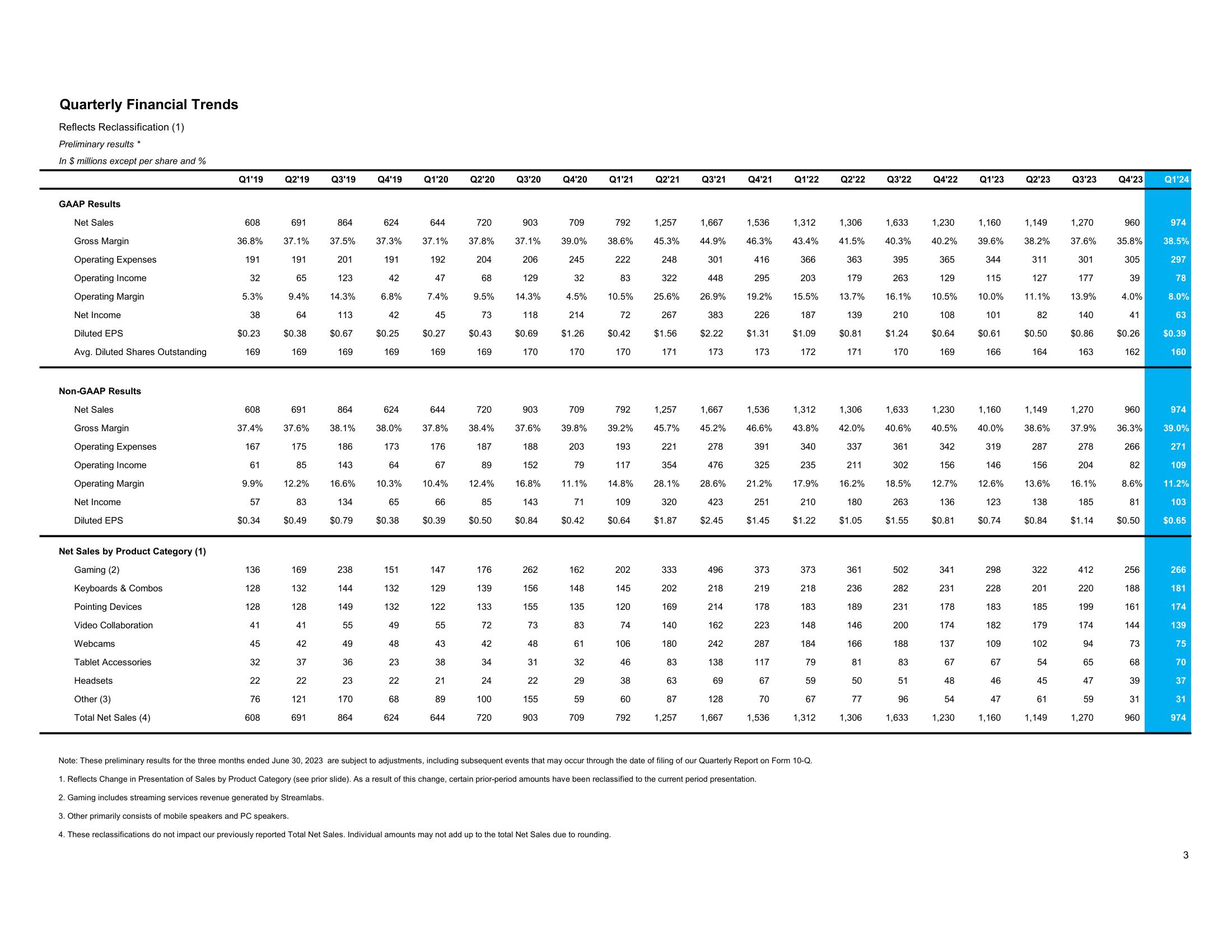

Supplemental Financial Information Q1 Fiscal Year 2024

Quarterly Financial Trends

Reflects Reclassification (1)

Preliminary results *

In $ millions except per share and %

GAAP Results

Net Sales

Gross Margin

Operating Expenses

Operating Income

Operating Margin

Net Income

Diluted EPS

Avg. Diluted Shares Outstanding

Non-GAAP Results

Net Sales

Gross Margin

Operating Expenses

Operating Income

Operating Margin

Net Income

Diluted EPS

Net Sales by Product Category (1)

Gaming (2)

Keyboards & Combos

Pointing Devices

Video Collaboration

Webcams

Tablet Accessories

Headsets

Other (3)

Total Net Sales (4)

