Trian Partners Activist Presentation Deck

Valued at a Meaningful Discount to Precedents/Strategic Value

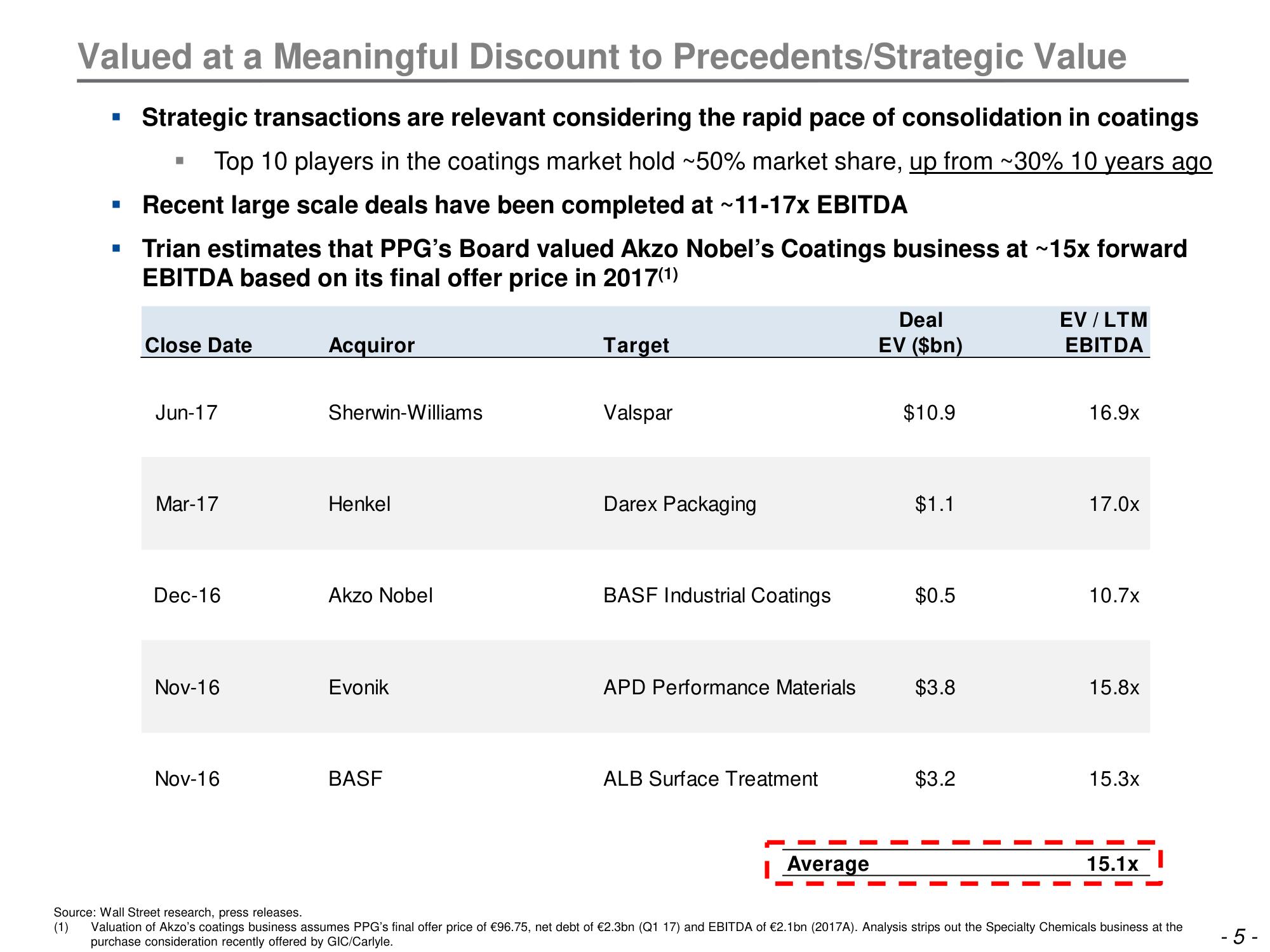

Strategic transactions are relevant considering the rapid pace of consolidation in coatings

Top 10 players in the coatings market hold ~50% market share, up from ~30% 10 years ago

Recent large scale deals have been completed at ~11-17x EBITDA

▪ Trian estimates that PPG's Board valued Akzo Nobel's Coatings business at ~15x forward

EBITDA based on its final offer price in 2017(¹)

H

■

■

Close Date

Jun-17

Mar-17

Dec-16

Nov-16

Nov-16

Acquiror

Sherwin-Williams

Henkel

Akzo Nobel

Evonik

BASF

Target

Valspar

Darex Packaging

BASF Industrial Coatings

APD Performance Materials

ALB Surface Treatment

Average

Deal

EV ($bn)

$10.9

$1.1

$0.5

$3.8

$3.2

EV/LTM

EBITDA

16.9x

17.0x

10.7x

15.8x

15.3x

15.1x

1

Source: Wall Street research, press releases.

(1) Valuation of Akzo's coatings business assumes PPG's final offer price of €96.75, net debt of €2.3bn (Q1 17) and EBITDA of €2.1bn (2017A). Analysis strips out the Specialty Chemicals business at the

purchase consideration recently offered by GIC/Carlyle.

- 5-View entire presentation