Strategically Positioning Truist Insurance Holdings for Long-Term Success

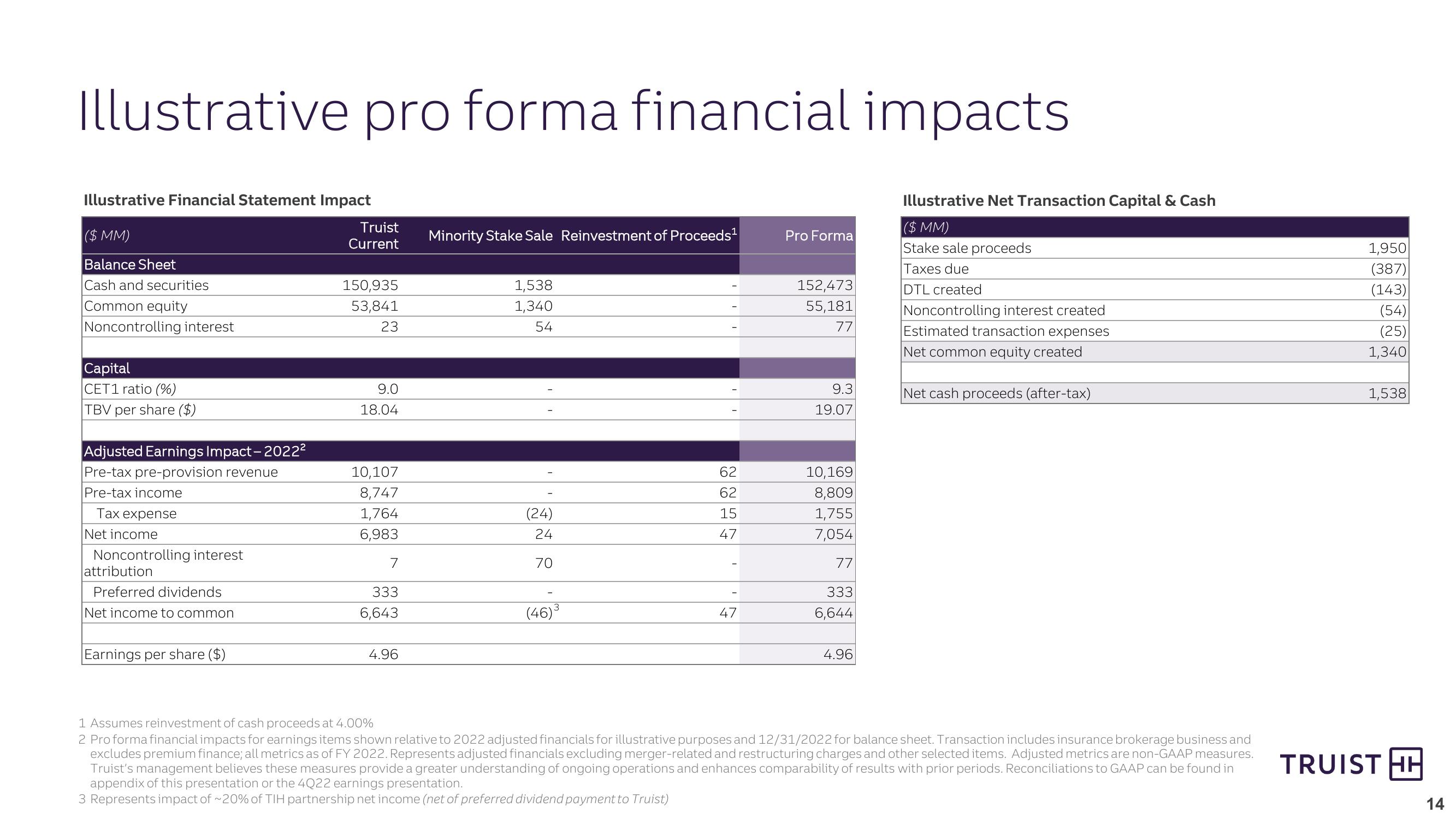

Illustrative pro forma financial impacts.

Cash and securities

150,935

1,538

Common equity

53,841

1,340

Noncontrolling interest

23

54

Illustrative Financial Statement Impact

Illustrative Net Transaction Capital & Cash

Truist

($ MM)

($ MM)

Balance Sheet

Minority Stake Sale Reinvestment of Proceeds¹

Pro Forma

Current

Stake sale proceeds

Taxes due

DTL created

Noncontrolling interest created

Estimated transaction expenses

Net common equity created

152,473

55,181

77

Capital

CET1 ratio (%)

9.0

TBV per share ($)

18.04

9.3

19.07

Net cash proceeds (after-tax)

Adjusted Earnings Impact - 20222

Pre-tax pre-provision revenue

10,107

Pre-tax income

8,747

Tax expense

1,764

(24)

Net income

6,983

24

2247

62

10,169

62

8,809

15

1,755

7,054

Noncontrolling interest

7

70

77

attribution

Preferred dividends

333

333

Net income to common

6,643

(46)³

47

6,644

Earnings per share ($)

4.96

4.96

1 Assumes reinvestment of cash proceeds at 4.00%

2 Pro forma financial impacts for earnings items shown relative to 2022 adjusted financials for illustrative purposes and 12/31/2022 for balance sheet. Transaction includes insurance brokerage business and

excludes premium finance; all metrics as of FY 2022. Represents adjusted financials excluding merger-related and restructuring charges and other selected items. Adjusted metrics are non-GAAP measures.

Truist's management believes these measures provide a greater understanding of ongoing operations and enhances comparability of results with prior periods. Reconciliations to GAAP can be found in

appendix of this presentation or the 4Q22 earnings presentation.

3 Represents impact of ~20% of TIH partnership net income (net of preferred dividend payment to Truist)

1,950

(387)

(143)

(54)

(25)

1,340

1,538

TRUIST HH

14View entire presentation