WeWork Investor Presentation Deck

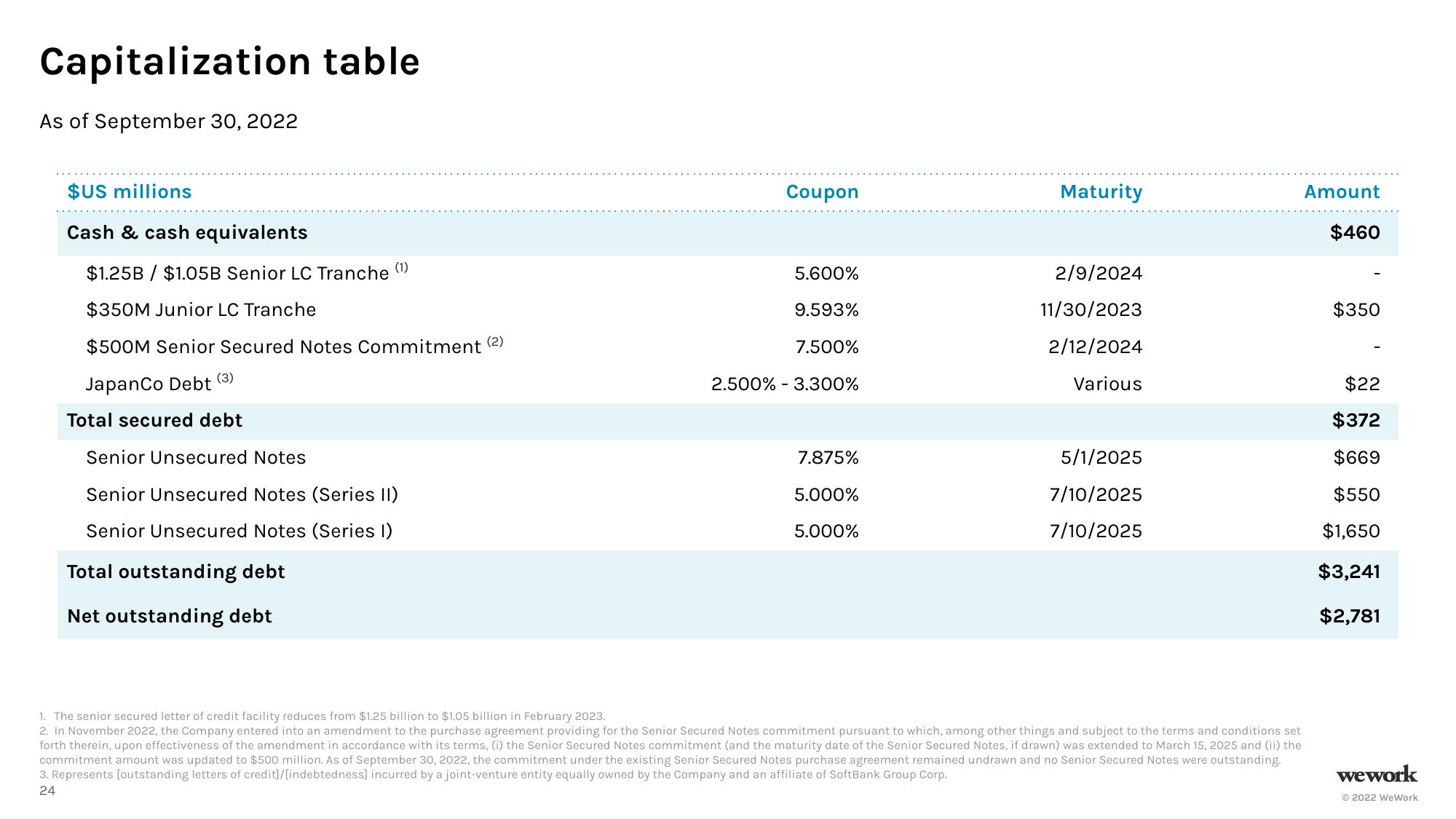

Capitalization table

As of September 30, 2022

$US millions

Cash & cash equivalents

$1.25B / $1.05B Senior LC Tranche

$350M Junior LC Tranche

$500M Senior Secured Notes Commitment (2)

JapanCo Debt

(3)

Total secured debt

Senior Unsecured Notes

Senior Unsecured Notes (Series II)

Senior Unsecured Notes (Series I)

Total outstanding debt

Net outstanding debt

Coupon

5.600%

9.593%

7.500%

2.500% - 3.300%

7.875%

5.000%

5.000%

Maturity

2/9/2024

11/30/2023

2/12/2024

Various

5/1/2025

7/10/2025

7/10/2025

1. The senior secured letter of credit facility reduces from $1.25 billion to $1.05 billion in February 2023.

2. In November 2022, the Company entered into an amendment to the purchase agreement providing for the Senior Secured Notes commitment pursuant to which, among other things and subject to the terms and conditions set

forth therein, upon effectiveness of the amendment in accordance with its terms, (i) the Senior Secured Notes commitment (and the maturity date of the Senior Secured Notes, if drawn) was extended to March 15, 2025 and (ii) the

commitment amount was updated to $500 million. As of September 30, 2022, the commitment under the existing Senior Secured Notes purchase agreement remained undrawn and no Senior Secured Notes were outstanding.

3. Represents [outstanding letters of credit]/[indebtedness] incurred by a joint-venture entity equally owned by the Company and an affiliate of SoftBank Group Corp.

24

Amount

$460

$350

$22

$372

$669

$550

$1,650

$3,241

$2,781

wework

Ⓒ2022 WeWorkView entire presentation