Nikola Results Presentation Deck

NIKOLA.

PAGE/1 1

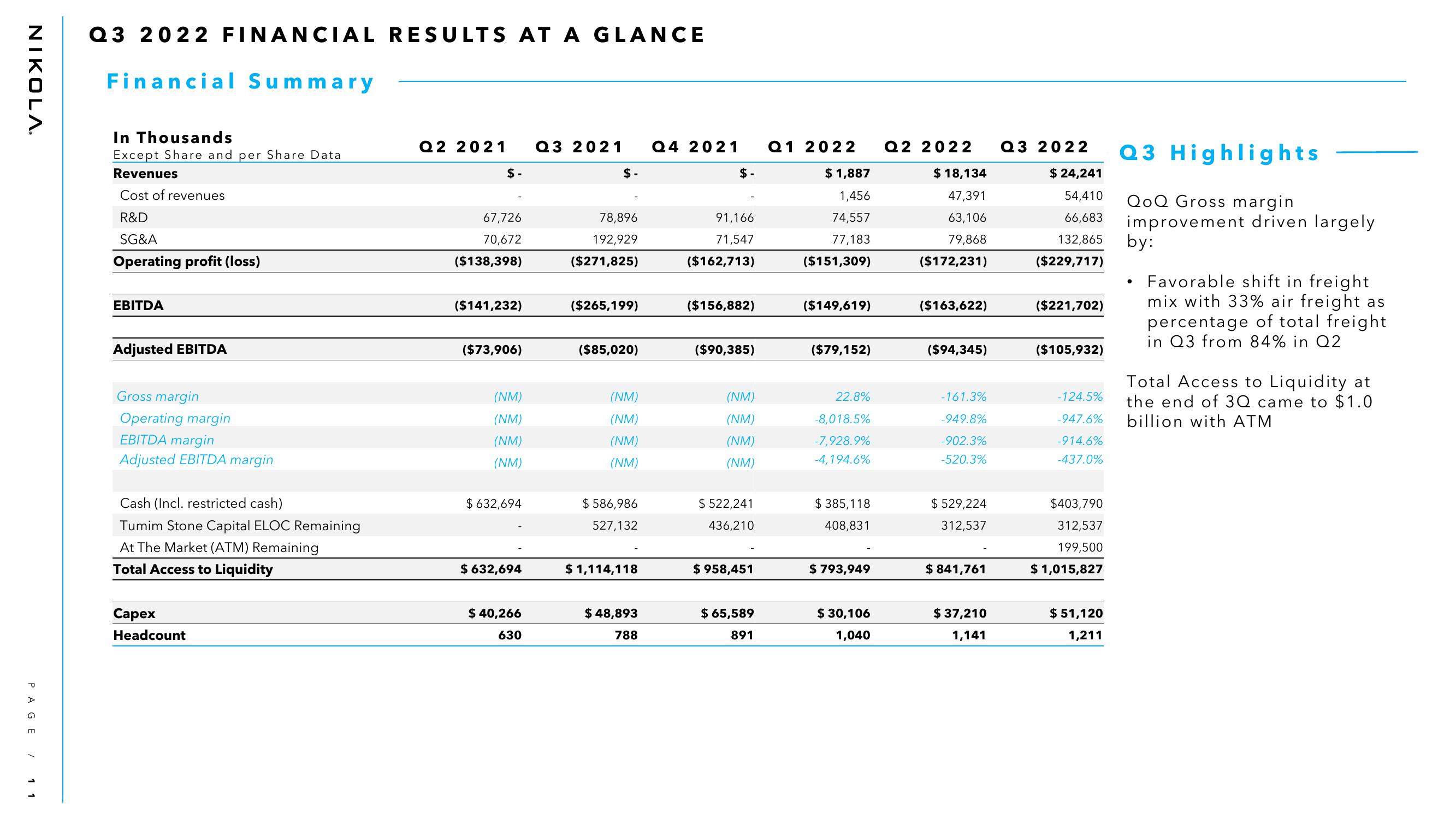

Q3 2022 FINANCIAL RESULTS AT A GLANCE

Financial Summary

In Thousands

Except Share and per Share Data

Revenues

Cost of revenues

R&D

SG&A

Operating profit (loss)

EBITDA

Adjusted EBITDA

Gross margin

Operating margin

EBITDA margin

Adjusted EBITDA margin

Cash (Incl. restricted cash)

Tumim Stone Capital ELOC Remaining

At The Market (ATM) Remaining

Total Access to Liquidity

Capex

Headcount

Q2 2021 Q3 2021 Q4 2021

$-

67,726

70,672

($138,398)

($141,232)

($73,906)

(NM)

(NM)

(NM)

(NM)

$632,694

$ 632,694

$ 40,266

630

$-

78,896

192,929

($271,825)

($265,199)

($85,020)

(NM)

(NM)

(NM)

(NM)

$ 586,986

527,132

$1,114,118

$ 48,893

788

$-

91,166

71,547

($162,713)

($156,882)

($90,385)

(NM)

(NM)

(NM)

(NM)

$ 522,241

436,210

$ 958,451

$ 65,589

891

Q1 2022 Q2 2022

$ 18,134

47,391

$ 1,887

1,456

74,557

77,183

($151,309)

63,106

79,868

($172,231)

($149,619)

($79,152)

22.8%

-8,018.5%

-7,928.9%

-4,194.6%

$385,118

408,831

$ 793,949

$ 30,106

1,040

($163,622)

($94,345)

-161.3%

-949.8%

-902.3%

-520.3%

$529,224

312,537

$ 841,761

$ 37,210

1,141

Q3 2022

$ 24,241

54,410

66,683

132,865

($229,717)

($221,702)

($105,932)

-124.5%

-947.6%

-914.6%

-437.0%

$403,790

312,537

199,500

$ 1,015,827

$ 51,120

1,211

Q3 Highlights

QoQ Gross margin

improvement driven largely

by:

●

Favorable shift in freight

mix with 33% air freight as

percentage of total freight

in Q3 from 84% in Q2

Total Access to Liquidity at

the end of 3Q came to $1.0

billion with ATMView entire presentation