Faraday Future SPAC Presentation Deck

Transaction Structure and Pro Forma Equity Ownership

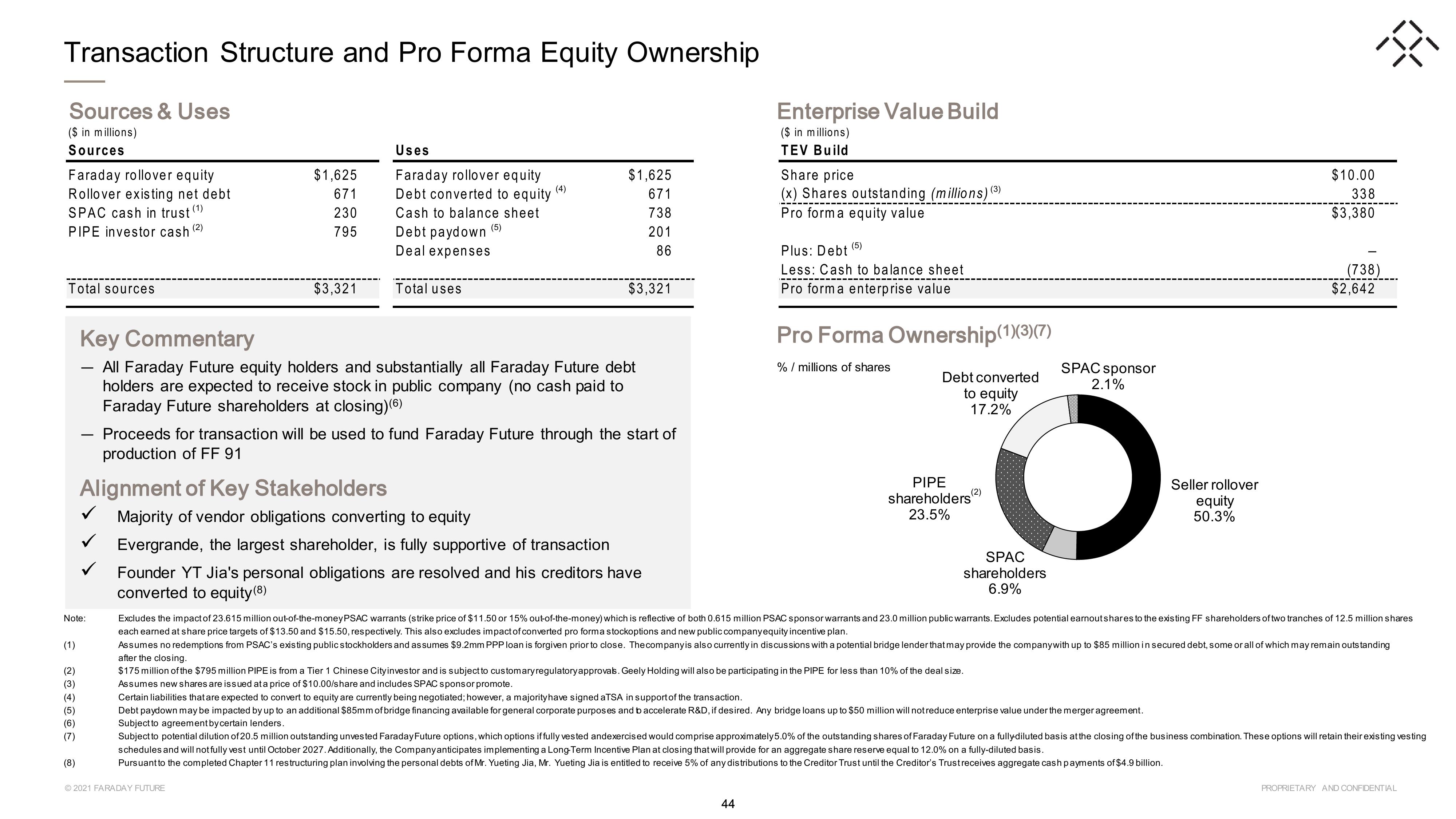

Sources & Uses

($ in millions)

