Pershing Square Investor Presentation Deck

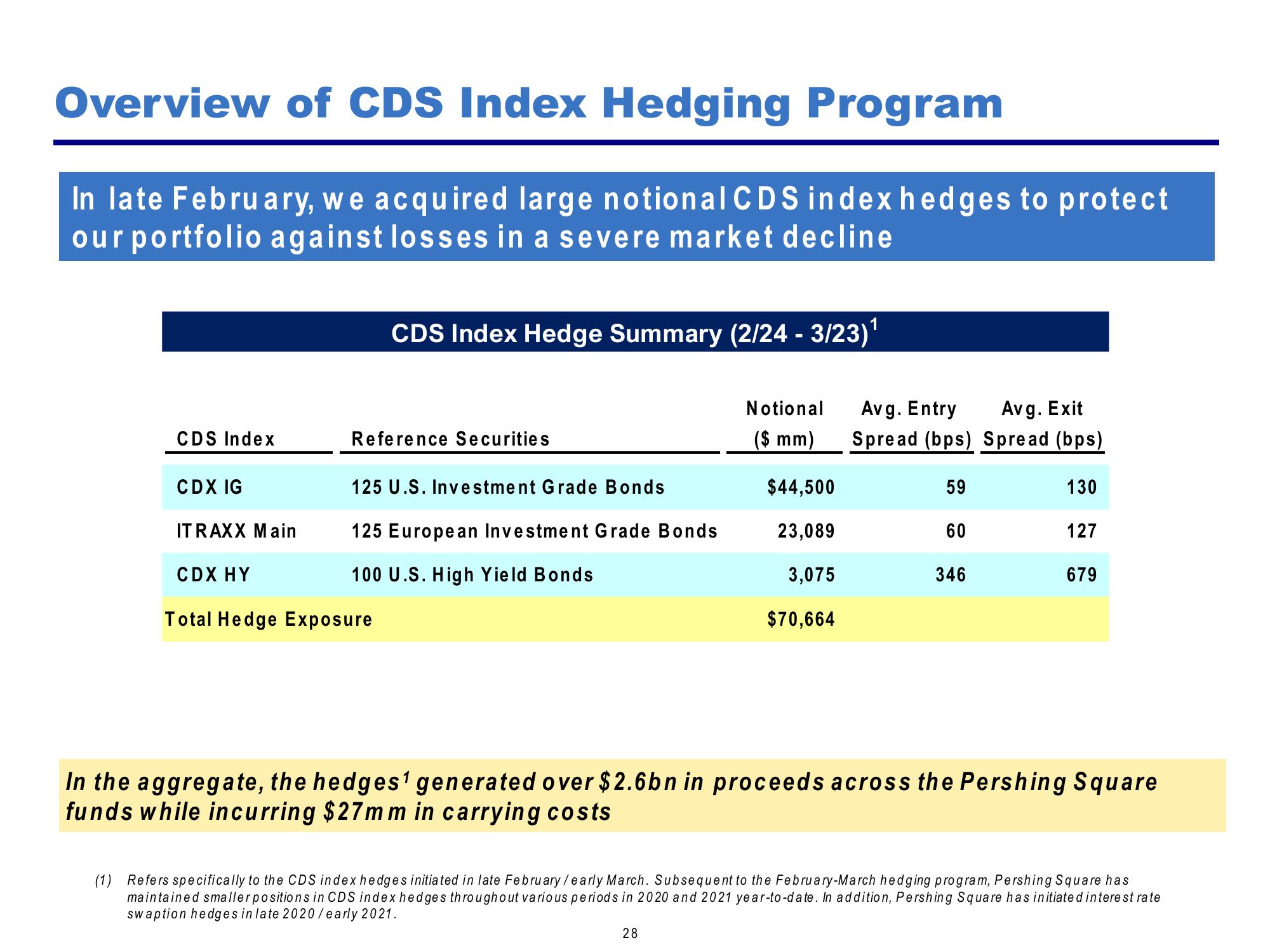

Overview of CDS Index Hedging Program

In late February, we acquired large notional CDS index hedges to protect

our portfolio against losses in a severe market decline

CDS Index

CDX IG

IT RAXX Main

CDX HY

CDS Index Hedge Summary (2/24 - 3/23)¹

Notional

($ mm)

Reference Securities

125 U.S. Investment Grade Bonds

125 European Investment Grade Bonds

100 U.S. High Yield Bonds

Total Hedge Exposure

$44,500

23,089

3,075

$70,664

Avg. Entry Avg. Exit

Spread (bps) Spread (bps)

28

59

60

346

130

127

679

In the aggregate, the hedges¹ generated over $2.6bn in proceeds across the Pershing Square

funds while incurring $27mm in carrying costs

(1) Refers specifically to the CDS index hedges initiated in late February / early March. Subsequent to the February-March hedging program, Pershing Square has

maintained smaller positions in CDS index hedges throughout various periods in 2020 and 2021 year-to-date. In addition, Pershing Square has initiated interest rate

swaption hedges in late 2020/early 2021.View entire presentation