Fort Capital Investment Banking Pitch Book

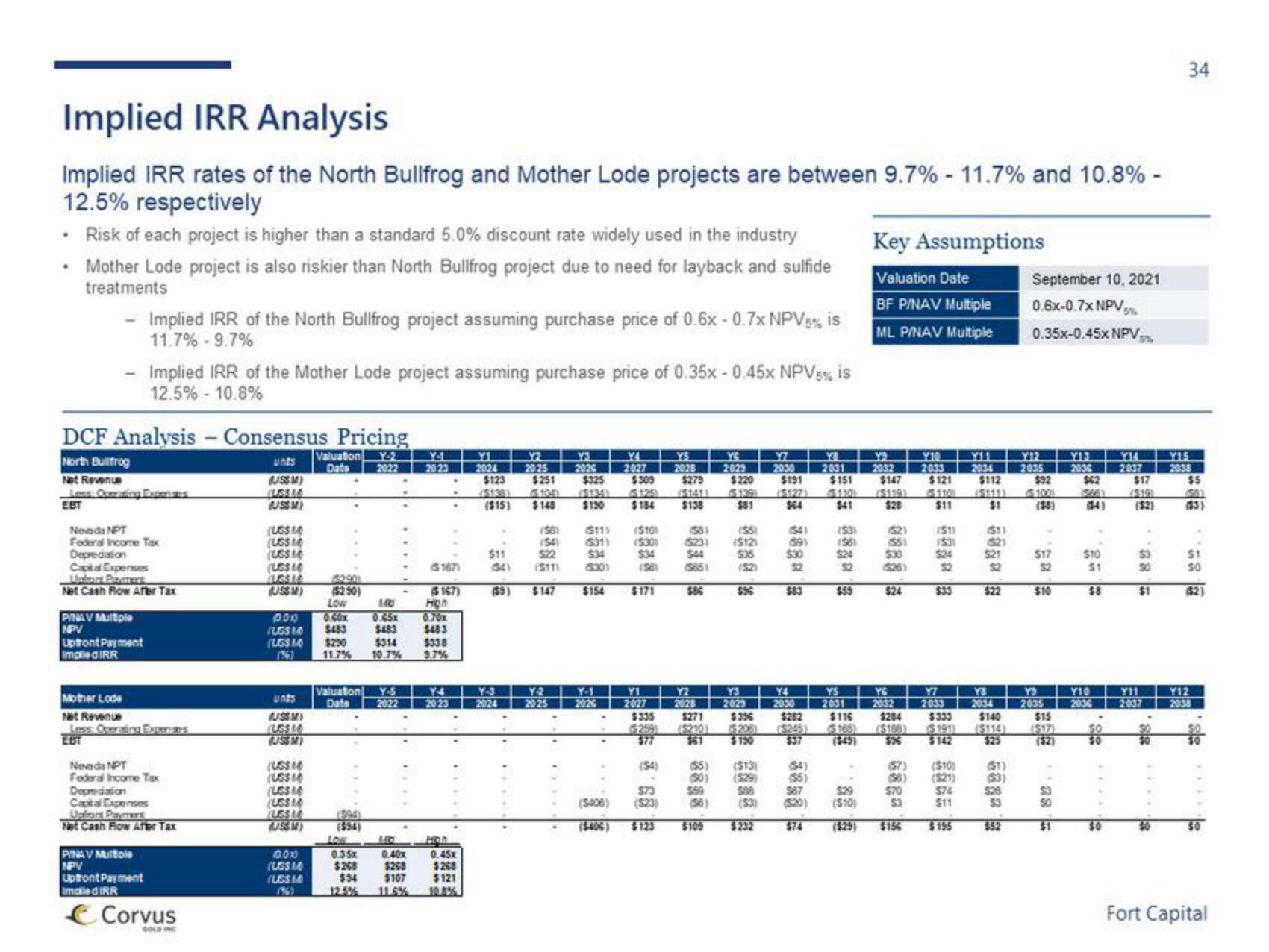

Implied IRR Analysis

Implied IRR rates of the North Bullfrog and Mother Lode projects are between 9.7% -11.7% and 10.8% -

12.5% respectively

Risk of each project is higher than a standard 5.0% discount rate widely used in the industry

Mother Lode project is also riskier than North Bullfrog project due to need for layback and sulfide

treatments

.

