Evercore Investment Banking Pitch Book

Financial Analysis

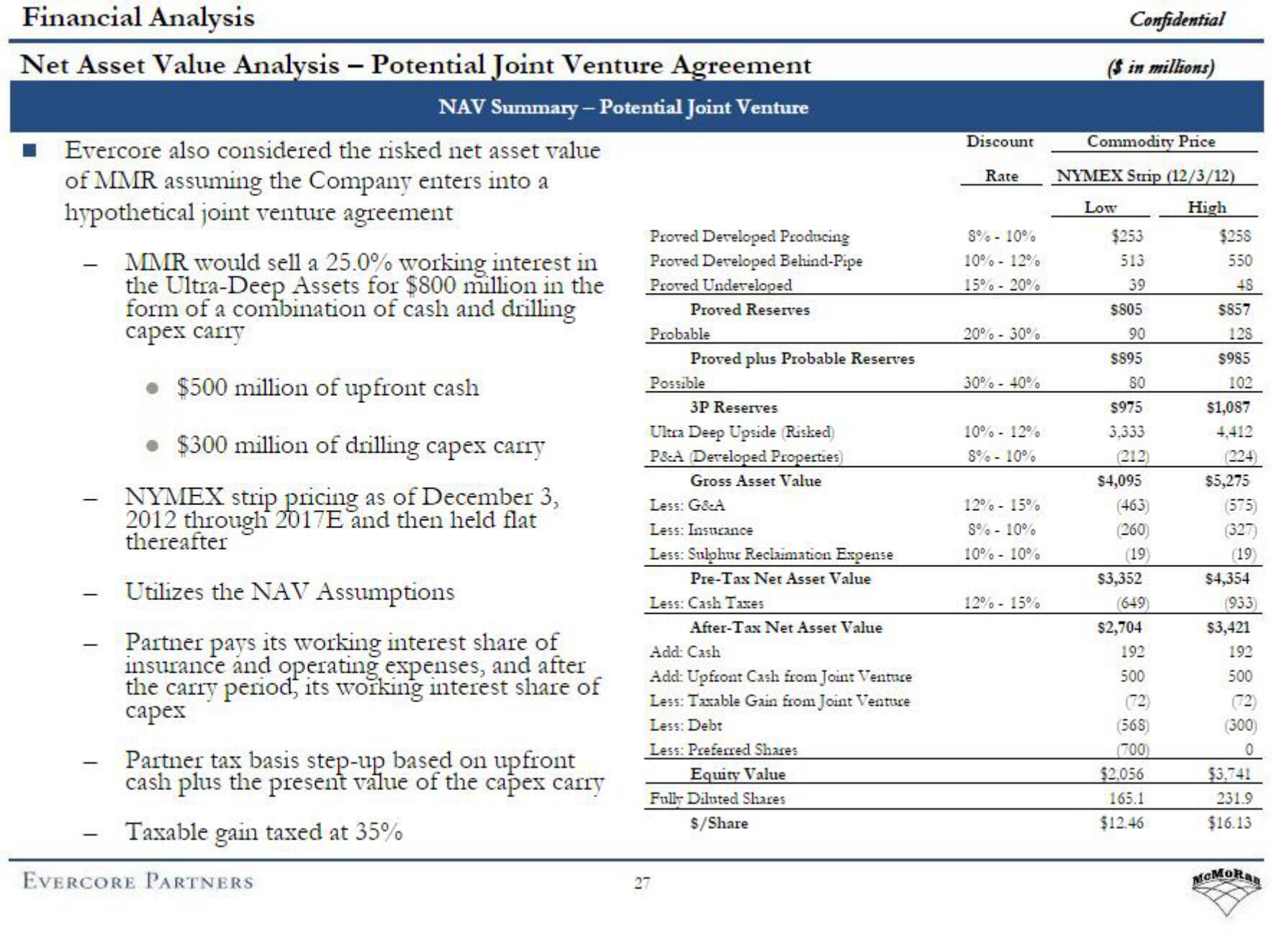

Net Asset Value Analysis - Potential Joint Venture Agreement

NAV Summary -Potential Joint Venture

Evercore also considered the risked net asset value

of MMR assuming the Company enters into a

hypothetical joint venture agreement

-

-

-

MMR would sell a 25.0% working interest in

the Ultra-Deep Assets for $800 million in the

form of a combination of cash and drilling

capex carry

$500 million of upfront cash

$300 million of drilling capex carry

NYMEX strip pricing as of December 3,

2012 through 2017E and then held flat

thereafter

Utilizes the NAV Assumptions

Partner pays its working interest share of

insurance and operating expenses, and after

the carry period, its working interest share of

capex

Partner tax basis step-up based on upfront

cash plus the present value of the capex carry

Taxable gain taxed at 35%

EVERCORE PARTNERS

Proved Developed Producing

Proved Developed Behind-Pipe

Proved Undeveloped

Proved Reserves

Probable

Proved plus Probable Reserves

Possible

3P Reserves

Ultra Deep Upside (Risked)

P&A Developed Properties)

Gross Asset Value

Less: G&A

Less: Insurance

Less: Sulphur Reclaimation Expense

Pre-Tax Net Asset Value

Less: Cash Taxes

27

After-Tax Net Asset Value

Add: Cash

Add: Upfront Cash from Joint Venture

Less: Taxable Gain from Joint Venture

Less: Debt

Less: Preferred Shares

Equity Value

Fully Diluted Shares

$/Share

Discount

Rate

8% - 10%

10% - 12%

15%-20%

20%-30%

30% -40%

10% -12%

8% - 10%

12%-15%

8% - 10%

10% 10%

12%-15%

Confidential

($ in millions)

Commodity Price

NYMEX Strip (12/3/12)

Low

High

$253

513

39

$805

90

$895

80

$975

3,333

(212)

$4,095

(463)

(260)

(19)

$3,352

(649)

$2,704

192

500

(72)

(568)

(700)

$2,056

165.1

$12.46

$258

550

48

$857

128

$985

102

$1,087

4,412

(224)

$5,275

(575)

(327)

(19)

$4,354

(933)

$3,421

192

500

(72)

(300)

$3,741

231.9

$16.13

MCMORanView entire presentation