PowerSchool Investor Presentation Deck

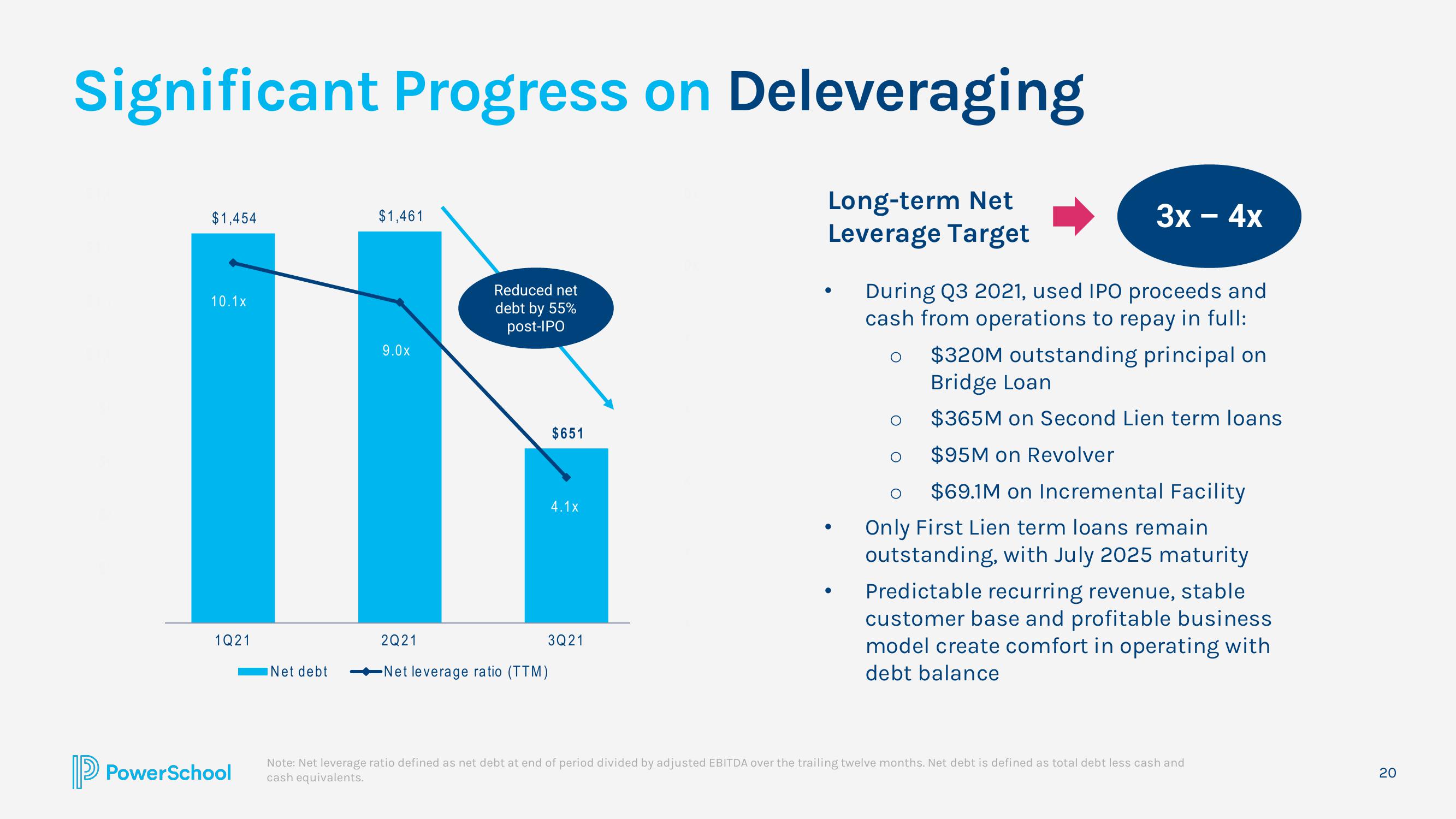

Significant Progress on Deleveraging

Long-term Net

Leverage Target

$1,454

10.1x

1Q21

PowerSchool

Net debt

$1,461

9.0x

Reduced net

debt by 55%

post-IPO

2Q21

Net leverage ratio (TTM)

$651

4.1x

3Q21

3x - 4x

During Q3 2021, used IPO proceeds and

cash from operations to repay in full:

$320M outstanding principal on

Bridge Loan

$365M on Second Lien term loans

$95M on Revolver

$69.1M on Incremental Facility

Only First Lien term loans remain

outstanding, with July 2025 maturity

Predictable recurring revenue, stable

customer base and profitable business

model create comfort in operating with

debt balance

Note: Net leverage ratio defined as net debt at end of period divided by adjusted EBITDA over the trailing twelve months. Net debt is defined as total debt less cash and

cash equivalents.

20View entire presentation