First Citizens BancShares Results Presentation Deck

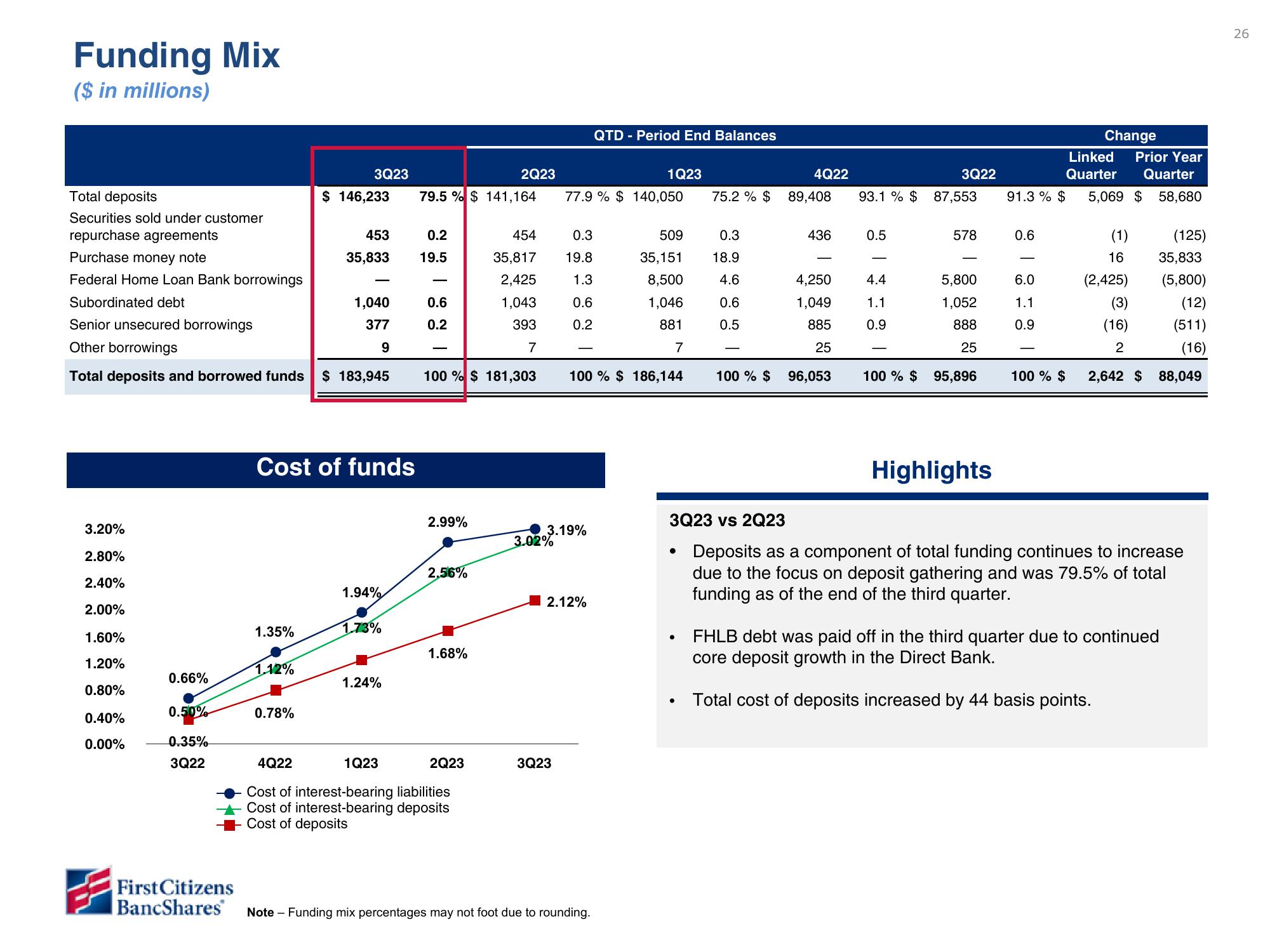

Funding Mix

($ in millions)

Total deposits

Securities sold under customer

repurchase agreements

Purchase money note

Federal Home Loan Bank borrowings

Subordinated debt

3.20%

2.80%

2.40%

2.00%

1.60%

1.20%

0.80%

0.40%

0.00%

0.66%

0.50%

0.35%

3Q22

Senior unsecured borrowings

Other borrowings

Total deposits and borrowed funds $ 183,945

First Citizens

BancShares

1.35%

1.12%

3Q23

0.78%

$ 146,233

Cost of funds

4Q22

453

35,833

1,040

377

9

1.94%

1.73%

1.24%

1Q23

79.5 %$ 141,164

0.2

19.5

0.6

0.2

2.99%

100% $ 181,303

2,56%

1.68%

2Q23

2Q23

Cost of interest-bearing liabilities

Cost of interest-bearing deposits

Cost of deposits

454

35,817

2,425

1,043

393

7

3.02%

0.3

19.8

1.3

0.6

0.2

3.19%

3Q23

77.9 % $ 140,050

2.12%

QTD - Period End Balances

1Q23

100% $ 186,144

Note - Funding mix percentages may not foot due to rounding.

509

35,151

8,500

1,046

881

7

●

●

75.2 % $

●

0.3

18.9

4.6

0.6

0.5

4Q22

89,408

436

4,250

1,049

885

25

100 % $ 96,053

93.1 % $ 87,553

0.5

4.4

1.1

0.9

3Q22

100 % $

578

5,800

1,052

888

25

95,896

Highlights

Change

Linked Prior Year

Quarter Quarter

91.3 % $ 5,069 $ 58,680

0.6

6.0

1.1

0.9

100 % $

(125)

35,833

(5,800)

(12)

(511)

(16)

2,642 $ 88,049

3Q23 vs 2Q23

Deposits as a component of total funding continues to increase

due to the focus on deposit gathering and was 79.5% of total

funding as of the end of the third quarter.

(1)

16

(2,425)

(3)

(16)

2

FHLB debt was paid off in the third quarter due to continued

core deposit growth in the Direct Bank.

Total cost of deposits increased by 44 basis points.

26View entire presentation