Citi Investment Banking Pitch Book

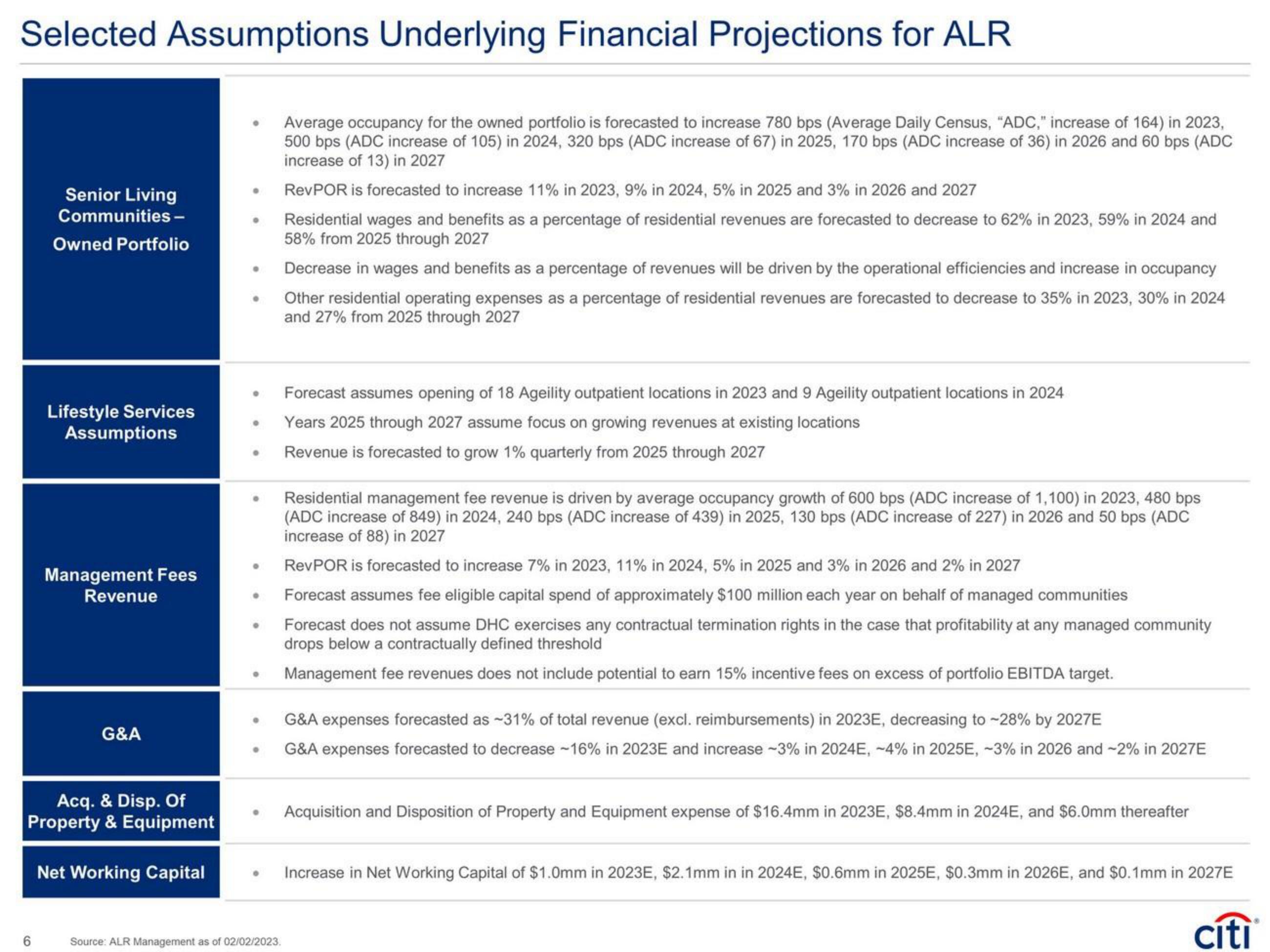

Selected Assumptions Underlying Financial Projections for ALR

Senior Living

Communities -

Owned Portfolio

Lifestyle Services

Assumptions

Management Fees

Revenue

G&A

Acq. & Disp. Of

Property & Equipment

Net Working Capital

●

●

Source: ALR Management as of 02/02/2023.

Average occupancy for the owned portfolio is forecasted to increase 780 bps (Average Daily Census, "ADC," increase of 164) in 2023,

500 bps (ADC increase of 105) in 2024, 320 bps (ADC increase of 67) in 2025, 170 bps (ADC increase of 36) in 2026 and 60 bps (ADC

increase of 13) in 2027

RevPOR is forecasted to increase 11% in 2023, 9% in 2024, 5% in 2025 and 3% in 2026 and 2027

Residential wages and benefits as a percentage of residential revenues are forecasted to decrease to 62% in 2023, 59% in 2024 and

58% from 2025 through 2027

Decrease in wages and benefits as a percentage of revenues will be driven by the operational efficiencies and increase in occupancy

Other residential operating expenses as a percentage of residential revenues are forecasted to decrease to 35% in 2023, 30% in 2024

and 27% from 2025 through 2027

Forecast assumes opening of 18 Ageility outpatient locations in 2023 and 9 Ageility outpatient locations in 2024

Years 2025 through 2027 assume focus on growing revenues at existing locations

Revenue is forecasted to grow 1% quarterly from 2025 through 2027

Residential management fee revenue is driven by average occupancy growth of 600 bps (ADC increase of 1,100) in 2023, 480 bps

(ADC increase of 849) in 2024, 240 bps (ADC increase of 439) in 2025, 130 bps (ADC increase of 227) in 2026 and 50 bps (ADC

increase of 88) in 2027

RevPOR is forecasted to increase 7% in 2023, 11% in 2024, 5% in 2025 and 3% in 2026 and 2% in 2027

Forecast assumes fee eligible capital spend of approximately $100 million each year on behalf of managed communities

Forecast does not assume DHC exercises any contractual termination rights in the case that profitability at any managed community

drops below a contractually defined threshold

Management fee revenues does not include potential to earn 15% incentive fees on excess of portfolio EBITDA target.

G&A expenses forecasted as ~31% of total revenue (excl. reimbursements) in 2023E, decreasing to -28% by 2027E

G&A expenses forecasted to decrease -16% in 2023E and increase -3% in 2024E, -4% in 2025E, -3% in 2026 and -2% in 2027E

Acquisition and Disposition of Property and Equipment expense of $16.4mm in 2023E, $8.4mm in 2024E, and $6.0mm thereafter

Increase in Net Working Capital of $1.0mm in 2023E, $2.1mm in in 2024E, $0.6mm in 2025E, $0.3mm in 2026E, and $0.1mm in 2027E

citiView entire presentation