PJT Partners Investment Banking Pitch Book

Pro Forma Capitalization Table

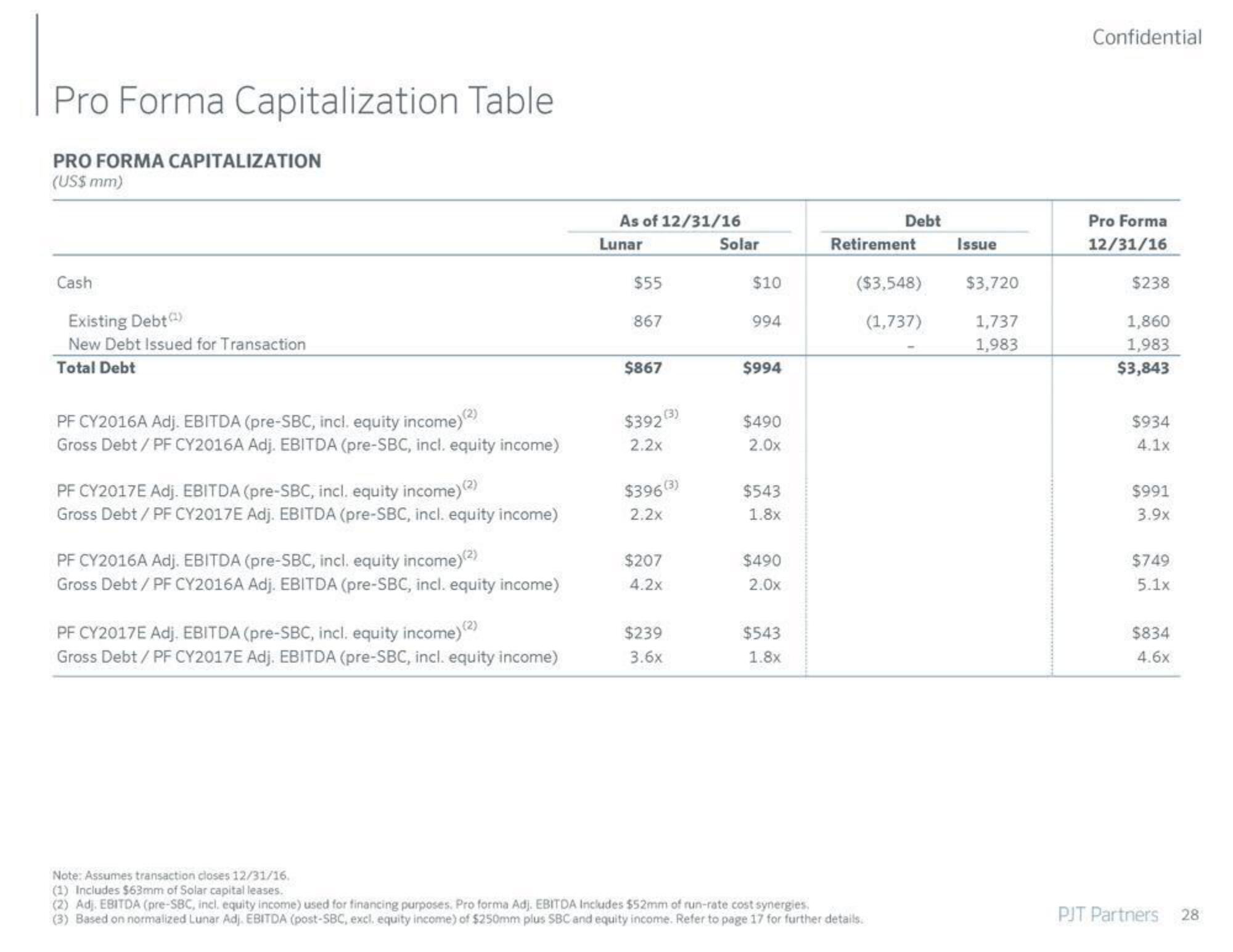

PRO FORMA CAPITALIZATION

(US$ mm)

Cash

Existing Debt (2)

New Debt Issued for Transaction

Total Debt

PF CY2016A Adj. EBITDA (pre-SBC, incl. equity income) (2)

Gross Debt / PF CY2016A Adj. EBITDA (pre-SBC, incl. equity income)

PF CY2017E Adj. EBITDA (pre-SBC, incl. equity income) (2)

Gross Debt / PF CY2017E Adj. EBITDA (pre-SBC, incl. equity income)

PF CY2016A Adj. EBITDA (pre-SBC, incl. equity income)(²)

Gross Debt/PF CY2016A Adj. EBITDA (pre-SBC, incl. equity income)

PF CY2017E Adj. EBITDA (pre-SBC, incl. equity income) (2)

Gross Debt / PF CY2017E Adj. EBITDA (pre-SBC, incl. equity income)

As of 12/31/16

Lunar

$55

867

$867

$392 (3)

2.2x

$396 (3)

2.2x

$207

4.2x

$239

3.6x

Solar

$10

994

$994

$490

2.0x

$543

1.8x

$490

2.0x

$543

1.8x

Debt

Retirement

($3,548)

(1,737)

Note: Assumes transaction closes 12/31/16.

(1) Includes $63mm of Solar capital leases.

(2) Adj. EBITDA (pre-SBC, incl. equity income) used for financing purposes. Pro forma Adj. EBITDA Includes $52mm of run-rate cost synergies.

(3) Based on normalized Lunar Adj. EBITDA (post-SBC, excl. equity income) of $250mm plus SBC and equity income. Refer to page 17 for further details.

Issue

$3,720

1,737

1,983

Confidential

Pro Forma

12/31/16

$238

1,860

1,983

$3,843

$934

4.1x

$991

3.9x

$749

5.1x

$834

4.6x

PJT Partners

28View entire presentation