KKR Real Estate Finance Trust Results Presentation Deck

Recent Operating Performance

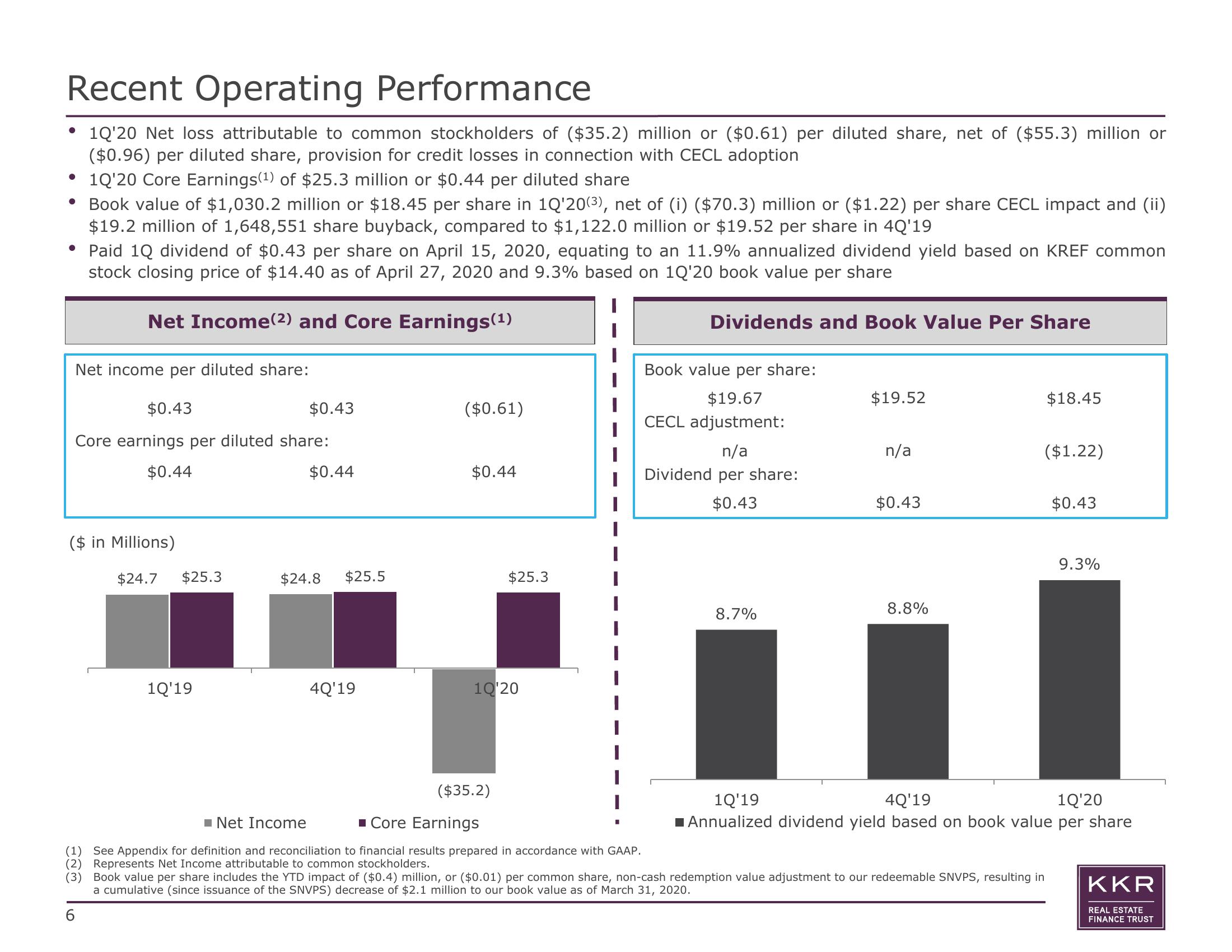

1Q'20 Net loss attributable to common stockholders of ($35.2) million or ($0.61) per diluted share, net of ($55.3) million or

($0.96) per diluted share, provision for credit losses in connection with CECL adoption

• 1Q'20 Core Earnings (¹) of $25.3 million or $0.44 per diluted share

• Book value of $1,030.2 million or $18.45 per share in 1Q'20(³), net of (i) ($70.3) million or ($1.22) per share CECL impact and (ii)

$19.2 million of 1,648,551 share buyback, compared to $1,122.0 million or $19.52 per share in 4Q'19

• Paid 1Q dividend of $0.43 per share on April 15, 2020, equating to an 11.9% annualized dividend yield based on KREF common

stock closing price of $14.40 as of April 27, 2020 and 9.3% based on 1Q'20 book value per share

Net Income (2) and Core Earnings (¹)

Net income per diluted share:

$0.43

Core earnings per diluted share:

$0.44

($ in Millions)

$24.7 $25.3

1Q'19

6

$0.43

$0.44

$24.8 $25.5

4Q'19

($0.61)

$0.44

$25.3

1Q'20

($35.2)

■ Net Income

■ Core Earnings

(1) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP.

(2) Represents Net Income attributable to common stockholders.

Dividends and Book Value Per Share

Book value per share:

$19.67

CECL adjustment:

n/a

Dividend per share:

$0.43

8.7%

$19.52

n/a

$0.43

8.8%

$18.45

($1.22)

(3) Book value per share includes the YTD impact of ($0.4) million, or ($0.01) per common share, non-cash redemption value adjustment to our redeemable SNVPS, resulting in

a cumulative (since issuance of the SNVPS) decrease of $2.1 million to our book value as of March 31, 2020.

$0.43

9.3%

1Q'19

4Q¹19

1Q'20

Annualized dividend yield based on book value per share

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation