Evercore Investment Banking Pitch Book

Discussion Materials

Preliminary Draft - Confidential

Illustrative Sharing of Synergies

($ in millions, except per share amounts)

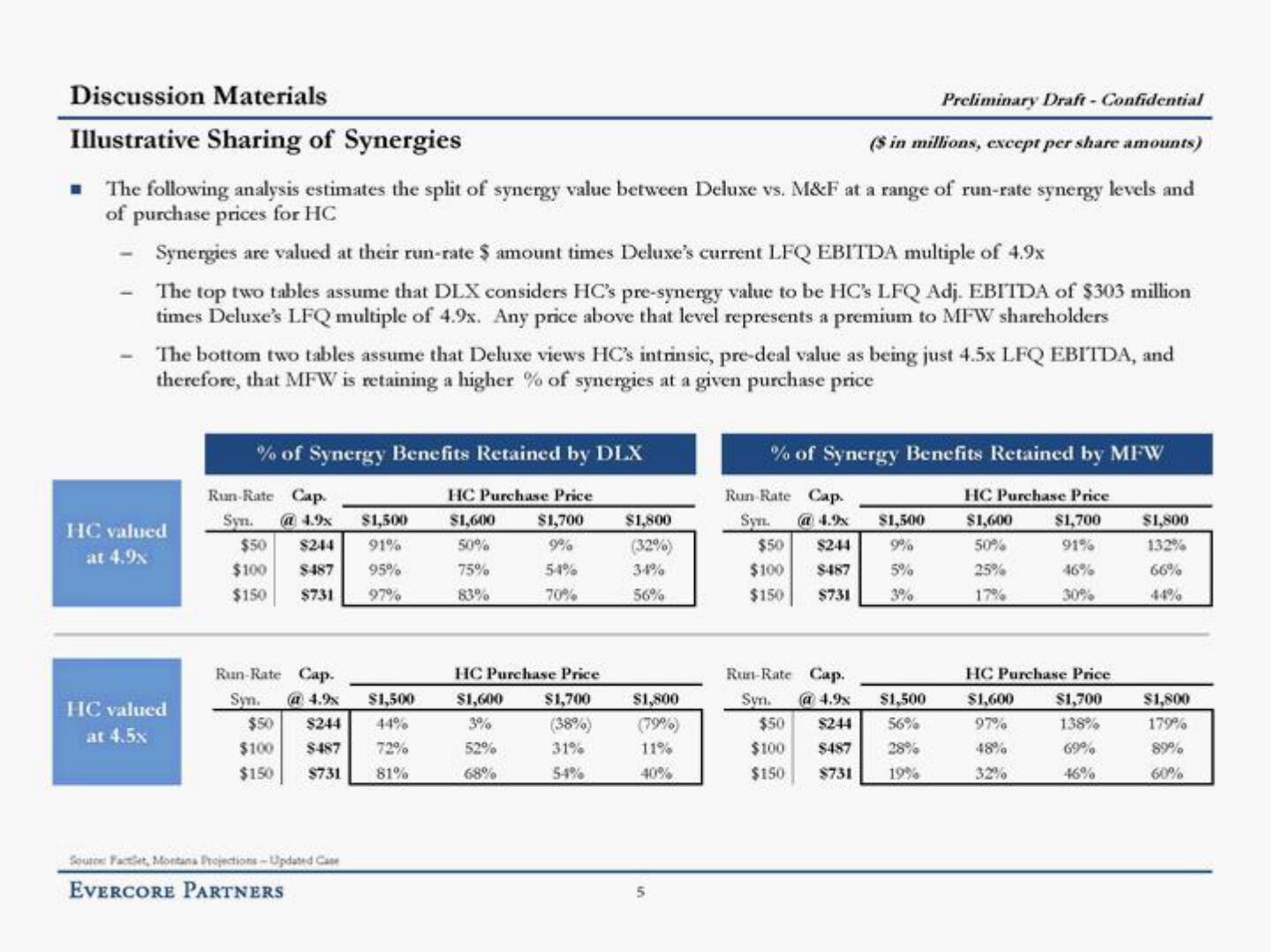

■ The following analysis estimates the split of synergy value between Deluxe vs. M&F at a range of run-rate synergy levels and

of purchase prices for HC

Synergies are valued at their run-rate $ amount times Deluxe's current LFQ EBITDA multiple of 4.9x

The top two tables assume that DLX considers HC's pre-synergy value to be HC's LFQ Adj. EBITDA of $303 million

times Deluxe's LFQ multiple of 4.9x. Any price above that level represents a premium to MFW shareholders

The bottom two tables assume that Deluxe views HC's intrinsic, pre-deal value as being just 4.5x LFQ EBITDA, and

therefore, that MFW is retaining a higher % of synergies at a given purchase price

HC valued

at 4.9x

HC valued

at 4.5x

% of Synergy Benefits Retained by DLX

Run-Rate Cap.

Syn. @4.9x $1,500

$50 $244 91%

$100

$487

95%

$150

$731

97%

Run-Rate Cap.

Syn. (4.9%

$1,500

$50 $244 44%

$100 $487

72%

$150

$731

81%

Source Factlet, Montana Projections-Updated Case

EVERCORE PARTNERS

HC Purchase Price

$1,600

$1,700

50%

9%

75%

54%

83%

70%

HC Purchase Price

$1,600

$1,700

3%

(38%)

31%

54%

52%

68%

$1,800

(32%)

34%

56%

$1,800

(79%)

11%

40%

5

% of Synergy Benefits Retained by MFW

Run Rate Cap.

Syn.

$50 $244

$100 $487

$150 $731

Run-Rate Cap.

Syn.

@ 4.9x

$50

$244

$100

$487

$150 $731

$1,500

9%

5%

3%

$1,500

56%

28%

19%

HC Purchase Price

$1,600

$1,700

50%

91%

25%

17%

46%

30%

HC Purchase Price

$1,600

$1,700

97%

138%

48%

69%

46%

$1,800

132%

66%

44%

$1,800

179%

89%

60%View entire presentation