- Implied IRR of the North Bullfrog project assuming purchase price of 0.6x-0.7x NPV5% is

11.7% -9.7%

DCF Analysis - Consensus Pricing

Valuation Y-2

Date

2022

North Bullfrog

Net Revenue

EBT

Nevada NPT

Federal Income Tax

Depredation

Captal Expenses

Net Cash Flow After Tax

PINA V Multiple

NPV

Implied IRR of the Mother Lode project assuming purchase price of 0.35x -0.45x NPV 5% is

12.5% -10.8%

Uptront Payment

impliedIRR

Mother Lode

Net Revenue

Less Operating Expenses

EBT

Nevada NPT

Federal Income Tax

Depreciation

Captal Expenses

Upfront Payment

Net Cash Flow After Tax

PINAV Muitole

NPV

Uptront Payment

ImaledIRR

Corvus

unts

(USSM)

(LGS 16

USSM

(USS

(USS

(USS)

(US$ 10

AUSSM)

10.00

IUSS LA

(US$ 14

unts

AUSS MI

(USS LA

USSMY

(US$ 14

(USS 10

(USS 14

(USS 10

(LES

AUSSMY

10.000

(UGS 14

(USS M

5290

($250)

LOW

MO

0.60x 0.65x

$483

$483

$250

$314

11.7% 10.7%

Valuation

Date

(594)

($54)

Y-S

2022

0.35x

0.40x

$268 $268

$34

$107

12.5%

2023

167)

(167)

Hon

0.70x

$483

$338

9.7%

Y4

20 23

Hot

0.45x

$268

$121

Y₁

2024

$123

(5138)

($15)

$11

641

(59)

Y-3

2024

Y2

2025

2026

$251

$325

$148 $130

Y-2

2025

(56)

5111

(510)

(531) (530)

(54)

$22

$34

534

($111

5301

1981

$147 $154

Y-1

2026

YA

2027

(5406)

($405)

$309

$279

$125) ($1411

$184 $138

$171

YI

2027

$335

Y5

2028

(54)

$73

(523)

$231

544

(13861

Y2

2028

$271

(5210)

$61

(55)

(30)

YC

2023

$59

$220

$81

(55)

(512)

$35

$56

(513)

(529)

598

(53)

$105 $232

2023

$356

$150

Y7

2030

$191

(54)

$30

52

$83

(35)

2031

$151

$41

987

(520)

$74

(531

(96)

524

Y4

2030

YS

2031

$282 $116

($245) $165)

52

$29

($10)

Key Assumptions

Valuation Date

BF P/NAV Multiple

ML P/NAV Multiple

2032

$147

$28

(52)

6551

$30

(526)

$24

YG

$284

($168)

$56

Y10

2033

$121

$11

17

(51)

(531

$24

52

Y7

2033

(57) ($10)

(98) (521)

$70

53

$156

2034

$112

($111)

$1

$74

$11

$195

611

521

YS

2034

$333 $140

1911 ($114)

$142

$25

521

$2

$22

526

53

$52

17

September 10, 2021

0.6x-0.7x NPV5%

0.35x-0.45X NPV%

Y12

2035

$92

($5)

$17

$2

$10

Y

2035

$15

(52)

$3

50

$1

Y13

2036

$62

W

Y10

2036

M

$10

$1

$8

$0

Y14

2037

$17

($2)

.

53

50

$1

Y11

2037

34

Y15

2038

$5

(153)

$1

50

$21

Y12

2038

Fort CapitalView entire presentation