XP Inc Results Presentation Deck

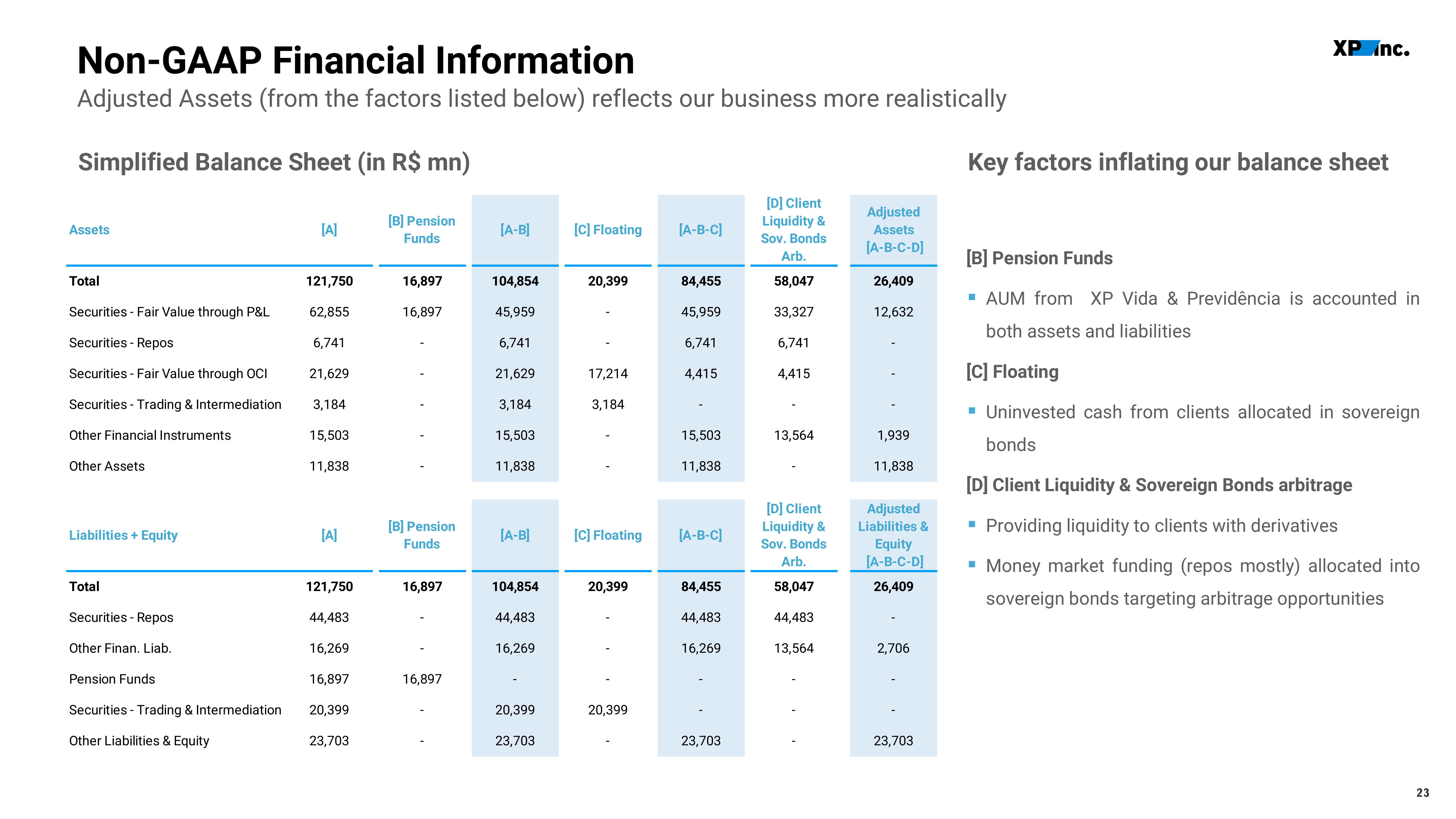

Non-GAAP Financial Information

Adjusted Assets (from the factors listed below) reflects our business more realistically

Simplified Balance Sheet (in R$ mn)

[B] Pension

Funds

Assets

Total

Securities - Fair Value through P&L

Securities Repos

Securities - Fair Value through OCI

Securities - Trading & Intermediation

Other Financial Instruments

Other Assets

Liabilities + Equity

Total

Securities - Repos

Other Finan. Liab.

Pension Funds

Securities - Trading & Intermediation

Other Liabilities & Equity

[A]

121,750

62,855

6,741

21,629

3,184

15,503

11,838

[A]

121,750

44,483

16,269

16,897

20,399

23,703

16,897

16,897

[B] Pension

Funds

16,897

16,897

[A-B]

104,854

45,959

6,741

21,629

3,184

15,503

11,838

[A-B]

104,854

44,483

16,269

20,399

23,703

[C] Floating

20,399

17,214

3,184

[C] Floating

20,399

20,399

[A-B-C]

84,455

45,959

6,741

4,415

15,503

11,838

[A-B-C]

84,455

44,483

16,269

I

I

23,703

[D] Client

Liquidity &

Sov. Bonds

Arb.

58,047

33,327

6,741

4,415

13,564

[D] Client

Liquidity &

Sov. Bonds

Arb.

58,047

44,483

13,564

Adjusted

Assets

[A-B-C-D]

26,409

12,632

1,939

11,838

Adjusted

Liabilities &

Equity

[A-B-C-D]

26,409

2,706

23,703

XP nc.

Key factors inflating our balance sheet

[B] Pension Funds

▪ AUM from XP Vida & Previdência is accounted in

both assets and liabilities

[C] Floating

▪ Uninvested cash from clients allocated in sovereign

bonds

[D] Client Liquidity & Sovereign Bonds arbitrage

■ Providing liquidity to clients with derivatives

▪ Money market funding (repos mostly) allocated into

sovereign bonds targeting arbitrage opportunities

23View entire presentation