Apollo Global Management Investor Presentation Deck

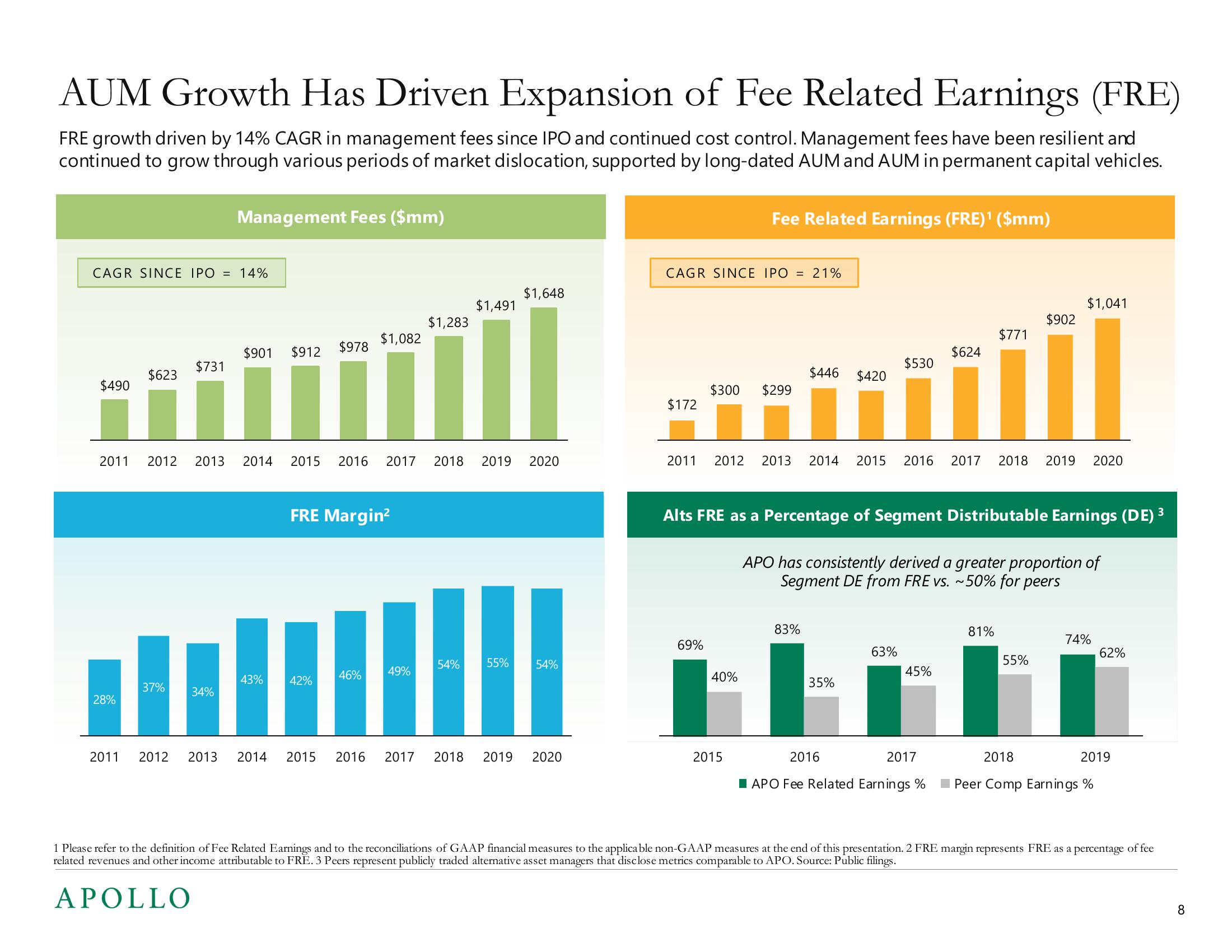

AUM Growth Has Driven Expansion of Fee Related Earnings (FRE)

FRE growth driven by 14% CAGR in management fees since IPO and continued cost control. Management fees have been resilient and

continued to grow through various periods of market dislocation, supported by long-dated AUM and AUM in permanent capital vehicles.

CAGR SINCE IPO = 14%

$490

$623

28%

$731

37%

Management Fees ($mm)

34%

$901 $912

43%

$978

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

$1,082

42%

FRE Margin²

$1,283

46% 49%

$1,491

54%

$1,648

55% 54%

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

CAGR SINCE IPO = 21%

$172

Fee Related Earnings (FRE)¹ ($mm)

$300 $299

69%

40%

2015

$446 $420

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

83%

$530

Alts FRE as a Percentage of Segment Distributable Earnings (DE) ³

3

35%

63%

$624

APO has consistently derived a greater proportion of

Segment DE from FRE vs. ~50% for peers

45%

$771

2016

2017

APO Fee Related Earnings %

$902

81%

$1,041

55%

74%

2018

Peer Comp Earnings %

62%

2019

1 Please refer to the definition of Fee Related Earnings and to the reconciliations of GAAP financial measures to the applicable non-GAAP measures at the end of this presentation. 2 FRE margin represents FRE as a percentage of fee

related revenues and other income attributable to FRE. 3 Peers represent publicly traded alternative asset managers that disclose metrics comparable to APO. Source: Public filings.

APOLLO

8View entire presentation