Polestar Investor Presentation Deck

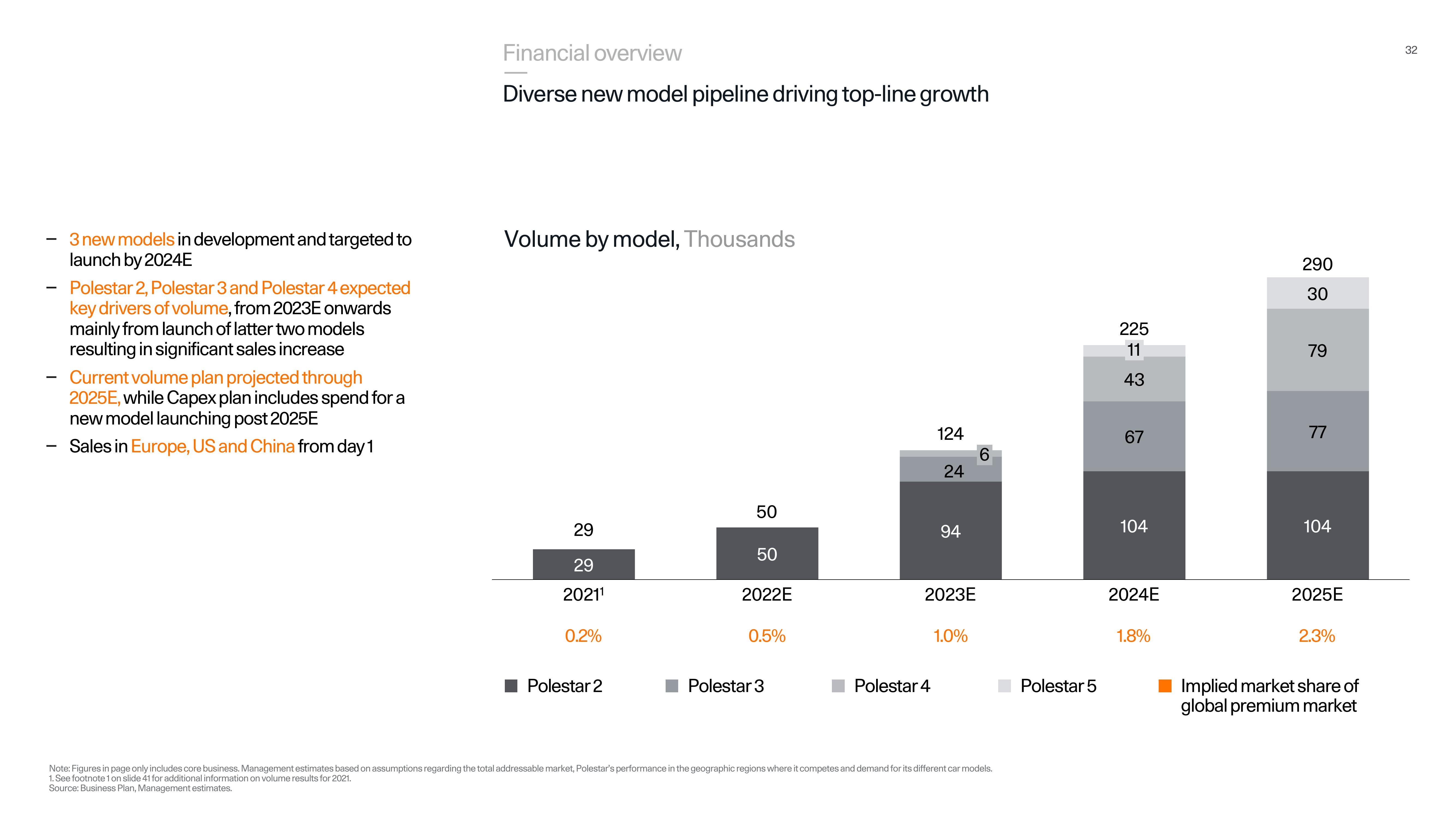

3 new models in development and targeted to

launch by 2024E

Polestar 2, Polestar 3 and Polestar 4 expected

key drivers of volume, from 2023E onwards

mainly from launch of latter two models

resulting in significant sales increase

Current volume plan projected through

2025E, while Capex plan includes spend for a

new model launching post 2025E

Sales in Europe, US and China from day 1

Financial overview

Diverse new model pipeline driving top-line growth

Volume by model, Thousands

29

29

2021¹

0.2%

Polestar 2

50

50

2022E

0.5%

Polestar 3

124

Polestar 4

24

94

2023E

1.0%

CO

Note: Figures in page only includes core business. Management estimates based on assumptions regarding the total addressable market, Polestar's performance in the geographic regions where it competes and demand for its different car models.

1. See footnote 1 on slide 41 for additional information on volume results for 2021.

Source: Business Plan, Management estimates.

Polestar 5

225

11

43

67

104

2024E

1.8%

290

30

79

77

104

2025E

2.3%

Implied market share of

global premium market

32View entire presentation