NioCorp SPAC Presentation Deck

NioCorp

Critical Mineral Security

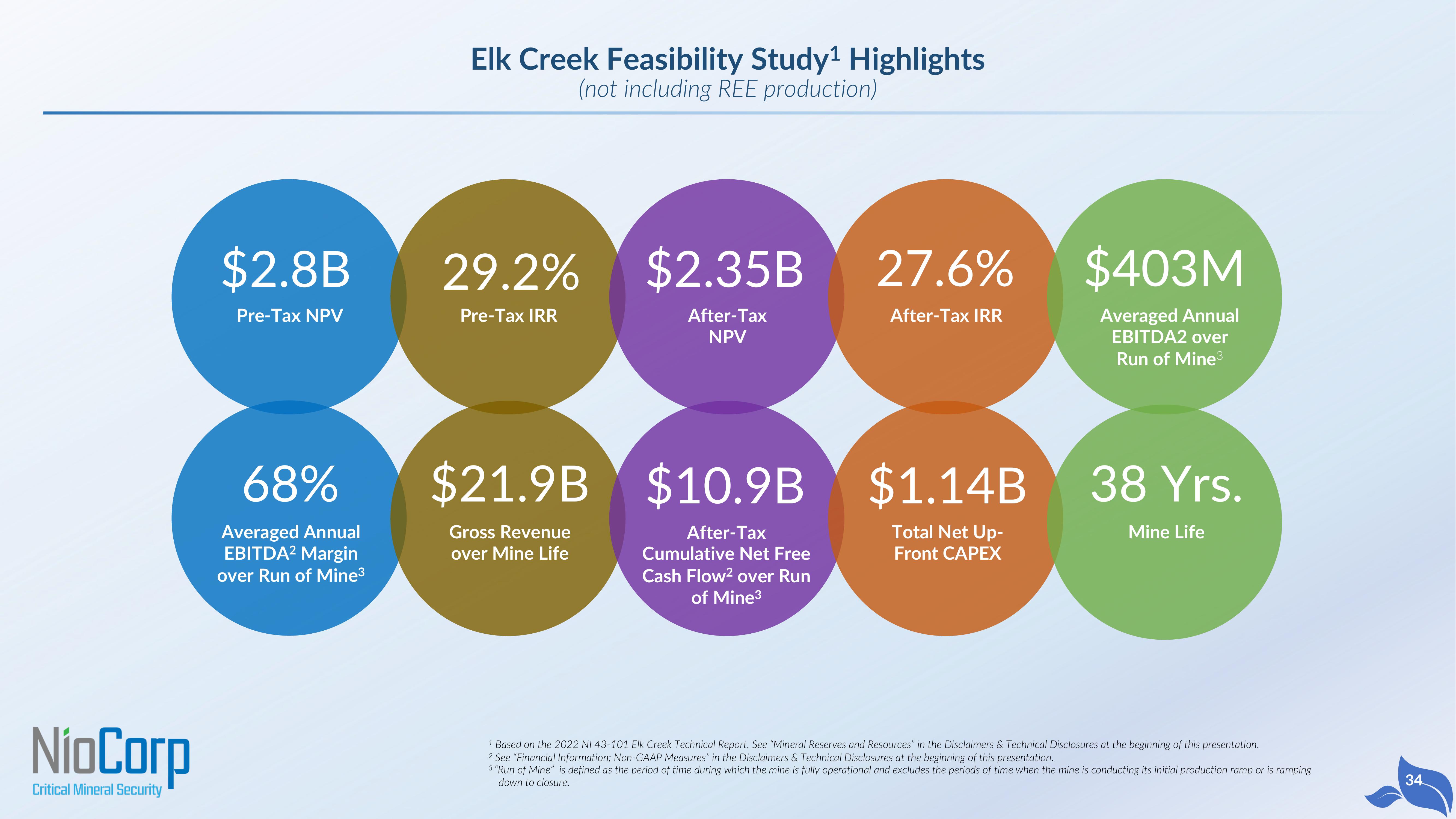

$2.8B

Pre-Tax NPV

68%

Averaged Annual

EBITDA² Margin

over Run of Mine³

Elk Creek Feasibility Study¹ Highlights

(not including REE production)

29.2%

Pre-Tax IRR

$2.35B

After-Tax

NPV

$21.9B $10.9B

After-Tax

Cumulative Net Free

Cash Flow² over Run

of Mine³

Gross Revenue

over Mine Life

27.6%

After-Tax IRR

$1.14B

Total Net Up-

Front CAPEX

$403M

Averaged Annual

EBITDA2 over

Run of Mine³

38 Yrs.

Mine Life

1 Based on the 2022 NI 43-101 Elk Creek Technical Report. See "Mineral Reserves and Resources in the Disclaimers & Technical Disclosures at the beginning of this presentation.

2 See "Financial Information; Non-GAAP Measures" in the Disclaimers & Technical Disclosures at the beginning of this presentation.

3 "Run of Mine" is defined as the period of time during which the mine is fully operational and excludes the periods of time when the mine is conducting its initial production ramp or is ramping

down to closure.

34View entire presentation