First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

First Busey Corporation | Ticker: BUSE

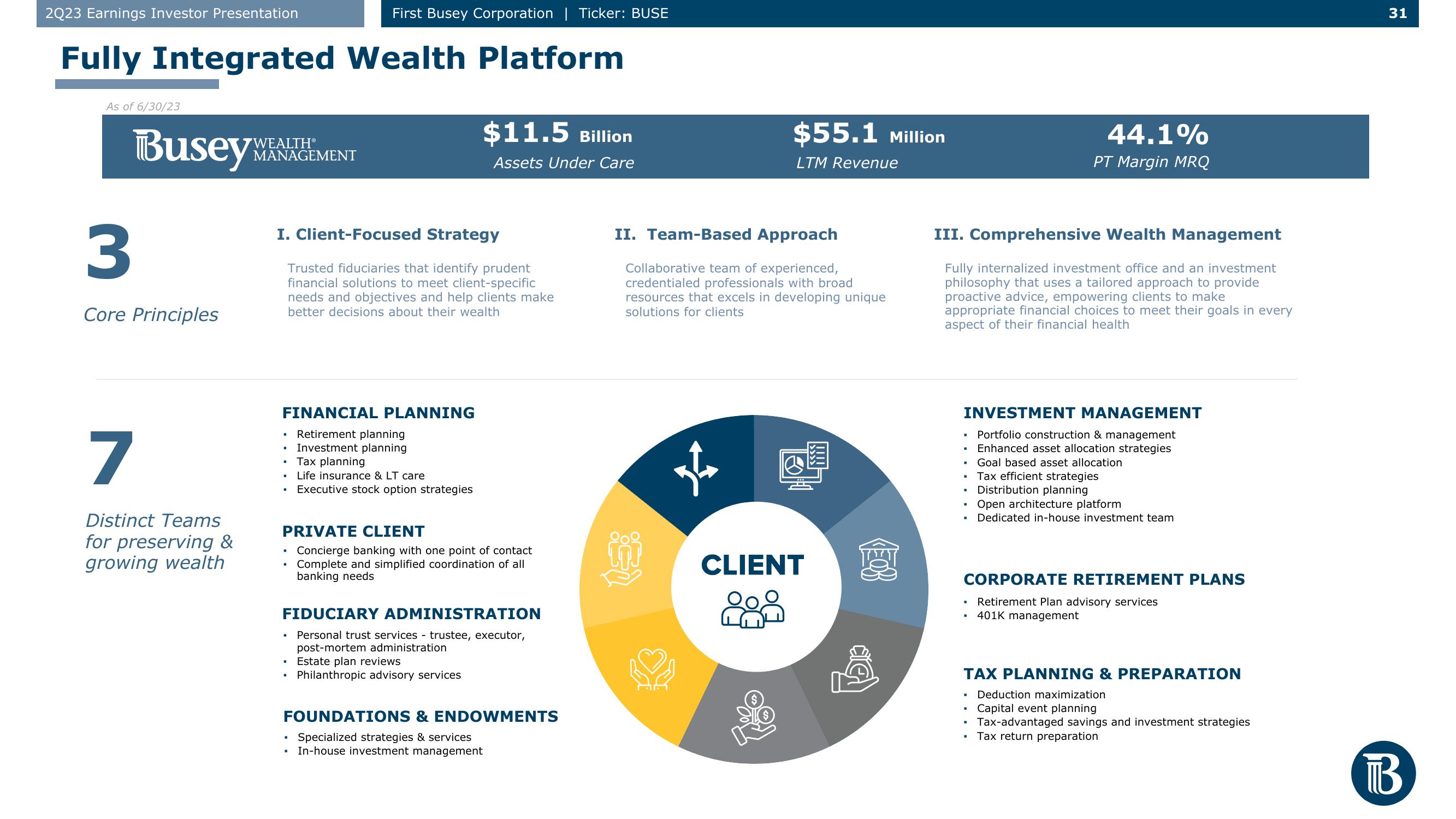

Fully Integrated Wealth Platform

As of 6/30/23

Busey

3

Core Principles

7

Distinct Teams

for preserving &

growing wealth

7WEALTHⓇ

MANAGEMENT

I. Client-Focused Strategy

Trusted fiduciaries that identify prudent

financial solutions to meet client-specific

needs and objectives and help clients make

better decisions about their wealth

FINANCIAL PLANNING

Retirement planning

Investment planning

.

■

.

.

Tax planning

Life insurance & LT care

Executive stock option strategies

PRIVATE CLIENT

Concierge banking with one point of contact

Complete and simplified coordination of all

banking needs

.

$11.5 Billion

Assets Under Care

FIDUCIARY ADMINISTRATION

Personal trust services trustee, executor,

post-mortem administration

.

Estate plan reviews

Philanthropic advisory services

FOUNDATIONS & ENDOWMENTS

▪ Specialized strategies & services

In-house investment management

$55.1 Million

LTM Revenue

II. Team-Based Approach

Collaborative team of experienced,

credentialed professionals with broad

resources that excels in developing unique

solutions for clients.

is

CLIENT

Lass

EB

III. Comprehensive Wealth Management

Fully internalized investment office and an investment

philosophy that uses a tailored approach to provide

proactive advice, empowering clients to make

appropriate financial choices to meet their goals in every

aspect of their financial health

INVESTMENT MANAGEMENT

Portfolio construction & management

Enhanced asset allocation strategies

44.1%

PT Margin MRQ

▪ Goal based asset allocation

Tax efficient strategies.

Distribution planning

.

.

CORPORATE RETIREMENT PLANS

Retirement Plan advisory services

401K management

·

Open architecture platform

Dedicated in-house investment team

TAX PLANNING & PREPARATION

Deduction maximization

. Capital event planning

• Tax-advantaged savings and investment strategies

Tax return preparation

31

BView entire presentation