NuStar Energy Investor Conference Presentation Deck

NuStar

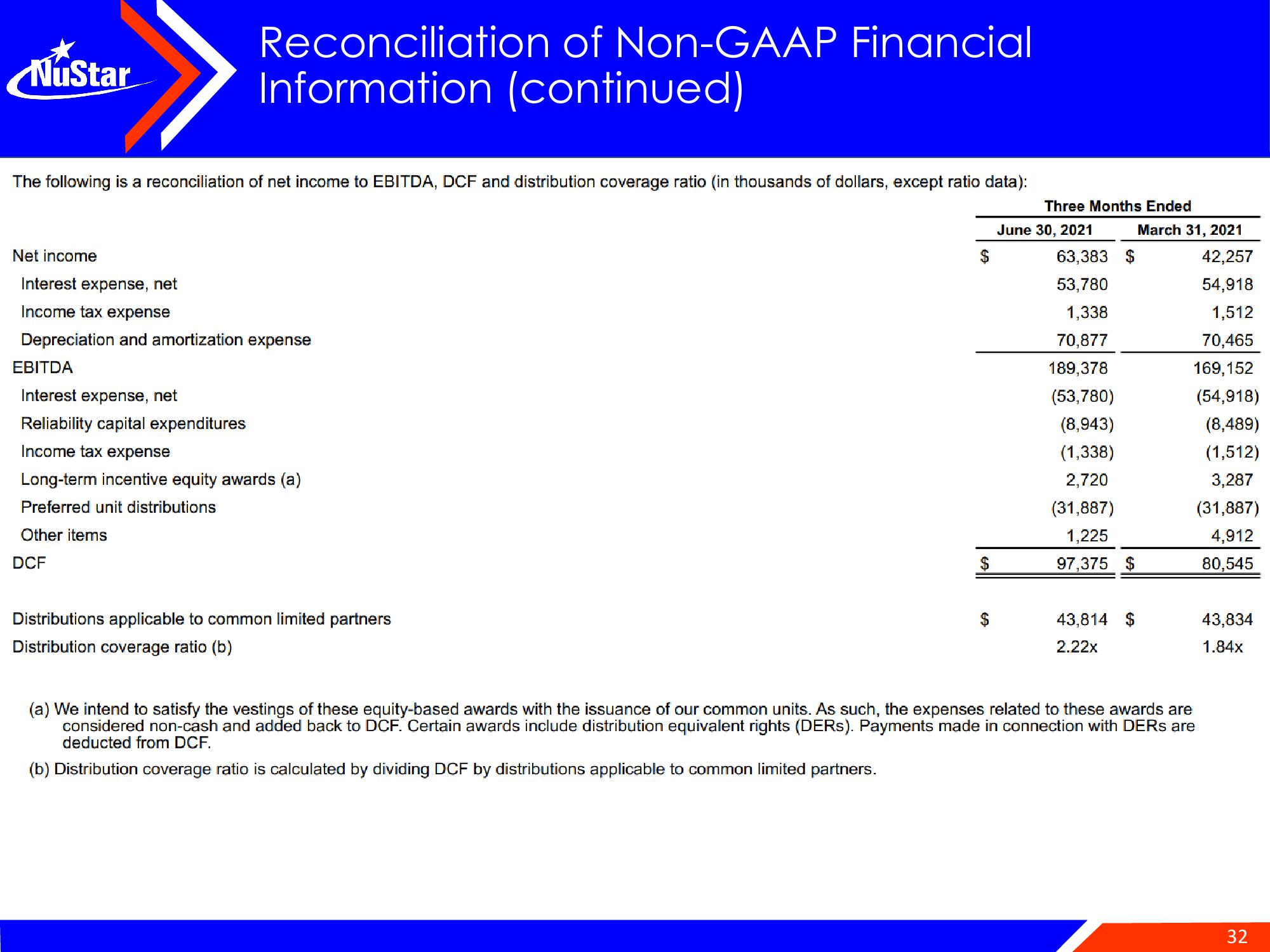

Reconciliation of Non-GAAP Financial

Information (continued)

The following is a reconciliation of net income to EBITDA, DCF and distribution coverage ratio (in thousands of dollars, except ratio data):

Net income

Interest expense, net

Income tax expense

Depreciation and amortization expense

EBITDA

Interest expense, net

Reliability capital expenditures

Income tax expense

Long-term incentive equity awards (a)

Preferred unit distributions

Other items

DCF

Distributions applicable to common limited partners

Distribution coverage ratio (b)

$

Three Months Ended

June 30, 2021

63,383 $

53,780

1,338

70,877

189,378

(53,780)

(8,943)

(1,338)

2,720

(31,887)

1,225

97,375 $

43,814 $

2.22x

March 31, 2021

42,257

54,918

1,512

70,465

169,152

(54,918)

(8,489)

(1,512)

3,287

(31,887)

4,912

80,545

(a) We intend to satisfy the vestings of these equity-based awards with the issuance of our common units. As such, the expenses related to these awards are

considered non-cash and added back to DCF. Certain awards include distribution equivalent rights (DERS). Payments made in connection with DERS are

deducted from DCF.

(b) Distribution coverage ratio is calculated by dividing DCF by distributions applicable to common limited partners.

43,834

1.84x

32View entire presentation