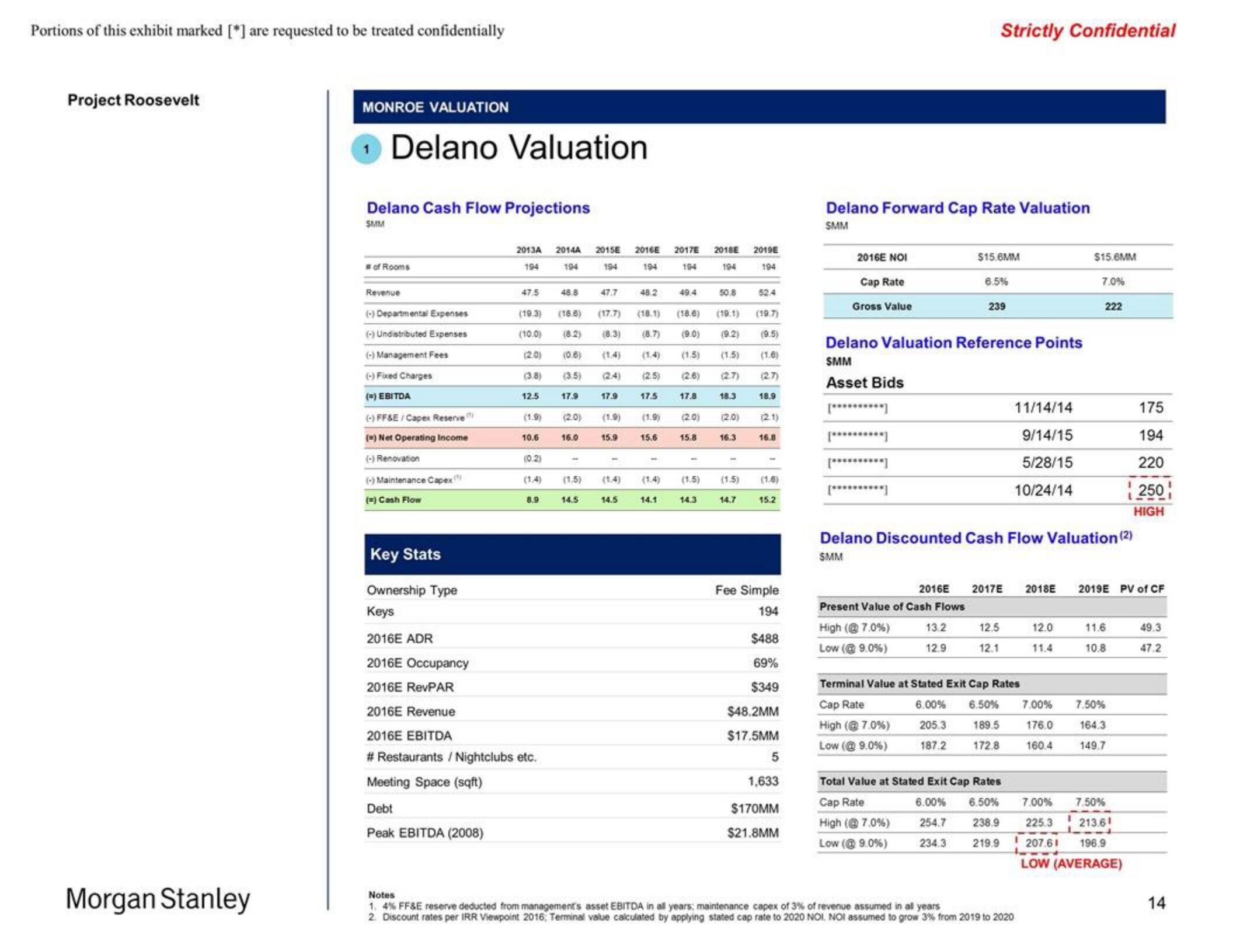

Delano Valuation

Delano Cash Flow Projections

SMM

# of Rooms

Revenue

(-) Departmental Expenses

(-)Undistributed Expenses

(-) Management Fees

(-) Fixed Charges

(=) EBITDA

(-) FF&E / Capex Reserve

(2) Net Operating Income

(-) Renovation

(-) Maintenance Capex

(=) Cash Flow

2013A 2014A 2015E

194

194

47.5

12.5

(19.3) (18.6)

(10.0) (8.2)

(2.0)

(3.8)

(1.9)

10.6

(0.2)

(1.4)

8.9

Key Stats

Ownership Type

Keys

2016E ADR

2016E Occupancy

2016E RevPAR

2016E Revenue

2016E EBITDA

# Restaurants /Nightclubs etc.

Meeting Space (sqft)

Debt

Peak EBITDA (2008)

48.8

47.7

(17.7) (18.1) (18.6)

(8.3) (8.7)

(0.6) (1.4) (1.4)

(3.5)

(2:4) (2.5)

17.9

(2.0)

16.0

(1.5)

14.5

17.9

15.9

2016E 2017E

194

194

14.5

48.2

17.5

15.6

(1.4)

49.4

(1.9) (2.0)

14.1

17.8

(19.1) (19.7)

(9.0) (9.2) (9.5)

(1.5) (1.5) (1.6)

(2.6) (2.7) (27)

15.8

(1.5)

2018E 2019E

194

194

14.3

50.8

18.3

(2.0)

16.3

(1.5)

52.4

14.7

18.9

(2.1)

16.8

(1.6)

15.2

Fee Simple

194

$488

69%

$349

$48.2MM

$17.5MM

5

1,633

$170MM

$21.8MM

Delano Forward Cap Rate Valuation

SMM

2016E NOI

Cap Rate

Gross Value

[**********]

Strictly Confidential

$15.6MM

Delano Valuation Reference Points

SMM

Asset Bids

Present Value of Cash Flows

High (@ 7.0%)

Low (@9.0%)

6.5%

13.2

12.9

239

12.5

12.1

11/14/14

9/14/15

5/28/15

10/24/14

Delano Discounted Cash Flow Valuation (2)

SMM

2016E 2017E 2018E 2019 PV of CF

Terminal Value at Stated Exit Cap Rates

Cap Rate

High (@ 7.0%)

Low (@9.0%)

6.00% 6.50%

205.3 189.5

187.2 172.8

Total Value at Stated Exit Cap Rates

Cap Rate

High (@7.0%)

Low (@ 9.0%)

12.0

11.4

Notes

1. 4% FF&E reserve deducted from management's asset EBITDA in all years; maintenance capex of 3% of revenue assumed in all years

2. Discount rates per IRR Viewpoint 2016, Terminal value calculated by applying stated cap rate to 2020 NOI. NOI assumed to grow 3% from 2019 to 2020

$15.6MM

7.0%

7.00%

176.0

160.4

222

6.00% 6.50% 7.00%

254.7 238.9

234.3 219.9

11.6

10.8

7.50%

164.3

149.7

7.50%

225.3 213.61

112

1 207.61 196.9

LOW (AVERAGE)

175

194

220

250

HIGH

49.3

47.2

14View entire presentation