Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

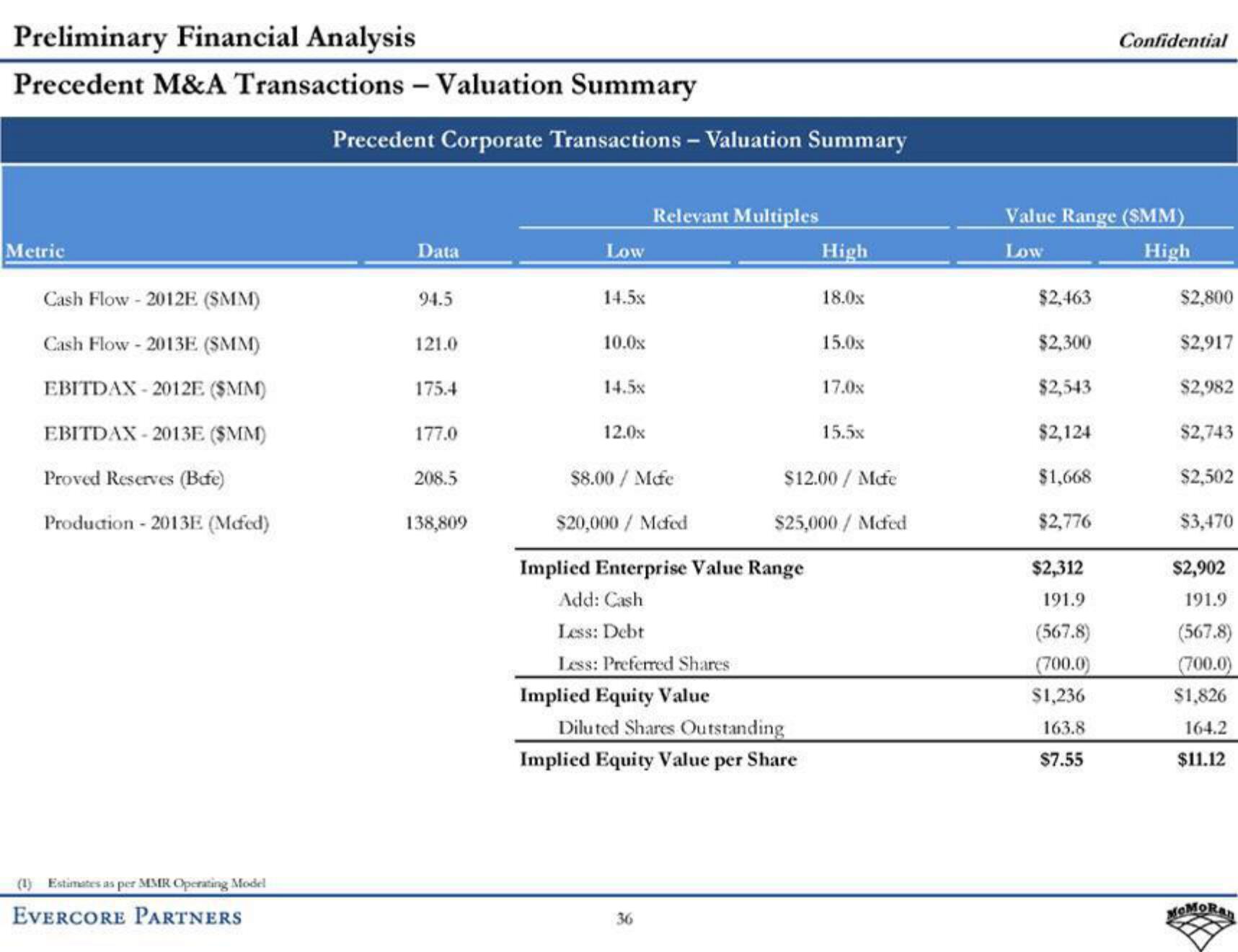

Precedent M&A Transactions - Valuation Summary

Metric

Cash Flow-2012E (SMM)

Cash Flow - 2013E (SMM)

EBITDAX-2012E ($MM)

EBITDAX 2013E ($MM)

Proved Reserves (Bafe)

Production - 2013E (Mcfed)

(1) Estimates as per MMR Operating Model

EVERCORE PARTNERS

Precedent Corporate Transactions - Valuation Summary

Data

94.5

121.0

175.4

177.0

208.5

138,809

Low

14.5x

10.0x

14.58

12.0x

Relevant Multiples

$8.00 / Mofe

$20,000/ Mcfed

Implied Equity Value

Implied Enterprise Value Range

Add: Cash

Less: Debt

Less: Preferred Shares

36

High

Diluted Shares Outstanding

Implied Equity Value per Share

18.0x

15.0x

17.0x

$12.00 / Mcfe

15.5x

$25,000/Mcfed

Value Range ($MM)

Low

High

$2,463

$2,300

$2,543

$2,124

$1,668

$2,776

Confidential

$2,312

191.9

(567.8)

(700.0)

$1,236

163.8

$7.55

$2,800

$2,917

$2,982

$2,743

$2,502

$3,470

$2,902

191.9

(567.8)

(700.0)

$1,826

164.2

$11.12

MOMORANView entire presentation