Engine No. 1 Activist Presentation Deck

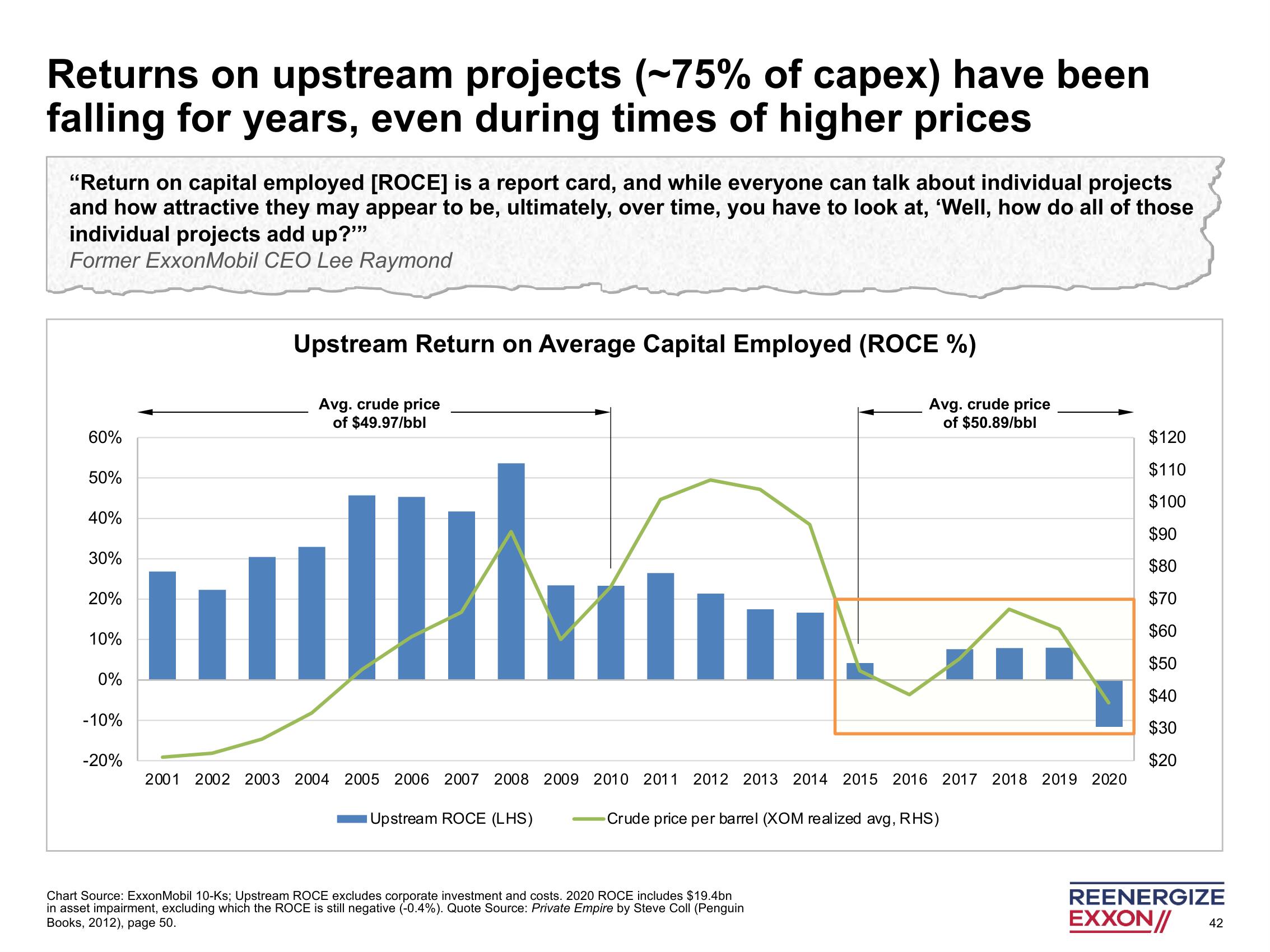

Returns on upstream projects (~75% of capex) have been

falling for years, even during times of higher prices

"Retu

Spr

AREN

CAUS

"Return on capital employed [ROCE] is a report card, and while everyone can talk about individual projects

and how attractive they may appear to be, ultimately, over time, you have to look at, 'Well, how do all of those

individual projects add up?""

Former ExxonMobil CEO Lee Raymond

60%

50%

40%

30%

20%

10%

0%

-10%

-20%

Upstream Return on Average Capital Employed (ROCE %)

Avg. crude price

of $49.97/bbl

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Upstream ROCE (LHS)

Avg. crude price

of $50.89/bbl

Crude price per barrel (XOM realized avg, RHS)

Chart Source: ExxonMobil 10-Ks; Upstream ROCE excludes corporate investment and costs. 2020 ROCE includes $19.4bn

in asset impairment, excluding which the ROCE is still negative (-0.4%). Quote Source: Private Empire by Steve Coll (Penguin

Books, 2012), page 50.

$120

$110

$100

$90

$80

$70

$60

$50

$40

$30

$20

REENERGIZE

EXXON//

42View entire presentation