Liberty Global Results Presentation Deck

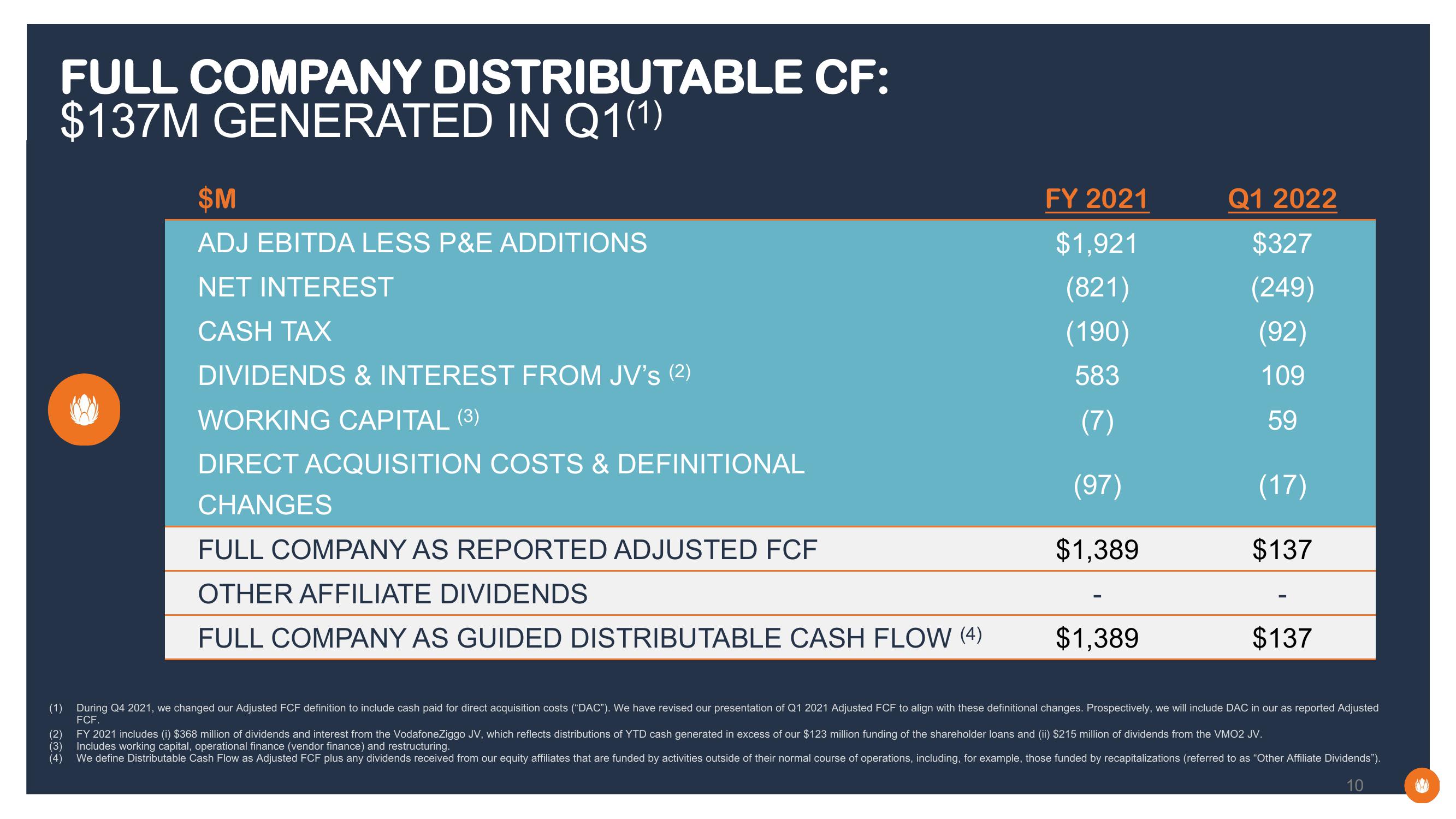

FULL COMPANY DISTRIBUTABLE CF:

$137M GENERATED IN Q1 (1)

$M

ADJ EBITDA LESS P&E ADDITIONS

NET INTEREST

CASH TAX

€

DIVIDENDS & INTEREST FROM JV's (2)

WORKING CAPITAL (3)

DIRECT ACQUISITION COSTS & DEFINITIONAL

CHANGES

FULL COMPANY AS REPORTED ADJUSTED FCF

OTHER AFFILIATE DIVIDENDS

FULL COMPANY AS GUIDED DISTRIBUTABLE CASH FLOW (4)

FY 2021

$1,921

(821)

(190)

583

(7)

(97)

$1,389

$1,389

Q1 2022

$327

(249)

(92)

109

59

(17)

$137

$137

(1) During Q4 2021, we changed our Adjusted FCF definition to include cash paid for direct acquisition costs ("DAC"). We have revised our presentation of Q1 2021 Adjusted FCF to align with these definitional changes. Prospectively, we will include DAC in our as reported Adjusted

FCF.

(2)

FY 2021 includes (i) $368 million of dividends and interest from the VodafoneZiggo JV, which reflects distributions of YTD cash generated in excess of our $123 million funding of the shareholder loans and (ii) $215 million of dividends from the VMO2 JV.

(3) Includes working capital, operational finance (vendor finance) and restructuring.

(4) We define Distributable Cash Flow as Adjusted FCF plus any dividends received from our equity affiliates that are funded by activities outside of their normal course of operations, including, for example, those funded by recapitalizations (referred to as "Other Affiliate Dividends").

10View entire presentation