Pathward Financial Results Presentation Deck

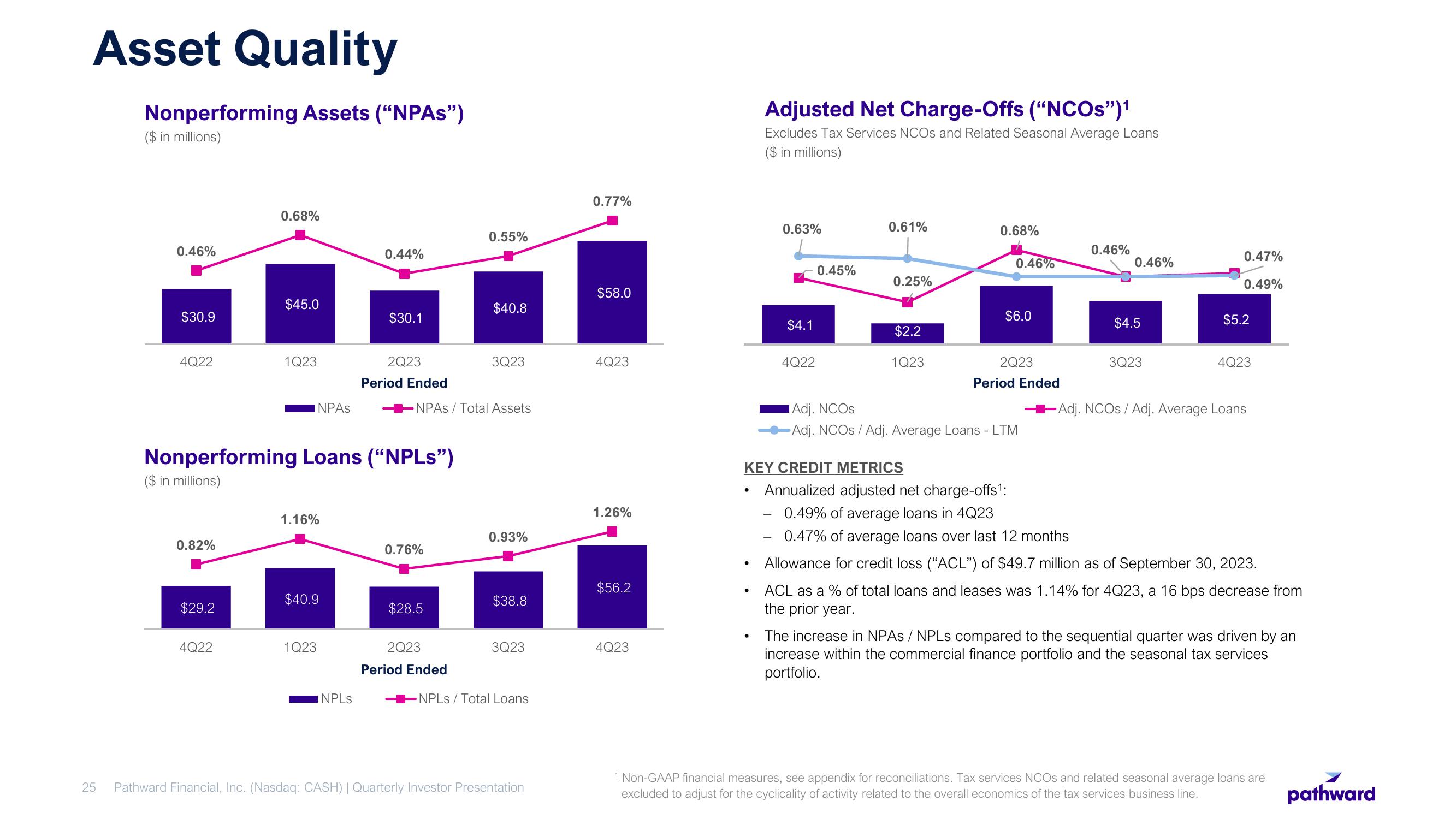

Asset Quality

25

Nonperforming Assets ("NPAs")

($ in millions)

0.46%

$30.9

4Q22

0.82%

$29.2

0.68%

4Q22

$45.0

1Q23

INPAS

1.16%

Nonperforming Loans ("NPLs")

($ in millions)

$40.9

1Q23

0.44%

INPLs

$30.1

2Q23

Period Ended

0.76%

-NPAS/ Total Assets

$28.5

2Q23

0.55%

Period Ended

$40.8

3Q23

0.93%

$38.8

3Q23

NPLs/Total Loans

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

0.77%

$58.0

4Q23

1.26%

$56.2

4Q23

●

●

●

Adjusted Net Charge-Offs ("NCOS")¹

Excludes Tax Services NCOs and Related Seasonal Average Loans

($ in millions)

●

0.63%

$4.1

4Q22

0.45%

0.61%

0.25%

$2.2

1Q23

0.68%

0.46%

$6.0

2Q23

Period Ended

Adj. NCOS

-Adj. NCOS / Adj. Average Loans - LTM

0.46%

0.46%

$4.5

3Q23

0.47%

0.49%

KEY CREDIT METRICS

Annualized adjusted net charge-offs¹:

0.49% of average loans in 4Q23

0.47% of average loans over last 12 months

Allowance for credit loss ("ACL") of $49.7 million as of September 30, 2023.

ACL as a % of total loans and leases was 1.14% for 4Q23, a 16 bps decrease from

the prior year.

$5.2

4Q23

-Adj. NCOS / Adj. Average Loans

The increase in NPAs / NPLs compared to the sequential quarter was driven by an

increase within the commercial finance portfolio and the seasonal tax services

portfolio.

1 Non-GAAP financial measures, see appendix for reconciliations. Tax services NCOS and related seasonal average loans are

excluded to adjust for the cyclicality of activity related to the overall economics of the tax services business line.

pathwardView entire presentation