Sources

Faraday rollover equity

Rollover existing net debt

SPAC cash in trust (¹)

PIPE investor cash (2)

Total sources

€ NOTODE

(8)

✓

✓

Note:

$1,625

671

230

795

$3,321

Alignment of Key Stakeholders

Uses

Faraday rollover equity

Debt converted to equity

Cash to balance sheet

(5)

Debt paydown

Deal expenses

Total uses

Key Commentary

- All Faraday Future equity holders and substantially all Faraday Future debt

holders are expected to receive stock in public company (no cash paid to

Faraday Future shareholders at closing) (6)

Ⓒ2021 FARADAY FUTURE

(4)

$1,625

671

738

201

86

$3,321

Proceeds for transaction will be used to fund Faraday Future through the start of

production of FF 91

Majority of vendor obligations converting to equity

Evergrande, the largest shareholder, is fully supportive of transaction

Founder YT Jia's personal obligations are resolved and his creditors have

converted to equity (8)

Enterprise Value Build

($ in millions)

TEV Build

44

Share price

(x) Shares outstanding (millions) (3)

Pro forma equity value

Plus: Debt (5)

Less: Cash to balance sheet

Pro forma enterprise value

Pro Forma Ownership(1)(3)(7)

% / millions of shares

Debt converted

to equity

17.2%

PIPE

shareholders"

23.5%

(2)

SPAC

shareholders

6.9%

SPAC sponsor

2.1%

Seller rollover

equity

50.3%

38

$10.00

338

$3,380

Excludes the impact of 23.615 million out-of-the-money PSAC warrants (strike price of $11.50 or 15% out-of-the-money) which is reflective of both 0.615 million PSAC sponsor warrants and 23.0 million public warrants. Excludes potential earnout shares to the existing FF shareholders of two tranches of 12.5 million shares

each earned at share price targets of $13.50 and $15.50, respectively. This also excludes impact of converted pro forma stockoptions and new public company equity incentive plan.

Assumes no redemptions from PSAC's existing public stockholders and assumes $9.2mm PPP loan is forgiven prior to close. The company is also currently in discussions with a potential bridge lender that may provide the company with up to $85 million in secured debt, some or all of which may remain outstanding

after the closing.

$175 million of the $795 million PIPE is from a Tier 1 Chinese Cityinvestor and is subject to customary regulatory approvals. Geely Holding will also be participating in the PIPE for less than 10% of the deal size.

Assumes new shares are issued at a price of $10.00/share and includes SPAC sponsor promote.

Certain liabilities that are expected to convert to equity are currently being negotiated; however, a majority have signed aTSA in support of the transaction.

Debt paydown may be impacted by up to an additional $85mm of bridge financing available for general corporate purposes and b accelerate R&D, if desired. Any bridge loans up to $50 million will not reduce enterprise value under the merger agreement.

Subject to agreement by certain lenders.

Subject to potential dilution of 20.5 million outstanding unvested Faraday Future options, which options if fully vested and exercised would comprise approximately 5.0% of the outstanding shares of Faraday Future on a fully-diluted basis at the closing of the business combination. These options will retain their existing vesting

schedules and will not fully vest until October 2027. Additionally, the Company anticipates implementing a Long-Term Incentive Plan at closing that will provide for an aggregate share reserve equal to 12.0% on a fully-diluted basis.

Pursuant to the completed Chapter 11 restructuring plan involving the personal debts of Mr. Yueting Jia, Mr. Yueting Jia is entitled to receive 5% of any distributions to the Creditor Trust until the Creditor's Trust receives aggregate cash payments of $4.9 billion.

(738)

$2,642

PROPRIETARY AND CONFIDENTIALView entire presentation