Kinnevik Results Presentation Deck

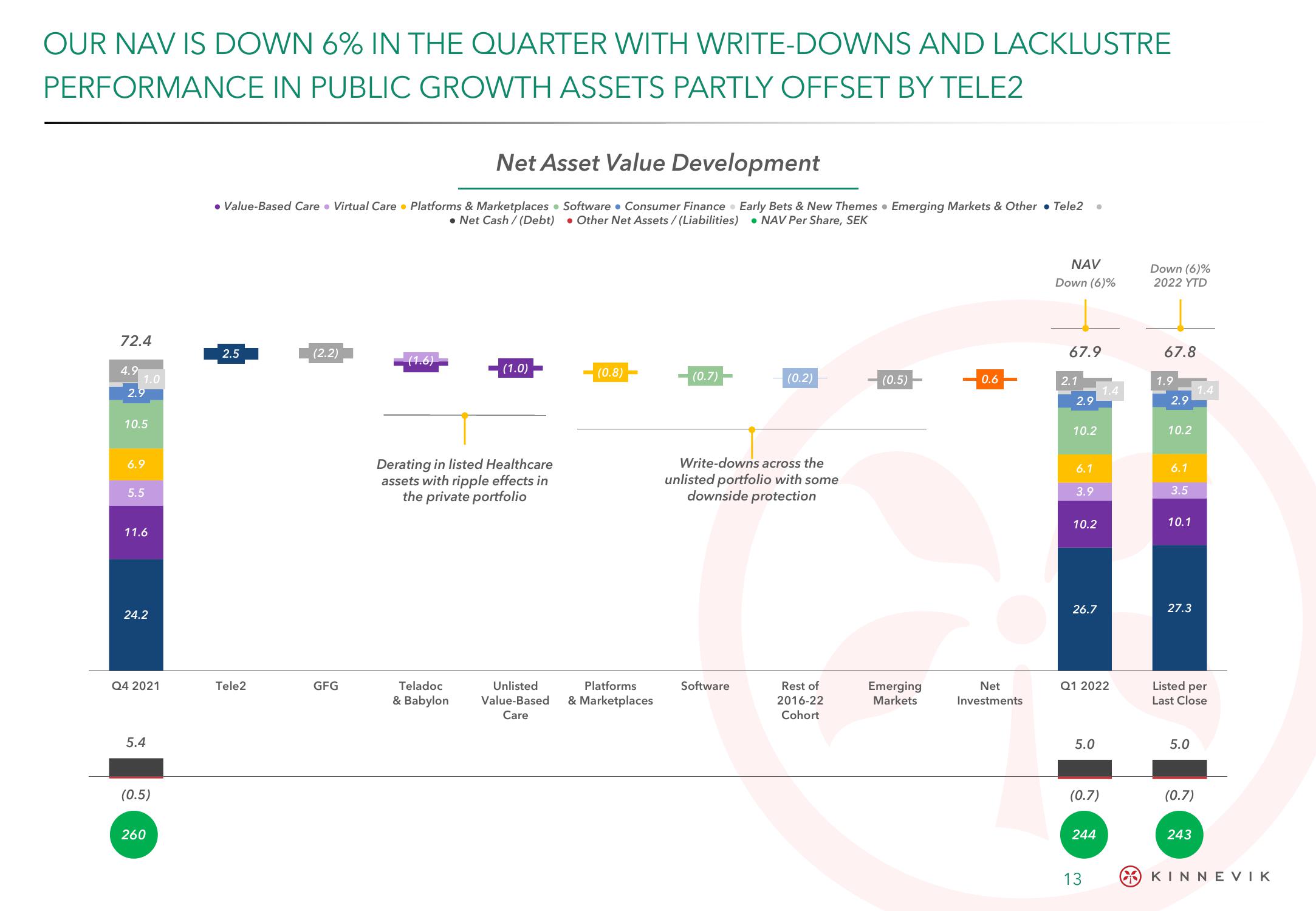

OUR NAV IS DOWN 6% IN THE QUARTER WITH WRITE-DOWNS AND LACKLUSTRE

PERFORMANCE IN PUBLIC GROWTH ASSETS PARTLY OFFSET BY TELE2

72.4

4.9

1.0

2.9

10.5

6.9

5.5

11.6

24.2

Q4 2021

5.4

(0.5)

260

Net Asset Value Development

• Value-Based Care Virtual Care Platforms & Marketplaces Software Consumer Finance Early Bets & New Themes Emerging Markets & Other • Tele2

.Net Cash/ (Debt) Other Net Assets/(Liabilities). NAV Per Share, SEK

2.5

Tele2

(2.2)

GFG

(1.6)

(1.0)

Derating in listed Healthcare

assets with ripple effects in

the private portfolio

Teladoc

& Babylon

(0.8)

Unlisted

Platforms

Value-Based & Marketplaces

Care

(0.7)

(0.2)

Write-downs across the

unlisted portfolio with some

downside protection

Software

Rest of

2016-22

Cohort

(0.5)

Emerging

Markets

0.6

Net

Investments

NAV

Down (6)%

67.9

2.1

2.9

10.2

6.1

3.9

10.2

26.7

Q1 2022

5.0

(0.7)

244

1.4

13

Down (6)%

2022 YTD

67.8

1.9

2.9

10.2

6.1

3.5

10.1

27.3

Listed per

Last Close

5.0

(0.7)

1.4

243

(9) ΚΙΝΝEVIKView entire presentation