Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

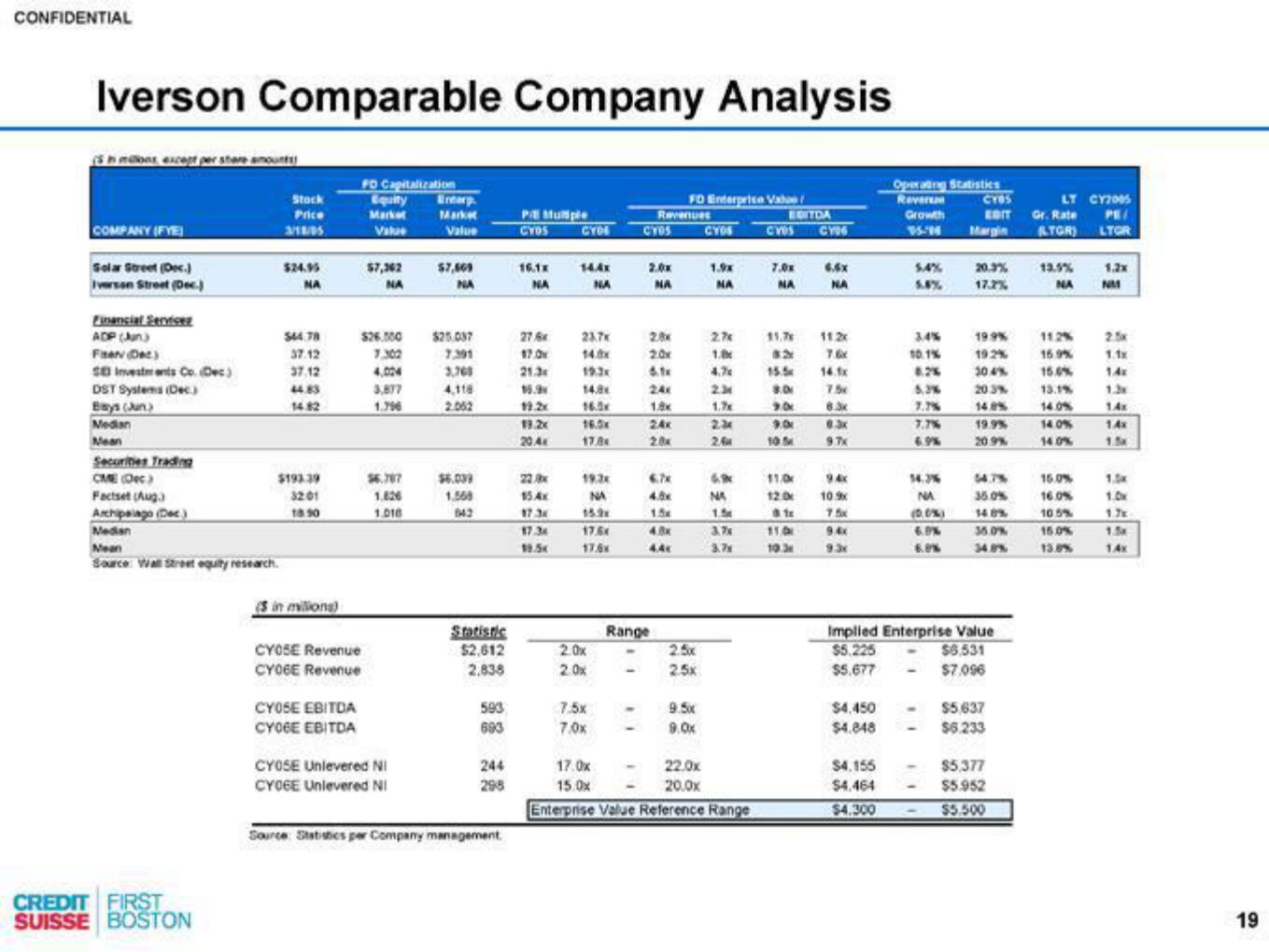

Iverson Comparable Company Analysis

ihn mios, except per share amounts

COMPANY (FYE

Solar Street (Dec.)

Iverson Street (Dec.)

Financial Service

ADP (Jun)

Fen (Dec)

S8 Investerents Co. (Dec)

DST Systems (Dec.)

Bays (Jun)

Median

Mean

Securities Trading

CME (Dec)

Factset (Aug

Archipelago (Dec.)

Median

Mean

Source: Wall Street equity research.

CREDIT FIRST

SUISSE BOSTON

Stock

Price

3/18/05

$24.95

NA

544.78

37.12

37.12

44.83

14.82

$193.39

32:01

18:50

(3 in millions)

FO Capitalization

Equity

Market

Value

CYOSE EBITDA

CYOFE EBITDA

CYOSE Revenue

CY06E Revenue

$7,362

NA

$26.000

7.302

4,004

3,877

1.796

56.767

1.826

1.016

CYOSE Unlevered Ni

CYOGE Unlevered Ni

Enterp

Market

Value

$7,669

NA

$25,037

3,768

4,118

2.052

$6.039

1.568

842

Statistic

$2,612

2.838

593

693

244

295

Source: Statistics per Company management

PT Mulple

CYOS

16.1x

NA

276x

17.0

21.3

15.9

19.2x

13.2x

20 Ax

22x

15.4x

17.3

17.3

19.5

CYDE

14.4x

NA

23.7K

14.0x

19.3x

14.8x

16.0

Theo

17.84

19.3x

NA

15.3x

17.6

2.0x

2.0x

7.5x

7.0x

CYOS

Revenues

2.0x

NA

2.8x

2.0x

6.1x

24x

1.8x

2.4x

2.8x

6.7x

1.5x

4.8x

4.4K

Range

FO Enterprise Vale

2.5x

2.5x

9.5x

9.0x

CYOS

1.9x

NA

2.7%

1.B

4.7

2.34

1.7

2.

EBITDA

17.0x

22.0x

15.0x

20.0x

Enterprise Value Reference Range

CYOS CYDG

7.0x

NA

11.7x

82

15.5

8.0

9.0k

9.0x

105

6.9

NA

1.5

8tc

3.7x 11.0

19.3

11.0

6.6x

NA

11.2x

76x

14.fx

7.5x

8.3x

8.3x

9.7x

9.4x

10.9x

75x

9.4x

$4.450

$4.848

Operating Statistics

Reverse

Growth

15:14

$4.155

$4,464

$4.300

5.4%

3.4%

10.1%

8.2%

5.3%

7.7%

7.7%

6.9%

14.3%

NA

(0.0%)

6.9%

6.0%

CYBS

EDIT

Margin

20.3%

19.9%

19.2%

30.4%

20.3%

14.8%

19.9%

20.9%

Implied Enterprise Value

$5.225

$5.677

54.7%

35.0%

14.0%

35.0%

34.8%

$6.531

$7,096

$5,637

$6.233

$5,377

$5.952

$5.500

LT CY2005

Gr. Rate

ATGR)

13.5%

NA

11.2%

15.9%

15.6%

13.1%

14.0%

14.0%

14.0%

16.0%

16.0%

10.5%

15.0%

13.8%

PE/

LTOR

1.2x

NM

2.5x

1.1x

1.4x

1.3x

1.4x

14x

1.5x

1.5k

1.0x

1.5x

1.4x

19View entire presentation