First Merchants Investor Presentation Deck

Asset Quality

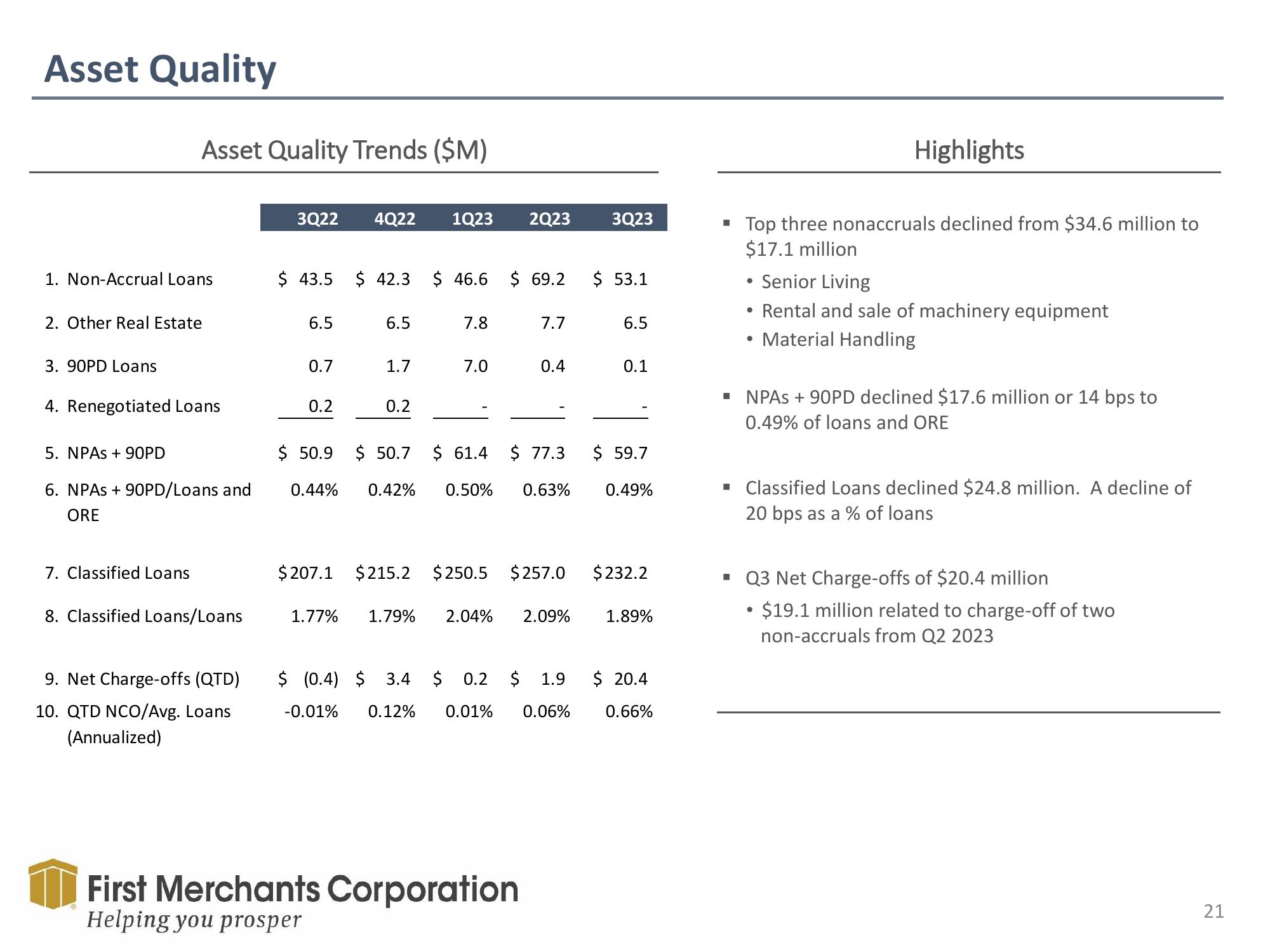

1. Non-Accrual Loans

Asset Quality Trends ($M)

2. Other Real Estate

3. 90PD Loans

4. Renegotiated Loans

5. NPAS + 90PD

6. NPAS + 90PD/Loans and

ORE

7. Classified Loans

8. Classified Loans/Loans

9. Net Charge-offs (QTD)

10. QTD NCO/Avg. Loans

(Annualized)

3Q22

6.5

0.7

4Q22 1Q23

$ 43.5 $ 42.3 $ 46.6 $ 69.2 $ 53.1

0.2

6.5

1.7

0.2

7.8

7.0

2Q23

7.7

0.4

3Q23

First Merchants Corporation

Helping you prosper

1.77% 1.79% 2.04% 2.09%

6.5

$ 50.9 $ 50.7 $ 61.4 $ 77.3 $ 59.7

0.44% 0.42% 0.50% 0.63%

0.1

$207.1 $215.2 $250.5 $257.0 $232.2

0.49%

1.89%

$ (0.4) $ 3.4 $ 0.2 $ 1.9 $ 20.4

-0.01% 0.12% 0.01% 0.06% 0.66%

=

■

M

■

Top three nonaccruals declined from $34.6 million to

$17.1 million

• Senior Living

Rental and sale of machinery equipment

Material Handling

●

Highlights

●

NPAS + 90PD declined $17.6 million or 14 bps to

0.49% of loans and ORE

Classified Loans declined $24.8 million. A decline of

20 bps as a % of loans

Q3 Net Charge-offs of $20.4 million

$19.1 million related to charge-off of two

non-accruals from Q2 2023

●

21View entire presentation