Main Street Capital Investor Day Presentation Deck

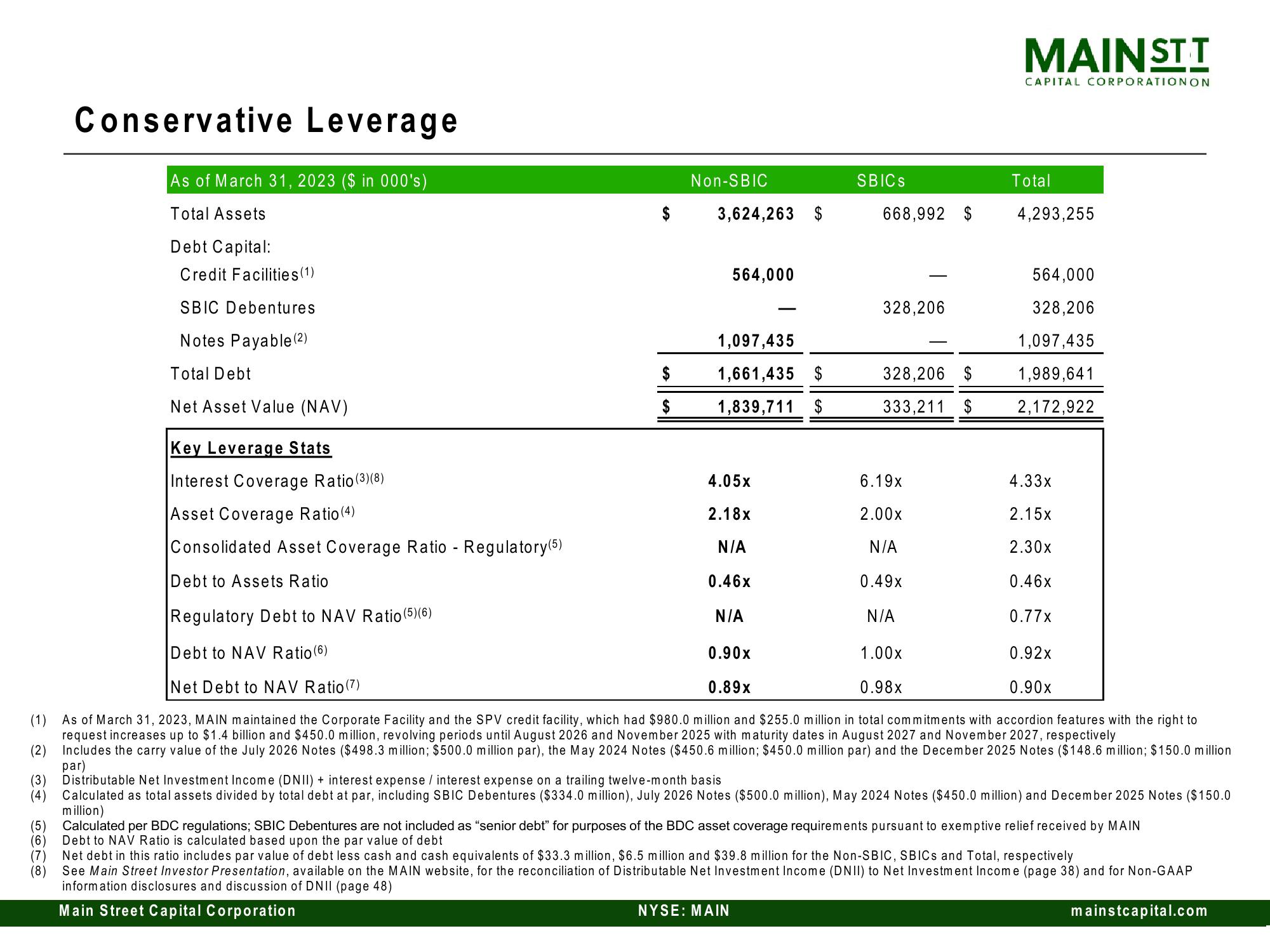

Conservative Leverage

=

As of March 31, 2023 ($ in 000's)

Total Assets

Debt Capital:

Credit Facilities (1)

SBIC Debentures

Notes Payable (2)

Total Debt

Net Asset Value (NAV)

$

$

Non-SBIC

3,624,263 $

564,000

1,097,435

1,661,435 $

1,839,711 $

4.05x

2.18x

N/A

0.46x

N/A

SBICS

668,992

328,206

NYSE: MAIN

328,206 $

333,211 $

MAINST T

6.19x

2.00x

N/A

0.49x

N/A

CAPITAL CORPORATIONON

Key Leverage Stats

Interest Coverage Ratio (3)(8)

4.33x

2.15x

Asset Coverage Ratio (4)

Consolidated Asset Coverage Ratio - Regulatory(5)

2.30x

Debt to Assets Ratio

0.46x

Regulatory Debt to NAV Ratio (5) (6)

0.77x

Debt to NAV Ratio (6)

0.90x

1.00x

0.92x

Net Debt to NAV Ratio (7)

0.89x

0.98x

0.90x

(1) As of March 31, 2023, MAIN maintained the Corporate Facility and the SPV credit facility, which had $980.0 million and $255.0 million in total commitments with accordion features with the right to

request increases up to $1.4 billion and $450.0 million, revolving periods until August 2026 and November 2025 with maturity dates in August 2027 and November 2027, respectively

(2) Includes the carry value of the July 2026 Notes ($498.3 million; $500.0 million par), the May 2024 Notes ($450.6 million; $450.0 million par) and the December 2025 Notes ($148.6 million; $150.0 million

par)

Total

4,293,255

564,000

328,206

1,097,435

1,989,641

2,172,922

(3) Distributable Net Investment Income (DNII) + interest expense / interest expense on a trailing twelve-month basis

(4) Calculated as total assets divided by total debt at par, including SBIC Debentures ($334.0 million), July 2026 Notes ($500.0 million), May 2024 Notes ($450.0 million) and December 2025 Notes ($150.0

million)

(5)

Calculated per BDC regulations; SBIC Debentures are not included as "senior debt" for purposes of the BDC asset coverage requirements pursuant to exemptive relief received by MAIN

(6) Debt to NAV Ratio is calculated based upon the par value of debt

(7) Net debt in this ratio includes par value of debt less cash and cash equivalents of $33.3 million, $6.5 million and $39.8 million for the Non-SBIC, SBICs and Total, respectively

(8)

See Main Street Investor Presentation, available on the MAIN website, for the reconciliation of Distributable Net Investment Income (DNII) to Net Investment Income (page 38) and for Non-GAAP

information disclosures and discussion of DNII (page 48)

Main Street Capital Corporation

mainstcapital.comView entire presentation