LCI Industries Investor Presentation Deck

APPENDIX

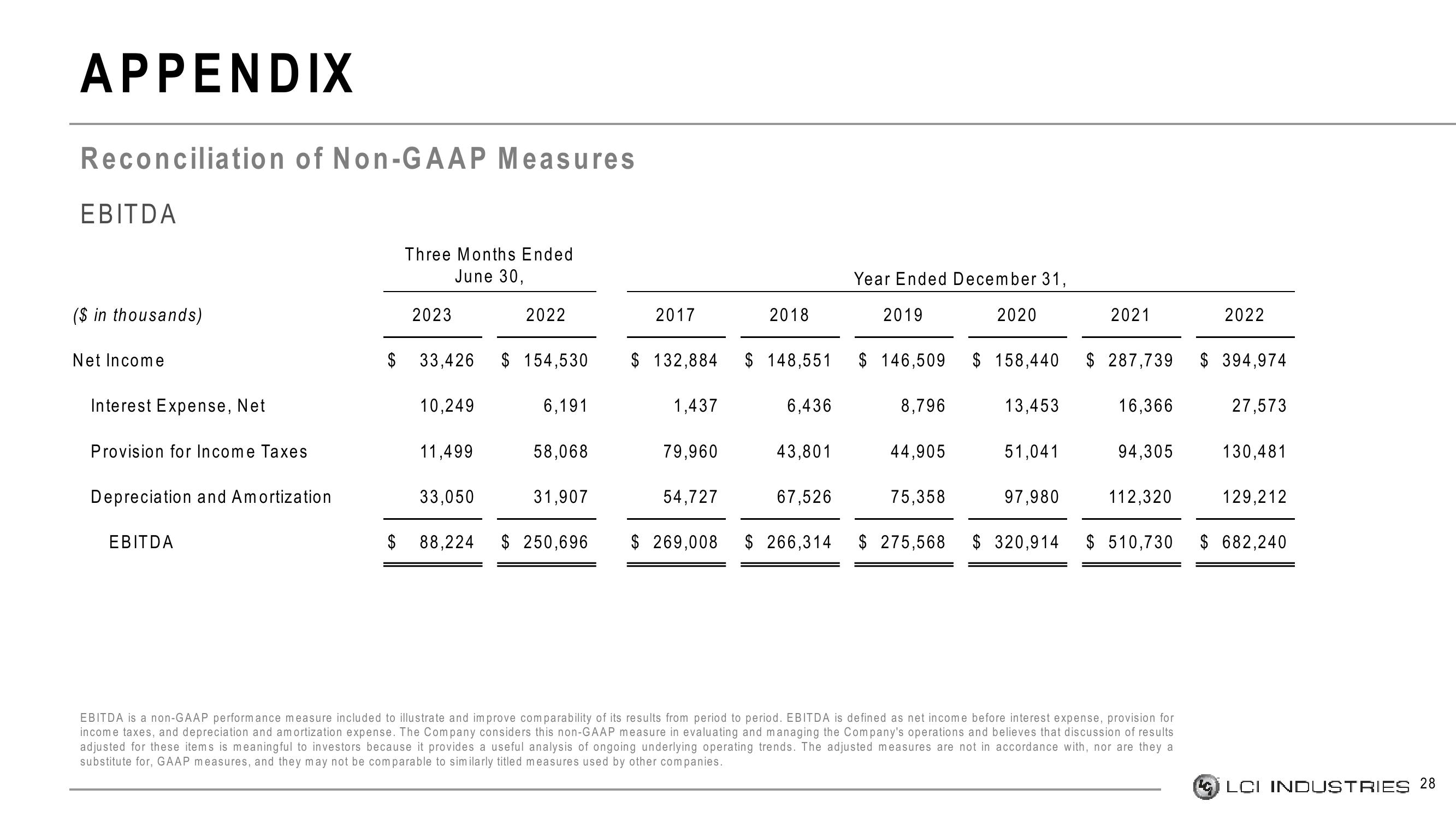

Reconciliation of Non-GAAP Measures

EBITDA

($ in thousands)

Net Income

Interest Expense, Net

Provision for Income Taxes

Depreciation and Amortization

EBITDA

Three Months Ended

June 30,

2023

$33,426

10,249

11,499

33,050

2022

6,191

58,068

2017

31,907

$ 154,530 $ 132,884 $ 148,551 $ 146,509 $ 158,440

1,437

79,960

2018

54,727

6,436

43,801

Year Ended December 31,

67,526

2019

8,796

44,905

75,358

2020

$ 88,224 $ 250,696 $ 269,008 $ 266,314 $275,568

13,453

51,041

97,980

2021

$287,739 $ 394,974

16,366

94,305

112,320

$320,914 $ 510,730

2022

EBITDA is a non-GAAP performance measure included to illustrate and improve comparability of its results from period to period. EBITDA is defined as net income before interest expense, provision for

income taxes, and depreciation and amortization expense. The Company considers this non-GAAP measure in evaluating and managing the Company's operations and believes that discussion of results

adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends. The adjusted measures are not in accordance with, nor are they a

substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies.

27,573

130,481

129,212

$682,240

LCI INDUSTRIES 28View entire presentation