Pathward Financial Results Presentation Deck

Interest Rate Risk Management

18

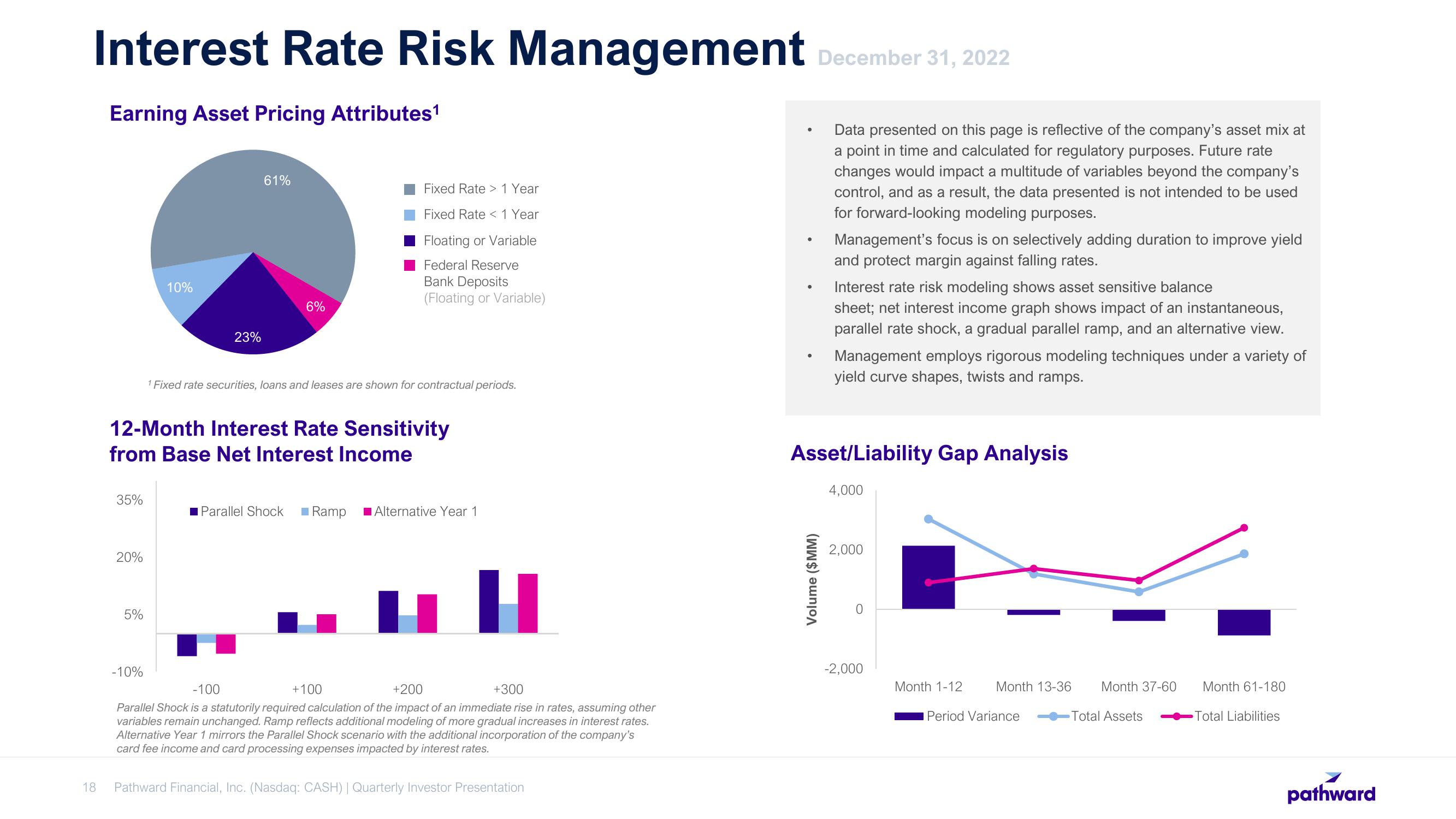

Earning Asset Pricing Attributes¹

35%

20%

5%

10%

-10%

23%

61%

12-Month Interest Rate Sensitivity

from Base Net Interest Income

6%

Fixed Rate > 1 Year

Fixed Rate < 1 Year

Floating or Variable

Federal Reserve

Bank Deposits

(Floating or Variable)

¹ Fixed rate securities, loans and leases are shown for contractual periods.

Parallel Shock ■Ramp ■Alternative Year 1

+100

H

-100

+200

+300

Parallel Shock is a statutorily required calculation of the impact of an immediate rise in rates, assuming other

variables remain unchanged. Ramp reflects additional modeling of more gradual increases in interest rates.

Alternative Year 1 mirrors the Parallel Shock scenario with the additional incorporation of the company's

card fee income and card processing expenses impacted by interest rates.

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

December 31, 2022

Data presented on this page is reflective of the company's asset mix at

a point in time and calculated for regulatory purposes. Future rate

changes would impact a multitude of variables beyond the company's

control, and as a result, the data presented is not intended to be used

for forward-looking modeling purposes.

Volume ($MM)

Management's focus is on selectively adding duration to improve yield

and protect margin against falling rates.

Interest rate risk modeling shows asset sensitive balance

sheet; net interest income graph shows impact of an instantaneous,

parallel rate shock, a gradual parallel ramp, and an alternative view.

Management employs rigorous modeling techniques under a variety of

yield curve shapes, twists and ramps.

Asset/Liability Gap Analysis

4,000

2,000

-2,000

Month 1-12

Month 13-36

Period Variance

Month 37-60

-Total Assets

Month 61-180

Total Liabilities

pathwardView entire presentation