Grab Results Presentation Deck

Business Update

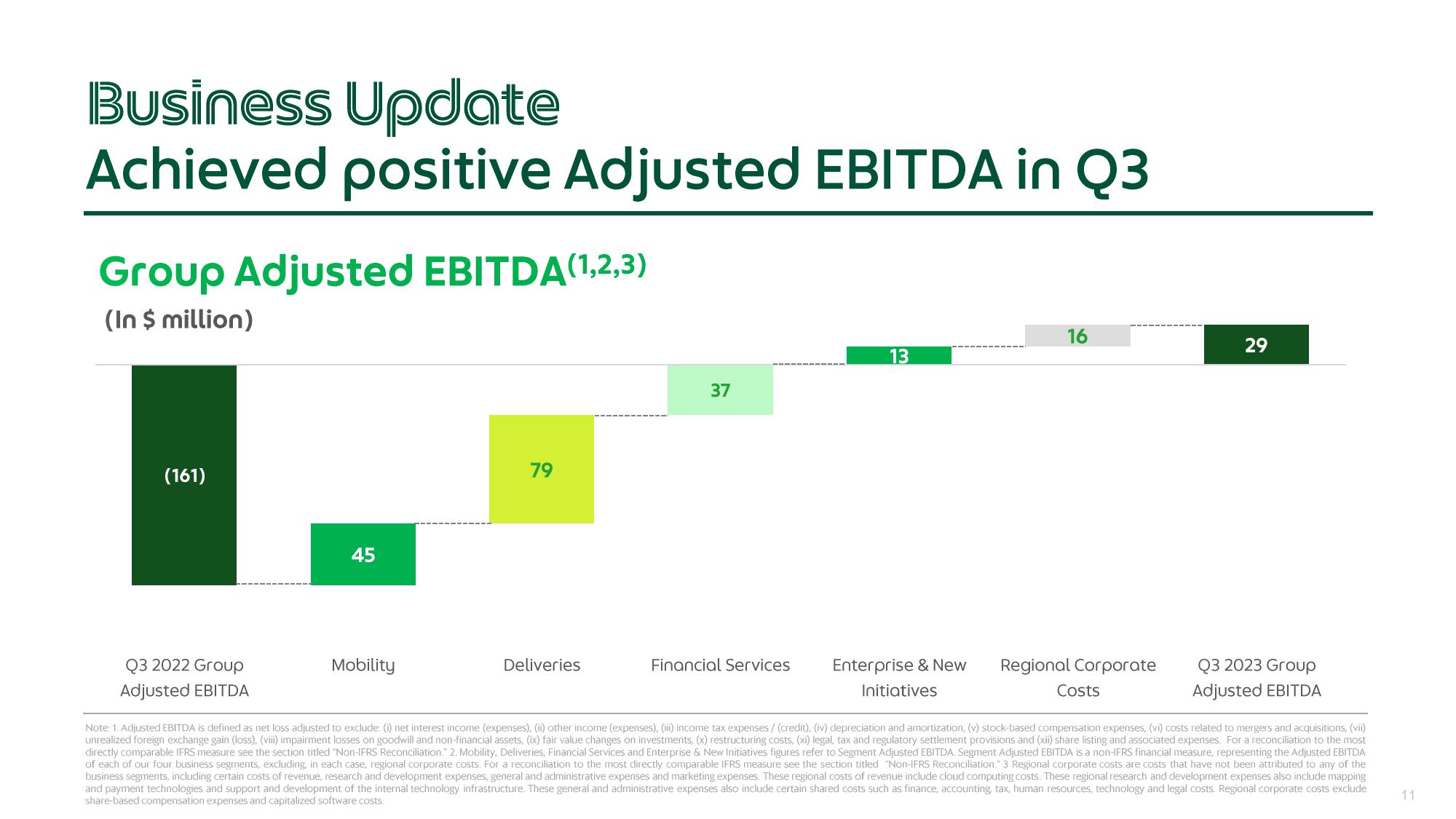

Achieved positive Adjusted EBITDA in Q3

Group Adjusted EBITDA(1,2,3)

(In $ million)

(161)

Q3 2022 Group

Adjusted EBITDA

45

Mobility

79

Deliveries

37

Financial Services

13

Enterprise & New

Initiatives

16

Regional Corporate

Costs

29

Q3 2023 Group

Adjusted EBITDA

Note: 1. Adjusted EBITDA is defined as net loss adjusted exclude: (1) net interest income (expenses), (ii) other income (expenses), (iii) income tax expenses/ (credit), (iv) depreciation and amortization, (v) stock-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii)

unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses. For a reconciliation to the most

directly comparable IFRS measure see the section titled "Non-IFRS Reconciliation." 2. Mobility, Deliveries, Financial Services and Enterprise & New Initiatives figures refer to Segment Adjusted EBITDA. Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA

of each of our four business segments, excluding, in each case, regional corporate costs. For a reconciliation to the most directly comparable IFRS measure see the section titled "Non-IFRS Reconciliation." 3 Regional corporate costs are costs that have not been attributed to any of the

business segments, including certain costs of revenue, research and development expenses, general and administrative expenses and marketing expenses. These regional costs of revenue include cloud computing costs. These regional research and development expenses also include mapping

and payment technologies and support and development of the internal technology infrastructure. These general and administrative expenses also include certain shared costs such as finance, accounting, tax, human resources, technology and legal costs. Regional corporate costs exclude

share-based compensation expenses and capitalized software costs.

11View entire presentation