Stem SPAC Presentation Deck

stem Gross Margins

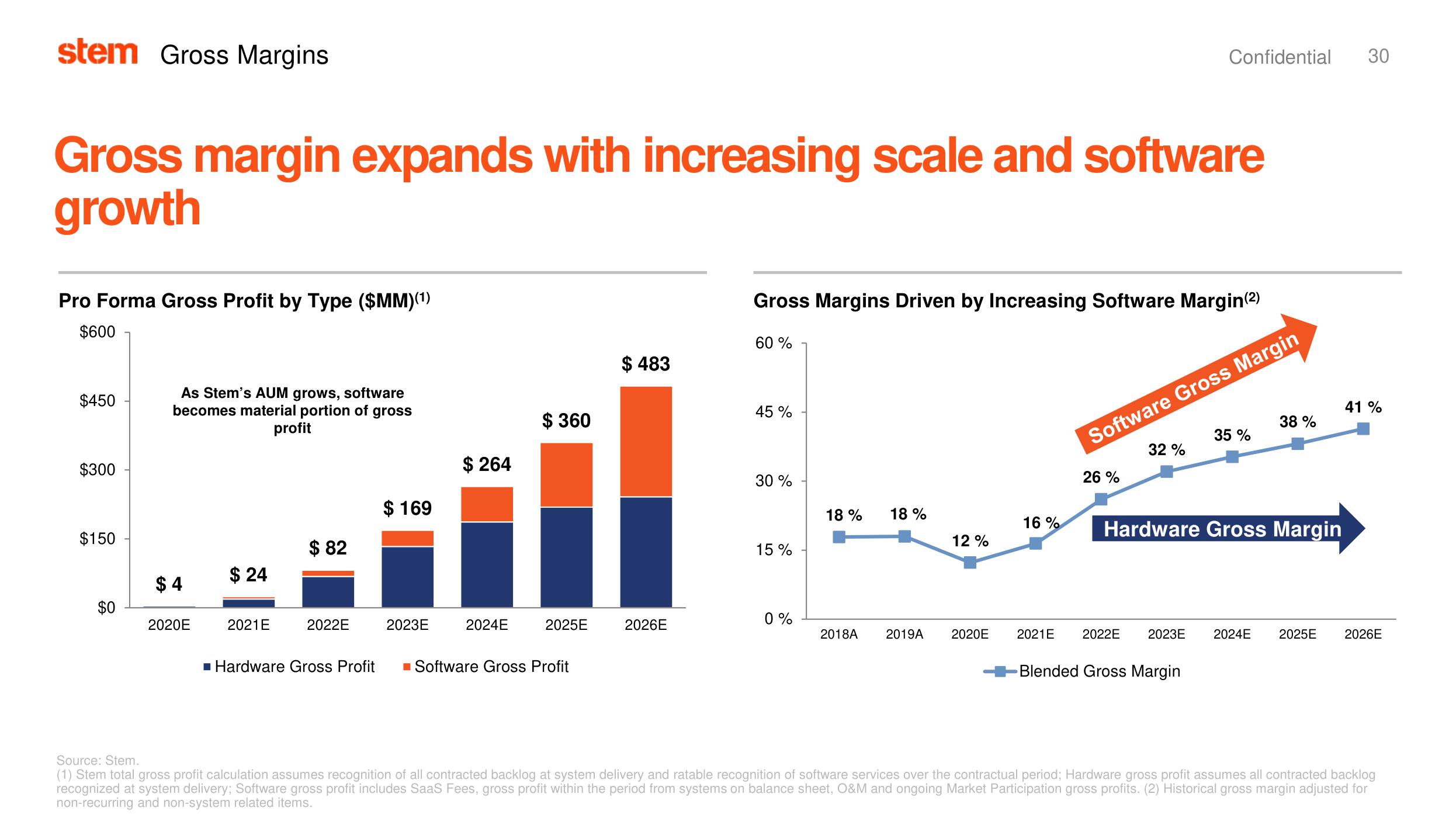

Gross margin expands with increasing scale and software

growth

Pro Forma Gross Profit by Type ($MM)(¹)

$600

$450

$300

$150

$0

As Stem's AUM grows, software

becomes material portion of gross

profit

$4

2020E

$ 24

2021E

$82

2022E

$169

2023E

$ 264

2024E

$360

2025E

■ Hardware Gross Profit ■ Software Gross Profit

$ 483

2026E

Gross Margins Driven by Increasing Software Margin(²)

60 %

45 %

30%

15%

0%

∞

18%

00

18 %

12%

2018A 2019A 2020E

16%

2021E

Confidential

26%

32%

Software Gross Margin

35 %

Blended Gross Margin

38%

Hardware Gross Margin

2022E 2023E 2024E

30

41%

2025E 2026E

Source: Stem.

(1) Stem total gross profit calculation assumes recognition of all contracted backlog at system delivery and ratable recognition of software services over the contractual period; Hardware gross profit assumes all contracted backlog

recognized at system delivery; Software gross profit includes SaaS Fees, gross profit within the period from systems on balance sheet, O&M and ongoing Market Participation gross profits. (2) Historical gross margin adjusted for

non-recurring and non-system related items.View entire presentation