Citi Investment Banking Pitch Book

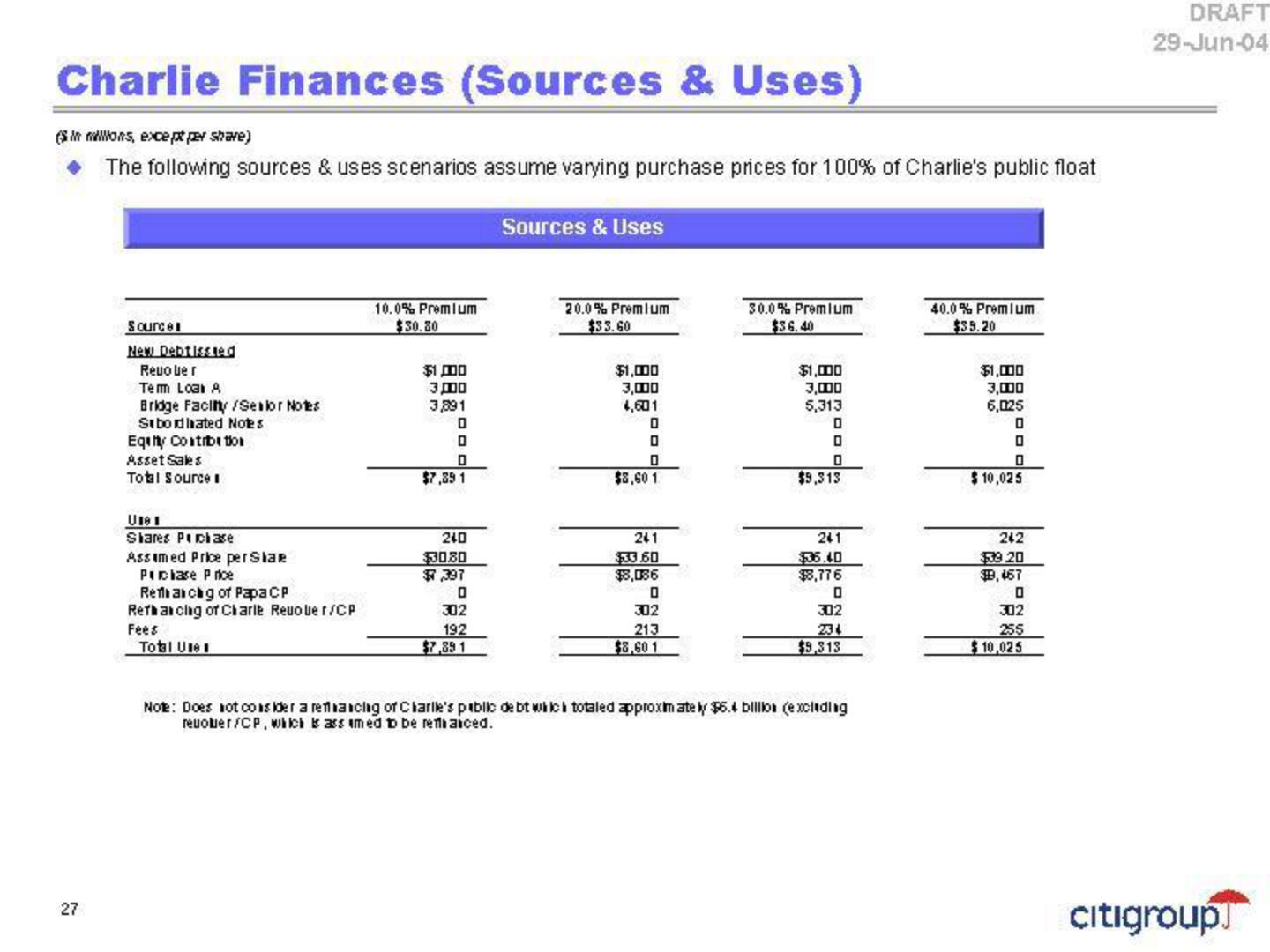

Charlie Finances (Sources & Uses)

(Sin lions, except per share)

The following sources & uses scenarios assume varying purchase prices for 100% of Charlie's public float

27

Source

New Debtissted

Reuouer

Term Loan A

Bridge Faciny /Sealor Notes

Sabordated Notes

Equy Contribution

Asset Sales

Total Source

Une

Shares Puchate

Assamed Price per Share

Purchase Price

Rethanchg of Papa CP

Rethancing of Charlè Reuouer/CP

Fees

Total Use

10.0% Premium

$30.80

$1,000

3,000

3,891

0

0

0

$7,89 1

240

$30.80

$7,397

0

302

192

$7,89 1

Sources & Uses

20.0% Premium

$33.60

$1,000

3,000

4,601

0

0

0

$8,60 1

241

$33.60

$8,086

0

302

213

$8,60 1

30.0% Premium

$36.40

$1,000

3,000

5,313

0

0

0

$9,313

241

$535.40

$3,776

0

302

234

$9,313

Note: Does not consider a refinanclag of Charlle's public debt which totaled approximately $5.4 billion (excluding

reuoluer/CP, which is assumed to be refhaiced.

40.0% Premium

$39.20

$1,000

3,000

6,025

0

0

0

$10,025

242

$39 20

$9,467

0

302

255

$10,025

DRAFT

29-Jun-04

citigroup]View entire presentation