Q1'19

608

36.8%

191

32

5.3%

38

$0.23

169

608

37.4%

167

61

9.9%

57

$0.34

136

128

128

41

45

32

22

76

608

Q2'19

691

864

37.1% 37.5%

191

201

65

123

14.3%

113

$0.67

169

9.4%

64

$0.38

169

691

37.6%

175

85

12.2%

83

$0.49

169

132

128

Q3'19

41

42

37

22

121

691

864

38.1%

186

143

16.6%

134

$0.79

238

144

149

55

49

36

23

170

864

Q4'19

624

37.3%

191

42

6.8%

42

$0.25

169

624

38.0%

173

64

10.3%

65

$0.38

151

132

132

49

48

23

22

68

624

Q1'20

644

37.1%

192

47

7.4%

45

$0.27

169

644

37.8%

176

67

10.4%

66

$0.39

147

129

122

55

43

38

21

89

644

Q2'20

720

37.8%

204

68

9.5%

73

$0.43

169

720

38.4%

187

89

12.4%

85

$0.50

176

139

133

72

42

34

24

100

720

Q3'20

903

37.1%

206

129

14.3%

118

$0.69

170

903

37.6%

188

152

16.8%

143

$0.84

262

156

155

73

48

31

22

155

903

Q4'20

709

39.0%

245

32

4.5%

214

$1.26

170

709

39.8%

203

79

11.1%

71

$0.42

162

148

135

83

61

32

29

59

709

Q1'21

792

38.6%

222

83

10.5%

72

$0.42

170

792

39.2%

193

117

14.8%

109

$0.64

202

145

120

74

106

46

38

60

792

Q2'21 Q3'21

1,257

45.3%

248

322

25.6%

267

$1.56

171

1,257

45.7%

221

354

28.1%

320

$1.87

333

202

169

140

180

83

63

87

1,257

1,667

44.9%

301

448

26.9%

383

$2.22

173

1,667

45.2%

278

476

28.6%

423

$2.45

496

218

214

162

242

138

69

128

1,667

Q4'21

1,536

46.3%

416

295

19.2%

226

$1.31

173

1,536

46.6%

391

325

21.2%

251

$1.45

373

219

178

223

287

117

67

70

1,536

Q1'22

1,312

43.4%

366

203

15.5%

187

$1.09

172

1,312

43.8%

340

235

17.9%

210

$1.22

373

218

183

148

184

79

59

67

1,312

Note: These preliminary results for the three months ended June 30, 2023 are subject to adjustments, including subsequent events that may occur through the date of filing of our Quarterly Report on Form 10-Q.

1. Reflects Change in Presentation of Sales by Product Category (see prior slide). As a result of this change, certain prior-period amounts have been reclassified to the current period presentation.

2. Gaming includes streaming services revenue generated by Streamlabs.

3. Other primarily consists of mobile speakers and PC speakers.

4. These reclassifications do not impact our previously reported Total Net Sales. Individual amounts may not add up to the total Net Sales due to rounding.

Q2'22

1,306

41.5%

363

179

13.7%

139

$0.81

171

1,306

42.0%

337

211

16.2%

180

$1.05

361

236

189

146

166

81

50

77

1,306

Q3'22

1,633

40.6%

361

302

18.5%

263

$1.55

1,633

40.3%

395

263

16.1%

210

1,230 1,160

40.2% 39.6%

365

344

129

115

10.5% 10.0%

108

101

$1.24 $0.64 $0.61

170

169

166

502

282

Q4'22

231

200

188

83

51

96

1,633

Q1'23

1,230 1,160

40.5% 40.0%

342

319

156

146

12.7% 12.6%

136

$0.81

123

$0.74

341

231

178

174

137

67

48

54

1,230

298

228

183

182

109

67

46

47

1,160

Q2'23

1,149

38.2%

311

127

11.1%

82

$0.50

164

1,149

38.6%

287

156

13.6%

138

$0.84

322

201

185

179

102

54

45

61

1,149

Q3'23

1,270

37.6%

301

177

13.9%

140

$0.86

163

1,270

37.9%

278

204

16.1%

185

$1.14

412

220

199

174

94

65

47

59

1,270

Q4'23 Q1'24

960

35.8%

305

39

4.0%

41

$0.26

162

960

36.3%

266

82

8.6%

81

$0.50

256

188

161

144

73

68

39

31

960

974

38.5%

297

78

8.0%

63

$0.39

160

974

39.0%

271

109

11.2%

103

$0.65

266

181

174

139

75

70

37

31

974

3View entire presentation