Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

MAERSK LINE

Contents

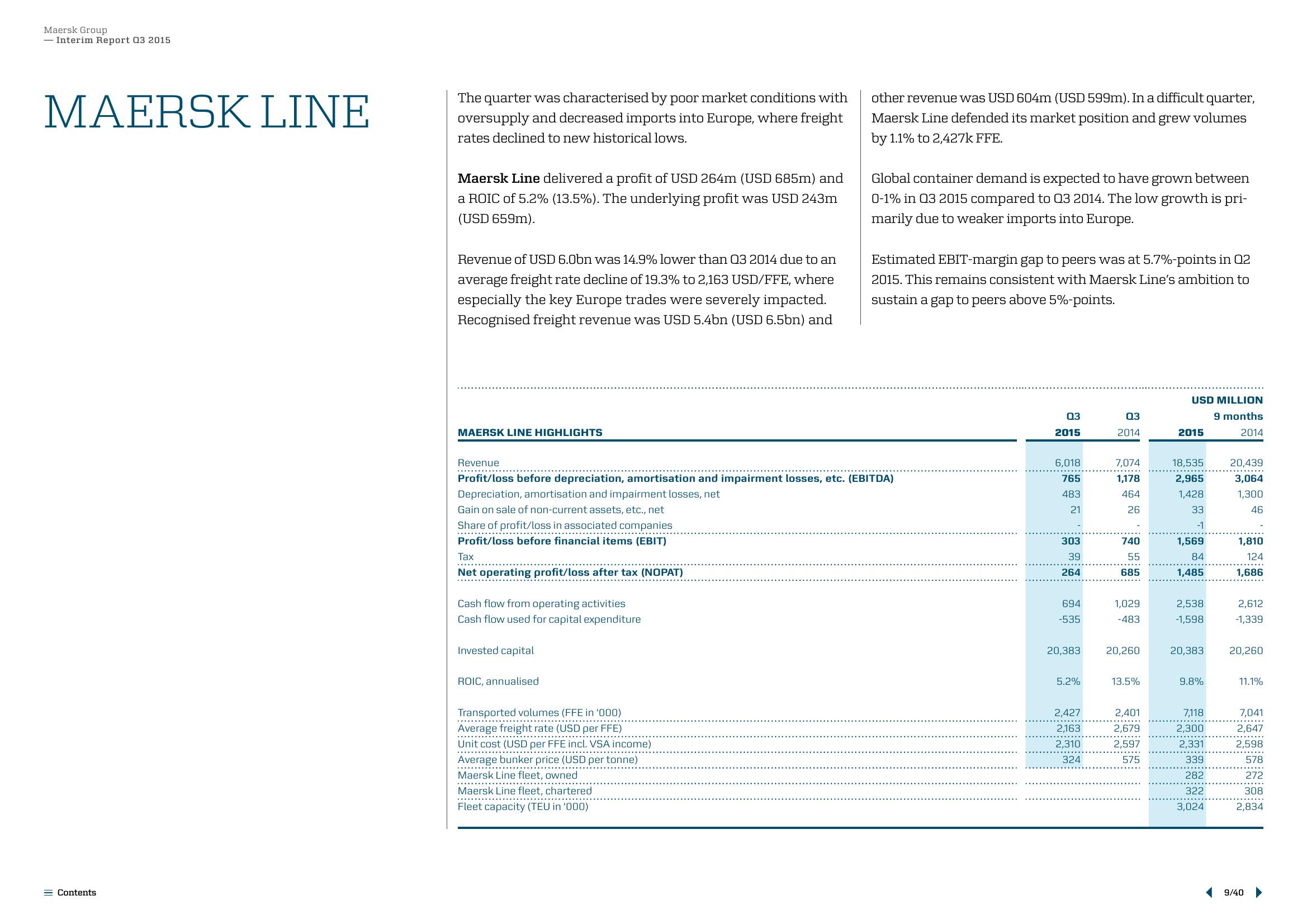

The quarter was characterised by poor market conditions with

oversupply and decreased imports into Europe, where freight

rates declined to new historical lows.

Maersk Line delivered a profit of USD 264m (USD 685m) and

a ROIC of 5.2% (13.5%). The underlying profit was USD 243m

(USD 659m).

Revenue of USD 6.0bn was 14.9% lower than 03 2014 due to an

average freight rate decline of 19.3% to 2,163 USD/FFE, where

especially the key Europe trades were severely impacted.

Recognised freight revenue was USD 5.4bn (USD 6.5bn) and

MAERSK LINE HIGHLIGHTS

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Revenue

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in associated companies

Profit/loss before financial items (EBIT)

Invested capital

ROIC, annualised

other revenue was USD 604m (USD 599m). In a difficult quarter,

Maersk Line defended its market position and grew volumes

by 1.1% to 2,427k FFE.

Transported volumes (FFE in '000)

Average freight rate (USD per FFE)

Unit cost (USD per FFE incl. VSA income)

Average bunker price (USD per tonne)

Maersk Line fleet, owned

Maersk Line fleet, chartered

Fleet capacity (TEU in '000)

Global container demand is expected to have grown between

0-1% in Q3 2015 compared to Q3 2014. The low growth is pri-

marily due to weaker imports into Europe.

Estimated EBIT-margin gap to peers was at 5.7%-points in 02

2015. This remains consistent with Maersk Line's ambition to

sustain a gap to peers above 5%-points.

03

2015

6,018

765

483

21

303

39

264

694

-535

20,383

5.2%

2,427

2,163

2,310

324

03

2014

7,074

1,178

464

26

740

55

685

1,029

-483

20,260

13.5%

2,401

2,679

2,597

575

USD MILLION

9 months

2014

2015

18,535

2,965

1,428

33

-1

1,569

84

1,485

2,538

-1,598

20,383

9.8%

7,118

2,300

2,331

339

282

322

3,024

20,439

3,064

1,300

46

1,810

124

1,686

2,612

-1,339

20,260

11.1%

7,041

2,647

2,598

578

272

308

2,834

9/40View entire presentation