jetBlue Mergers and Acquisitions Presentation Deck

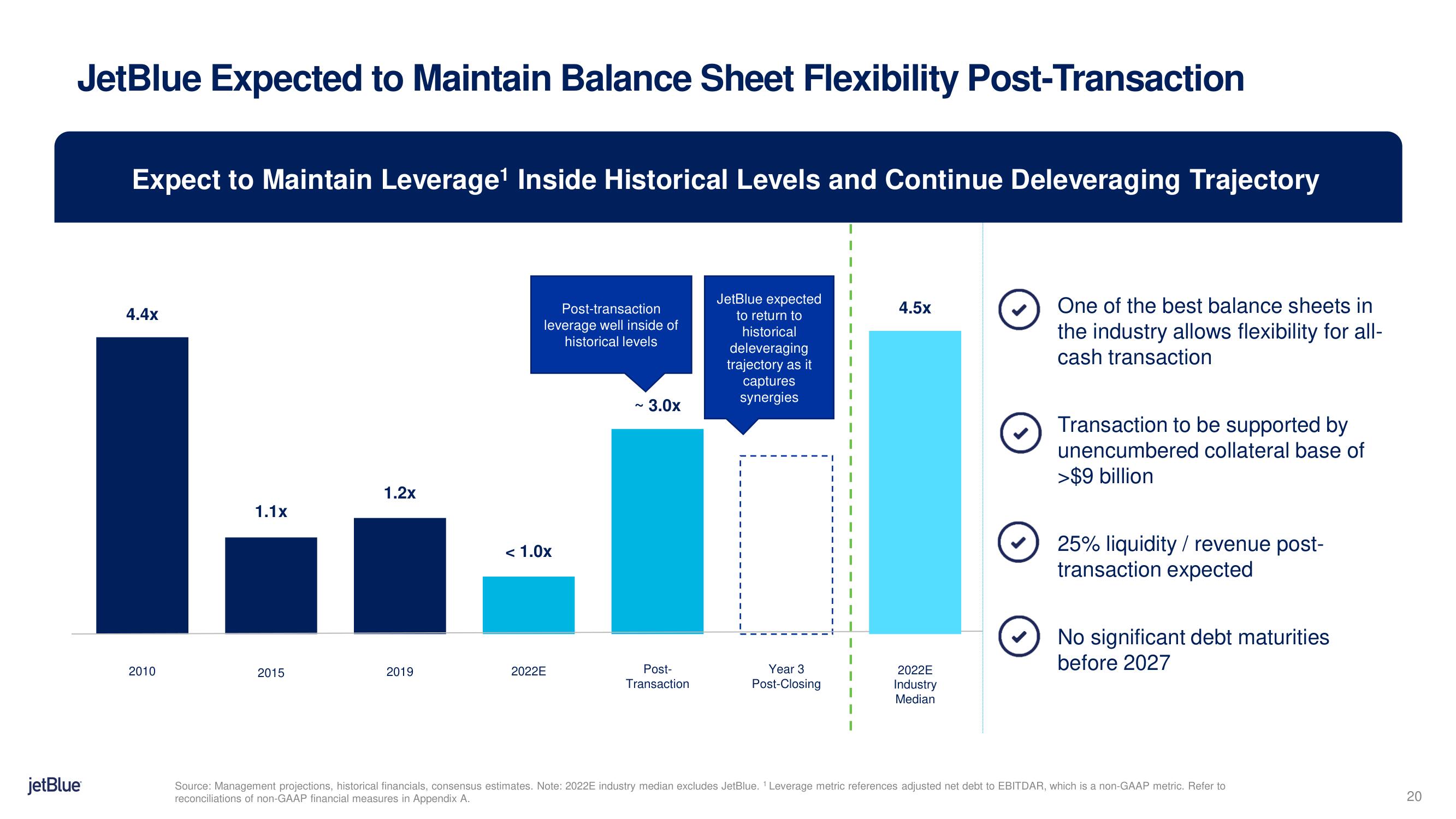

JetBlue Expected to Maintain Balance Sheet Flexibility Post-Transaction

jetBlue

Expect to Maintain Leverage¹ Inside Historical Levels and Continue Deleveraging Trajectory

4.4x

2010

1.1x

2015

1.2x

2019

Post-transaction

leverage well inside of

historical levels

< 1.0x

2022E

~ 3.0x

Post-

Transaction

JetBlue expected

to return to

historical

deleveraging

trajectory as it

captures

synergies

Year 3

Post-Closing

4.5x

2022E

Industry

Median

One of the best balance sheets in

the industry allows flexibility for all-

cash transaction

Transaction to be supported by

unencumbered collateral base of

>$9 billion

25% liquidity / revenue post-

transaction expected

No significant debt maturities

before 2027

Source: Management projections, historical financials, consensus estimates. Note: 2022E industry median excludes JetBlue. ¹ Leverage metric references adjusted net debt to EBITDAR, which is a non-GAAP metric. Refer to

reconciliations of non-GAAP financial measures in Appendix A.

20View entire presentation